Monday's market sell-off was brutal...

The Dow Jones Industrial Average dropped 600 points and the S&P 500 Index fell 1.7%. In fact, it has been a brutal month for stocks... Stocks have finished lower in each of the past three weeks.

Adding more fear, investment bank Morgan Stanley made headlines when it said that stocks may fall 20% or more. According to Chief U.S. Equity Strategist Mike Wilson, a bear market could happen because of slowing economic growth, falling consumer confidence, and less fiscal stimulus.

And while you should pay attention to all of that, I (Jeff Havenstein) am not worried.

I don't think this is the beginning of a bear market.

First, I'll point out that these types of bearish market calls just don't happen at market tops.

Think back to the dot-com boom. How many analysts did you hear calling for a significant market drop?

Probably not a lot.

In the late 1990s and in the early part of 2000, there was a sense of euphoria surrounding the markets. Just about every asset class went up. Investors felt they could do no wrong.

As a result, everyone had a hot stock tip for their neighbor... and most of your friends couldn't stop bragging about their big winners.

There was little talk of market corrections or bear markets... The only real difficult decision people had to make was how much money they would borrow to buy even more stocks.

Today, folks aren't as euphoric. They are too worried. The crash from COVID-19 is still fresh in their minds and it's causing them to be defensive.

This tells me stocks aren't likely at a peak yet...

When you start bumping into people you haven't seen for a while and they give you investment advice, that's when you'll know it's time to get out. We saw some of this earlier this year, but that has cooled.

To me, the recent sell-off in the market is a perfect example of "buy the dip."

Another reason I don't think that this is the beginning of the end – or at least a market drop of 20% or greater – is because the economy is in a good place.

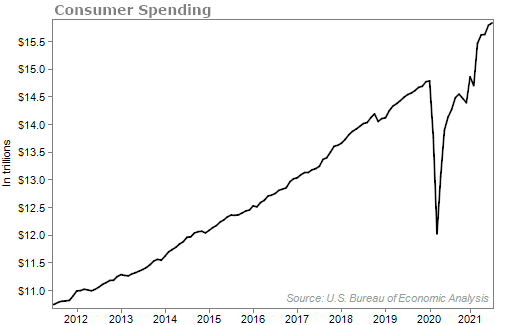

Consumer spending has roared back since the start of the pandemic. It's currently at all-time highs. And as the consumer goes, so goes the economy...

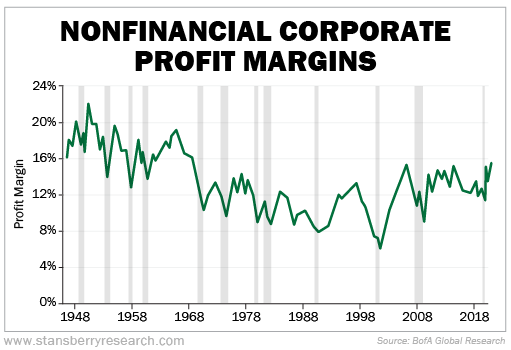

Corporate profit margins haven't been this high since 1968...

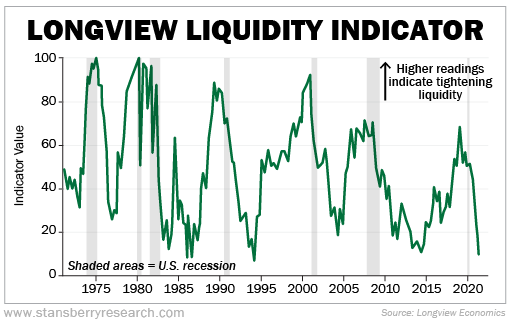

Plus, the chart below will show you there is plenty of liquidity in the U.S. economy. That means the risk of a near-term recession is low.

Now, I want to be clear... I'm not saying stocks will bounce back to new highs immediately. It's possible, even likely, that there's more selling to come.

A correction of 5% to 12% may be coming... And you should be OK with that.

We're overdue for a pullback. Stocks haven't seen a 5% correction in over a year.

The market has been too hot lately, and it won't be a bad thing if it cools since that will help get rid of some of the speculators.

As Doc Eifrig always likes to say, "Corrections are a normal part of the market cycle."

Even during the last great speculative market run during the dot-com boom, the tech-heavy Nasdaq fell roughly 10% four times on its way to posting a return of 255%. Again, corrections are normal. They are nothing to fear... even in bull markets.

I'm bullish over the next few months, despite the recent underperformance in the market. I'd recommend all my friends and family to buy this dip.

But my bullish stance isn't the unanimous outlook here at Stansberry Research. We have other analysts who aren't as optimistic... We even have a few bears.

There's currently such a spirited debate about where the market will head over the next few months that Stansberry Research is hosting a Bull vs. Bear Summit.

Next Tuesday, September 28 at 8 p.m. Eastern time, you'll hear from True Wealth editor Steve Sjuggerud and Extreme Value editor Dan Ferris about which side of the debate they are on.

You'll also hear from Doc... and his outlook might surprise you.

No matter if you tend to be bearish by nature or like to speculate, this is an event you must watch. You'll hear from both bulls and bears... And you should want all the information possible to help guide your investment decisions.

And as an added bonus, if you register today, you'll get a free special report: The 7 Most Overvalued Stocks in the World Today. (You probably own at least one of these stocks.)

Click here to register for next Tuesday's event and claim your free report.

What We're Reading...

- Morgan Stanley sees growing risk of a 20% drop in S&P 500.

- JPMorgan says buy that S&P 500 dip, but you might want to look at this chart first.

- Something different: Chipotle will add smoked brisket to its menu for a limited time.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

September 22, 2021