I knew the retirement landscape was bad, but now the situation is dire...

A new survey from personal finance site Credit Karma is shocking. It found that nearly one in five people aged 59 and older said they didn't have a retirement account... And 27% of respondents said they haven't set anything aside for their later years.

That's brutal. What's worse, even younger generations, like Gen X, have more saved.

I've talked before about the importance of net worth later in your life. Basically, net worth is the value of assets you own minus your liabilities. Assets include things like your house, car, savings accounts, investments, etc. Liabilities are debt, like credit-card debt, car loans, and mortgages.

As you get closer to retirement, you want to increase your net worth. You don't want to spend your golden years paying off debt.

According to the same Credit Karma survey, 21% of folks 59 and older have zero or even a negative net worth.

They owe more than they own.

That's a recipe for disaster and hardship in retirement.

Every year, statistics come out like this showing that people have not taken retirement seriously enough. I get a pit in my stomach as I read them every single year.

When looking at the big picture, according to a study from Boston College, we're looking at a roughly $7 trillion retirement-savings shortfall among American households. Half of these households will have to deal with a lower standard of living once they stop working.

Again, you work your whole life to be able to enjoy retirement. But the numbers prove that a lot of Americans will only face more stress in retirement... It will likely push a lot of retirees back into the workforce, too.

To be fair, this is not an easy time to retire compared with previous years.

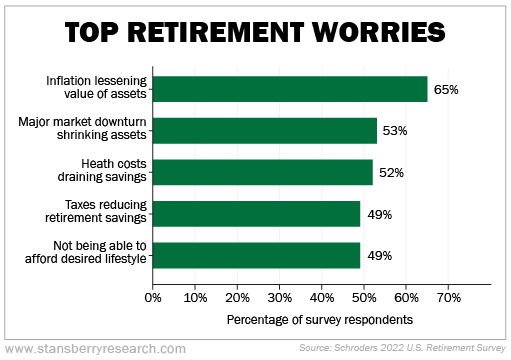

Folks getting ready to retire are worried. And they should be. These are the top retirement worries according to asset-management company Schroders from a 2022 survey...

I wrote last week that employees used to rely on pensions to support their retirement. But most employers don't offer pensions anymore... And pensions – both public and private – promised to earlier generations are in dire financial straits.

I also said that you shouldn't count on Social Security to fund your retirement in the future.

You have to be in charge of your own retirement.

There are a lot of people who are already retired who did not take their retirement savings seriously. Despite all the worries surrounding the retirement landscape, there's still time and opportunity for you to live the way you want to in retirement.

There are ways to position your money where you get paid each and every quarter to take care of expenses.

I'm of course talking about income investing.

I believe every investor, especially ones who are close to or in retirement, needs to have a portion of their portfolio in income-generating assets. And today is the ultimate time to profit from income.

Last week, I sat down with my top analyst to discuss the opportunity in income investing. We discussed why today is a rare opportunity to start collecting cash yields of 14% or more in this volatile market...

This video won't be around much longer. So please click here to watch my presentation if you haven't already.

What We're Reading...

- Something different: A $300,000 salary only feels like $100,000 in these pricey cities.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 19, 2023