Football has become a religion to many in the U.S. So, when the two best teams in the National Football League ("NFL") square off for the Lombardi Trophy, you know a lot of people are going to watch.

Despite a dip in viewership the past few years, the Super Bowl still draws in over 100 million people, making it one of the biggest nights in TV for the year.

This year, the NFC champion, the San Francisco 49ers, will play the AFC champion, the Kansas City Chiefs. The game takes place two Sundays from now on, February 2.

The 49ers have one of the best defenses in the league and the Chiefs have one of the most prolific offenses in the league led by the quarterback and 2018 MVP Patrick Mahomes. It's going to be a "can't miss" game. (And it'll be a relief for most fans that a team other than the New England Patriots will be involved in Super Bowl Sunday.)

But more than just sports fans may be glued to the game. Some members of the investing world will be paying close attention, too.

And that's because of something called the Super Bowl Indicator.

Leonard Koppett, a sportswriter for The New York Times, first introduced the Super Bowl Indicator in 1978.

The indicator says that a Super Bowl win for any AFC team means that the stock market will fall over the next year. And a win for a team from the NFC, as well as teams from the original NFL before the merger of NFL and American Football League (AFL) in 1966, means the stock market will rise in the coming year.

There are also a few amendments that have been proposed over the years to deal with expansion teams, teams that change conferences, etc... but I won't get into that for simplicity.

This indicator may sound laughable, but some people take it seriously.

It was correct for 15 of the first 16 Super Bowls. And that lead to the Los Angeles Times quoting a stockbroker saying, "Market observers will be glued to their TV screens... It will be hard to ignore an S&P indicator with an accuracy quotient that's greater than 94%."

But since then, results have been mixed.

Last year the New England Patriots beat the Los Angeles Rams 13-3. Since the Patriots are in the AFC, stocks should have fallen this year.

As you well know, that didn't happen. In fact, stocks had a historic year. The S&P 500 finished the year up 29%... And total return (with dividends) was 31%.

Over the last four years the indicator has been wrong. And since 2009, it's been right about 50% of the time.

Still, over the long term, the indicator has been right more than it's been wrong.

Some of that is because the Pittsburgh Steelers, an AFC team, has been counted as an NFC team because Pittsburgh was one of the original members of the NFL.

Since the Steelers are a successful franchise and have won many Super Bowls (six total), and since the market typically goes up in a given year, it helps the indicator's winning percentage.

So, according to the Super Bowl Indicator, if the Chiefs win this year's title, you should expect stocks to finish lower for the year. That means a lot of investors will be rooting for the 49ers.

Here's the thing... When Koppett first described this trend, he intended it to be a funny example of how correlation is not the same as causation.

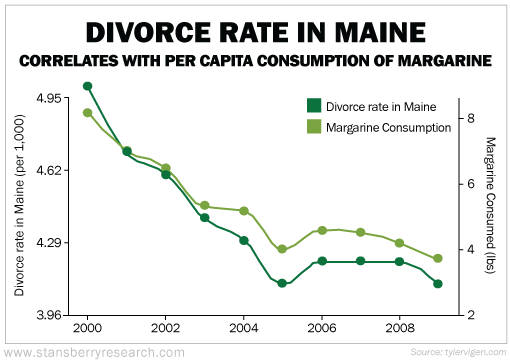

I've shown this chart many times over the years but it's a great example of how correlation does not equal causation. It compares the divorce rate in Maine to the per capita consumption of margarine.

At first glance, you might think they are related... but after a second to think about it, you'll realize it's just a coincidence.

There are countless other examples...

There's the age of Miss America and how that correlates to murders by steam, hot vapors, and hot objects. There's the number of pedestrians killed in collisions with railways trains and how that correlates to precipitation in Howard County, MO.

Just remember this... correlation does not equal causation.

At the end of the day, do you really think that the performance of the stock market has anything to do with a football game?

There are traders who wager real money because of it. I sure hope you don't.

The Super Bowl won't give us any answers about how to invest for 2020... Just enjoy the game. And root for your favorite team without giving any thought to the market.

Go Chiefs!

What We're Reading...

- Something different: Will China and the U.S. reach a trade deal soon?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 22, 2020