Brace yourself for more volatility...

At least until this month is over.

It seems all anyone can talk about lately is the upcoming presidential election. It makes sense... Election Day is finally on our doorstep after months of chaos on the campaign trail.

Many folks are even calling for this year's election to be more impactful than any other in recent memory.

I (Jeff Havenstein) get it. November 5 will be an important day.

I'm not here to write about politics, though. You get enough of that from just about every major news outlet. I'm more concerned with writing about markets and sharing ideas to make you money.

With that in mind, I need to warn you that markets will probably be bumpy over the next several weeks.

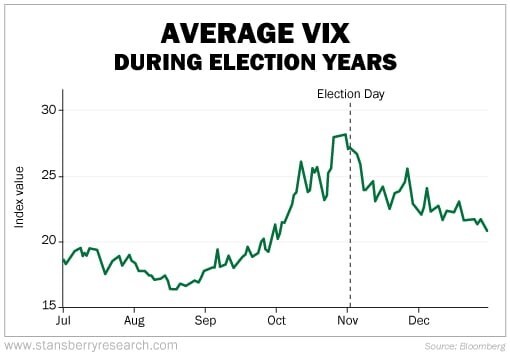

To gauge market volatility, I use the CBOE Volatility Index, or the "VIX" for short. The VIX shows the market's expectation of volatility over the next 30 days by using the implied volatility of options from the S&P 500 Index.

The chart below looks at the average VIX during election years since 1992. As you can see, the index usually starts to spike quite a bit in October...

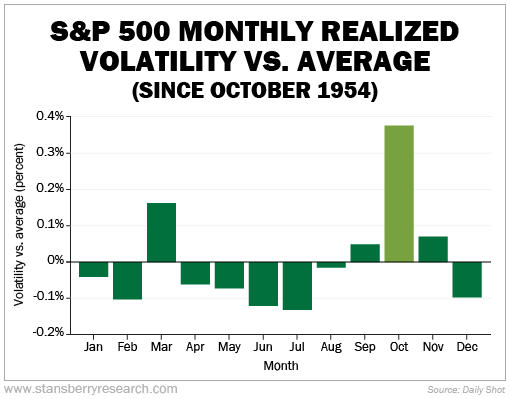

Even without the election, we tend to see more volatility in October...

Now, more volatility isn't necessarily a bad thing. Sure, some of your holdings may fall a bit (more on that later). But you'll also get buying opportunities as things go haywire in the short term.

And if you sell options – one of my favorite strategies – you'll love this type of market. Option sellers see greater profits from their trades as market volatility creeps higher. They essentially get to cash in on investor fear.

What I want to talk about today is why you shouldn't let the upcoming bout of volatility derail your long-term plans as an investor.

Stocks may currently be pricey, but I see plenty of upside in the coming year. (Go back and read my September 18 issue titled "Human Emotions Point to More Market Gains" to understand why this bull market still has room to run higher.)

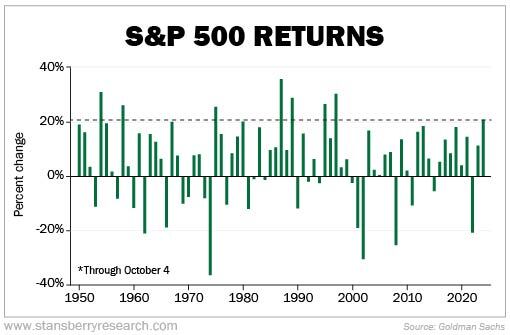

The S&P 500 is up more than 20% this year, marking its best performance since 1997... And that's good news for stocks in 2025.

The chart below looks at S&P 500 returns since 1950. The index has only posted a better return than what we're seeing this year seven times in that 74-year span. And returns were positive the next year in six out of those seven instances. Take a look...

In conclusion, be prepared for markets to get rockier for the rest of this month. But know that history tells us this volatility won't last forever. The election will be over soon. And then things should calm down.

Plus, remember what I wrote to you last month... Bull markets don't die on a whimper. We have yet to see any real signs of euphoria – folks are still too cautious today. Stocks have plenty of room to run from here.

According to my colleague Dan Ferris, we're witnessing the beginning of an investment setup that only comes our way a handful of times in a generation.

Dan says now is the time to sell any big tech stocks you own... and buy a small group of stocks that has moved opposite to tech stocks for the past 30 years.

What We're Reading...

- Investors turn to volatility trades to profit from the tight U.S. election.

- The key dates in this year's presidential election.

- Something different: The Federal Reserve's Alberto Musalem argues for more rate cuts.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

October 9, 2024