The death toll in Israel keeps mounting...

As of this writing, 1,600 people have died after Hamas, the Palestinian militant group that controls the Gaza Strip, launched one of the broadest invasions on Israeli territory in 50 years. At least 14 Americans have been killed during the fighting so far.

Israeli Prime Minister Benjamin Netanyahu said in a video statement that Israel is "at war" and called for a massive military response.

Today, I (Jeff Havenstein) am not going to focus on the horrors of what's happening right now. Instead, I'm going to decipher what this war means for markets, specifically the oil market.

As a result of the attacks, the price of oil jumped more than 3% on Monday. We've seen oil prices react like this when previous wars broke out.

The question is, why – since Israel doesn't produce any oil – is the price of the commodity spiking?

The answer is that there are concerns about retaliation toward Iran for its support of Hamas... Iran is certainly a major oil-producing country.

Iran, however, has denied any involvement in the attacks on Israel... though a White House national-security official said Iran is "broadly complicit."

Quincy Krosby, strategist for North Carolina-based LPL Financial, had this to say in a statement...

The crude oil market remains hyper-alert to any indication that the conflict between Israel and Hamas is poised to expand into the oil producing region in the Middle East... Reports regarding Iran's support for the Hamas attack have been denied by Iran but concern is focused on a broader Iran-Israeli conflict, which would, in turn lead to a dramatic escalation of conflict in the region, and a dramatic climb in oil prices.

If there was more war throughout the Middle East, this would reduce the amount of oil that could make it out to the market. And the fact is that supply of oil is already tight... Going back to Economics 101, less supply means rising prices.

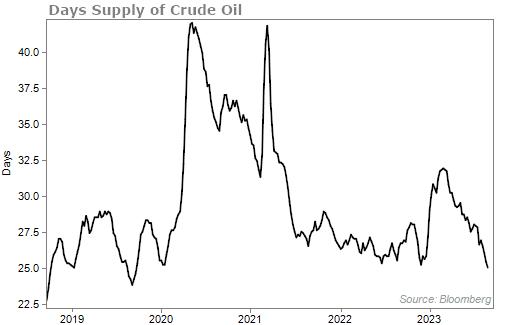

Let's look at the supply of oil in the U.S.

The chart below shows that if we stopped producing oil today, we'd have less than 26 days' worth of the commodity on hand. That's near the lowest level of the past five years...

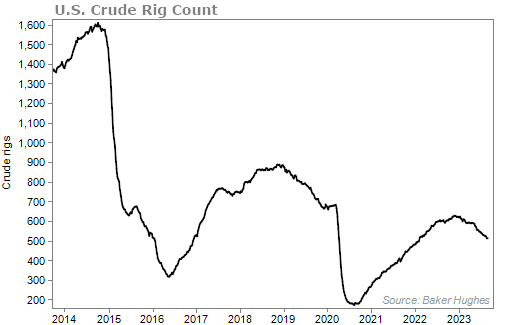

Another way to track oil supply is by looking at the below chart from oil-services firm Baker Hughes. It shows how many rotary rigs are active and drilling for oil.

Another way to track oil supply is by looking at the below chart from oil-services firm Baker Hughes. It shows how many rotary rigs are active and drilling for oil.

As you'll see, the rig count rose after its collapse during the COVID-19 pandemic. But it's still not past pre-pandemic levels yet, and it has been on a downtrend this year. Plus, it's well below levels seen in 2014. Take a look...

With such a small buffer, a single pipeline shutdown or other temporary interruptions (such as a war) could send prices soaring.

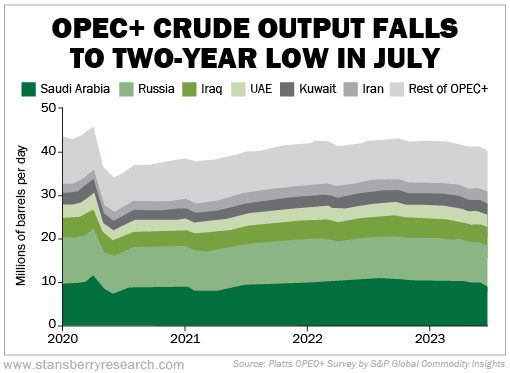

Supply is not likely to expand, either... OPEC is cutting oil production.

In July, OPEC+ (the 13 countries in OPEC along with some other oil-producing countries like Russia, representing most of the world's oil-export market) cut its crude output to a two-year low. Take a look...

For the past few months, I thought that the price of oil needed to rise because of simple supply-and-demand dynamics. If we do see more escalation in the Middle East, global supply could only become tighter... And that means we could see crude climb back above $90 a barrel.

This is a situation I will be closely monitoring in the days and weeks to come. But betting on oil stocks in the meantime seems like a safe bet to me.

What We're Reading...

- Something different: Russian ruble rebounds from 18-month-plus low versus U.S. dollar.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

October 11, 2023