In my book, a "B" is a failing grade...

I don't like to lose. Worse, I hate settling for anything less than excellence...

Earning a "B" might be a fine "passing" grade – but it's not excellent.

More important than my own competitive nature is that a "B" means I didn't deliver what I wanted to for you, my subscribers.

In case you don't receive the Stansberry Digest, every year our publisher reviews and grades the performance of all the investment newsletters here at Stansberry Research for a specific period.

This year, the publications were graded on a three-year period – January 1, 2016 to December 31, 2018. There were three double-digit drops in the market during this time, which gives a better idea of how a portfolio did when times are good, and when there's some turbulence as well.

The results came in last week...

Today, I want to share the grades for three of my newsletters: Income Intelligence, Retirement Millionaire, and Retirement Trader. I'll show you how my team and I did... and I'll also take you "behind the scenes" to show you how we're working to do better, including tips that can help improve your own portfolio performance.

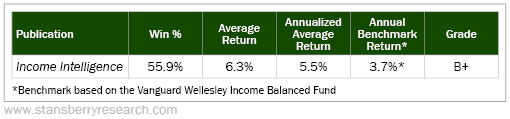

Let's start with Income Intelligence...

This is my income-focused newsletter. We make recommendations on just about everything that will pay us a steady stream of income. That includes blue-chip stocks, master limited partnerships (MLPs), foreign stocks, bonds, preferred shares, real estate, and others.

This year, we got a "B+."

* Benchmark based on the Vanguard Wellesley Income Balanced Fund.

Most fund managers or newsletter writers would be ecstatic to beat their benchmark over a three-year period. And we are proud of our returns.

But I'm not in the business of settling for "Bs." And we got one because our 55.9% win rate was just below where we wanted.

Yes, we could make excuses. The grading period ended on December 31, 2018 – just a few days after the S&P 500 Index hit a fresh 52-week low. That means seven of the positions in our portfolio were just barely negative, bringing down the win rate. Six out of those seven positions are now back in the green.

But at the end of the day, our win rate needs to be higher. It's as simple as that.

Let me know how you performed with our Income Intelligence strategy. What grade would you give us? Write me at [email protected].

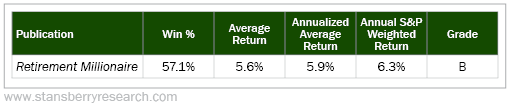

Let's move onto Retirement Millionaire, my flagship investment newsletter. Here, we received a "B." And like the Income Intelligence grade, I'm not thrilled about it.

Here's how Retirement Millionaire looked...

We are happy that we outperformed the average hedge fund – which declined 4.1% on a fund-weighted basis, as reported by Bloomberg. But we didn't quite beat our benchmark. Instead, we performed about the same.

We got most hurt by a few stocks that we recommended that quickly hit their stops. Shortly after we recommended stocks like Celgene (CELG), Tractor Supply (TSCO), and Ctrip.com (CTRP), they dropped enough to trigger our stop losses. We were forced to sell each of these stocks for about 25% losses.

A quick stop out, of course, means a terrible annualized loss. All three of those positions had annualized losses of around 100%, which really hurt us.

We have a stop-loss strategy in place so we can take emotions out of the equation. We want to cut our losers short and let our winners run. And for the most part, we do...

For example, we closed out several positions in May 2018 for some big gains...

We earned 184% on Cisco (CSCO), 151% on Boeing (BA), 145% on Johnson & Johnson (JNJ), and 161% on the AllianzGI Equity & Convertible Fund (NIE). But these positions were recommended before January 1, 2016, so they weren't factored into this year's grade.

If you're a Retirement Millionaire subscriber, you know we buy positions for the long haul. In fact, we have three stock positions we recommended roughly a decade ago that we're still holding today. The average gain on those three positions is just over 300%.

We don't mind cutting a few positions short since we let our winners run. Since launching Retirement Millionaire, we have a 75% win rate and an average annualized gain of about 13%. That's why this year's grade doesn't sit well with me.

Some people may be content with earning "Bs." I'm not. I'm sitting down with my team this week and reviewing all of our past Retirement Millionaire recommendations to see what worked and, more importantly, what didn't. That way, we can improve our results for you moving forward.

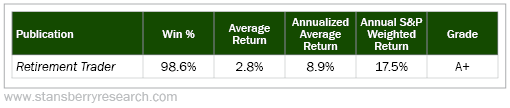

Finally, let's look at Retirement Trader – my options trading service.

There was only one other "A+" given out this year besides Retirement Trader. I'm extremely happy about out our 98.6% win rate.

If subscribers made 100 Retirement Trader trades and only one or two were losers, I'd sleep well at night (and I love my sleep). At the end of the day, the goal of this letter is helping you trade for safe income in retirement.

We made nearly 9% a year and have a current winning streak of 53 winning closed positions in a row. And we're not slowing down anytime soon... no matter what the market throws our way. We're prepared for a bull market, a flat market, and we even have tools for a bear market.

Thank you for your trust and support throughout the years. Know that I'll never be pleased earning anything but an "A" and will do everything I can to make sure my readers get the best advice possible.

And again, please let me know how you'd grade us. I read every message that you send to [email protected].

What We're Reading...

- Check out the archive of Stansberry Yearly Report Cards.

- Something different: What's going on with General Electric?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 27, 2019