Stansberry Research editors don't usually drop the F-bomb on camera...

But a few years ago, while recording a video to celebrate our firm's 20th anniversary, I was asked, "What was your scariest moment of the past 20 years?"

My answer evoked some foul language.

You see, during my time writing Retirement Trader – my options-trading service – there hasn't been too much that has scared me. Sure, there have been ups and downs in the market... but that hasn't changed what we do in that trading advisory.

So my answer to the above question was, "I was most disappointed when my Retirement Trader 136-trade winning streak came to an end."

Not exactly a horror story, I know...

That's when my colleague and Extreme Value editor Dan Ferris jokingly said, "Doc, if that's your scariest moment, then..."

Well... you probably get the idea.

I wasn't trying to be arrogant. I was truly disappointed to book a losing trade.

Thankfully, though, I've gotten over my 136-trade winning streak coming to an end. The reason: We're currently on an even better winning streak in Retirement Trader.

It has been 1,379 days since we've taken a loss in Retirement Trader... We're currently on a 188-position winning streak.

We've been able to avoid a loss from March 2020 all the way up until today. That's a period that includes the bear market in 2022 when the S&P 500 fell 20% and the tech-heavy Nasdaq fell 33%.

I tell people all the time that there are very few markets that selling options can't succeed in.

Few people believe me. But our results prove it.

Let's rewind to 2021...

At the end of each year, my team and I post our results for the previous 12 months. We want to be transparent to our subscribers about what has worked well and what has not.

Fortunately, results rarely vary from year to year.

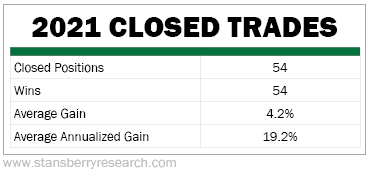

Stocks ripped higher in 2021. And our option-selling strategy kept up with the booming market. We posted the table below in our 2021 year-end review showing the results of all our 2021 closed trades...

Our average annualized gains kept up with the S&P 500 for the year. Again, the S&P 500 had a fantastic year coming out of the COVID-19 pandemic.

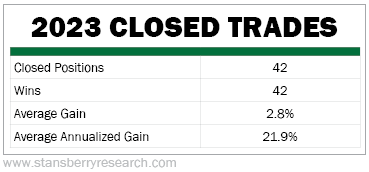

But you're probably more interested to see how we did in 2022 when stocks plummeted by 20%. Here are the results we shared with subscribers at the end of 2022...

The results were... nearly identical.

We didn’t close as many winning trades as 2021 thanks to the bear market. And while our average gain was lower, we were able to book our winners in less time, earning a higher average annualized gain. (We held each trade for an average of about three months.)

In fact, our option-selling strategy shines when there is fear in the market. You can see that as we posted 20% annualized gains when the market was down by 20%.

Now, let's turn to 2023...

The markets had another rebound year following 2022's disastrous performance. The S&P 500 is up 23% year to date (as I write).

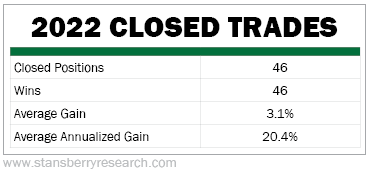

Guess how we did? Well, we did about the same as the previous two years...

Again, nearly identical to the previous two years. This time, our average holding period was only about two and a half months for each closed trade.

Add everything up and we did just over 20% annualized, once again.

For those who don't believe me that selling options can do well in just about any market, here's proof.

Unless we see something really wild in the market (like the quick COVID-19 drop), we expect about 20% annualized gains... even in bear markets.

Selling options is by far one of the best trading strategies you will ever find. In Retirement Trader, we sell options on only the best stocks in the world. That means we take very little risk.

For that reason, we see consistent results just about every year.

I believe our current winning streak of 188 trades is the longest in the history of our industry.

The thing is, I don't see this streak stopping anytime soon. We're already sitting on some gains in our portfolio and that will increase the streak over the next few weeks. And as I look ahead to 2024, I don't see any reason why we can't close 40-plus trades for profit... and end up with average annualized gains of 20%.

Because my team and I are on a historical winning streak, my publisher has decided to offer a subscription to Retirement Trader at a tremendous bargain. We want to get even more subscribers to start their own winning streak in 2024.

If you are interested in learning more about a subscription to Retirement Trader, please click here to learn more. (This will lead to a video that's only a few minutes long.)

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

December 21, 2023

Editor's note: Our offices are closed this coming Friday and Monday for the Christmas holiday. Your next issue of the Health & Wealth Bulletin will be in your e-mail inbox on Tuesday, December 26. From all of us here on the Health & Wealth Bulletin team, we wish you and your loved ones a safe and happy holiday.