We all fear the bear...

Even the most optimistic investors will lose sleep over it. The truth is that a bear market could strike at any point. Anyone who claims they know exactly when it will come is either foolish or lying to you.

Even when you have all the data, your timing could still be way off.

For example, Michael Burry, star of Michael Lewis' book The Big Short, first spotted that we were in a housing bubble in 2005. He began buying credit default swaps – or bets against the housing market – that same year.

So for a couple years, Burry was losing money. As you know, the bubble didn't pop until later in 2007. That's a long wait... And Burry became a household name because of his resiliency to ride it out.

Bear markets and market collapses never turn out the way most folks imagine them to be. Each one is different and on its own timeline.

But throughout the history of big market drops, some things remain similar.

In the May 2019 issue of Retirement Millionaire, my team and I put together a "Bear Market Almanac" where we basically broke down everything there is to know about bear markets: what exactly they are, how often they happen, ways to know they are coming, and how to protect yourself from one.

Specifically, in one of the sections, we looked at how well different stock market sectors held up during bear markets. We also looked at the performance of gold.

Since we have experienced another bear market since May 2019, I wanted to look at how the 2020 COVID-19 bear market compared with previous ones.

Let's start with sector performance...

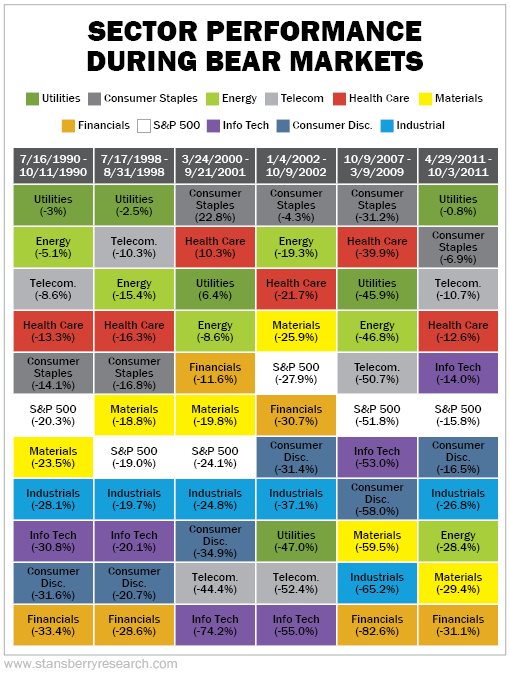

The table below is from our 2019 Bear Market Almanac. It shows the broad sectors of the market and their performances over the last six bear markets.

Our definition of a bear market was a little different than the standard 20% drop. But still, this table offered some clear lessons.

Utilities, consumer staples, and health care stocks offer opportunities to safeguard your wealth. Also, financials and technology stocks are often hit the hardest. They should typically be avoided.

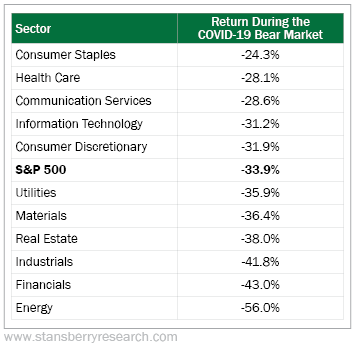

In the 2020 bear market, we saw many similar things... Although some of the sector names have changed, like telecom changing to "communication services," consumer staples and health care stocks still held up very well compared with other sectors. Utilities did OK... falling about the same as the S&P 500 Index.

Also, financials were crushed like in many other bear markets. Perhaps the most interesting thing was that technology stocks actually held up pretty well. Take a look...

In the 2019 edition of the "Bear Market Almanac," we also looked at the performance of gold during bear markets. As I've talked about before, gold is often referred to as a safe haven during market turmoil.

And that makes sense... Gold is a physical asset and has been a store of value for thousands of years. Gold coins were minted for commerce beginning around 550 B.C.

No matter what happens to the economy, even if the banks collapse and our economic structure goes down in spirals, gold will always have value.

That's why I like to call gold a "chaos hedge." I've long maintained that part of your portfolio belongs in gold as protection for when things in the economy get ugly.

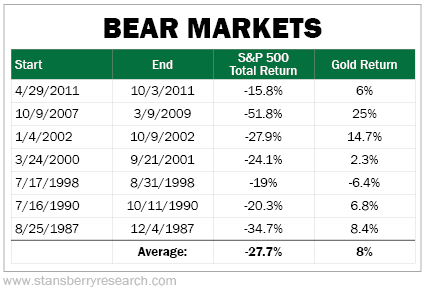

Historically, the performance of gold proves that to be true. Here's the chart we showed in our 2019 write-up...

And for this most recent bear market, gold was once again a defensive asset.

While the S&P 500 fell 34% from February to March in 2020, gold was only down by 3% over that same time frame. You basically broke even when just about everything was getting hammered. Gold did its job.

The takeaway from all of this is clear... No matter what type of bear market comes next, there are places where you can feel good about keeping your money. You should be able to weather the storm better if you're invested in sectors like utilities, consumer staples, and health care stocks.

And of course, gold is the ultimate hedge. If you don't own any of this chaos hedge today and you're worried about a big market plunge... it might be time to add some to your holdings.

If you're a subscriber to Retirement Millionaire, you can click here to read my Bear Market Almanac. And if you're not a subscriber, you can sign up here.

Later tonight, my team and I are releasing a brand-new stock recommendation in Retirement Millionaire... It's a stock unlike anything we've ever recommended before. It's a stock that has a market cap of just $1.1 billion, it only costs about $16 a share, there are no analysts who are covering it, and it has a brand-new type of business model that has profit margins over 80%... The best part is that it's dirt-cheap.

Be sure to check your inboxes later today for the stock's name and ticker if you're already a subscriber. And again, if you're not a subscriber, you can sign up here.

What We're Reading...

- Dr. David Eifrig's Bear Market Almanac.

- How to Use Gold as an Investment in a Bear Market.

- Something different: Seven hikes? Fast-rising wages could cause the Fed to raise interest rates even higher this year.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 9, 2022