I was shocked by how monstrous his house really is...

The legendary investor (known to some as the "Oracle of Omaha") is one of the richest men in the world. In 1960, he started a partnership with 10 doctors. It's rumored here in town that each of those doctors now has about $700 million from their initial $10,000 deposits. It's also rumored that Buffett only put in $100, but transformed that into billions.

But despite his immense wealth, Buffett is portrayed as a simple guy, famous for still living in the house he bought in 1957 for $31,500.

So while investigating a few investment possibilities in Omaha, Nebraska... I decided to swing by Buffett's home to see how simple it really is. In my mind, I pictured an understated rancher home built in the then-outskirts of Omaha... a home just like so many others thrown up in thousands of new suburban communities all over the country in the '40s and '50s.

Boy, was I wrong. Buffett's house is huge... a beautiful five-bedroom, light brown- and white-brick home, with a Craftsman sort of flavor. It's clearly been renovated over the years, with a new roof recently placed and impeccable landscaping. But what struck me the most was its size.

Today, it's worth just over $650,000. Almost anywhere on the East Coast, that house would easily go for $1 million or more. But not here in Omaha.

On the surface, it would seem Buffett's home investment hasn't done so well – barely 5.85%. That's much less than the 20% per year he has averaged over 54 years of investing in his firm, Berkshire Hathaway.

But for the world's best investor, his home is a sleep-well-at-night investment. Buffett didn't speculate on his house and pay some crazy multiple of his gross income. Instead, he bought an affordable home and watched it appreciate a little bit every year for 55 years. He didn't lose much in the downturns, because he didn't consume too much house in the beginning.

To become wealthy, you don't need a fancy home in San Francisco or Los Angeles. You don't need to spend money on fancy clothes or cars. What's critical for a wealthy retirement is saving money and investing regularly.

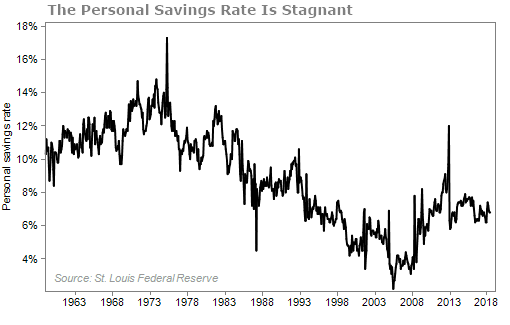

But most Americans don't understand investing and savings... We've created a generation of people who consume instead of saving and investing. That's the road to poverty, not wealth. Just take a look at what's happened to the savings rate in this country in the graph below...

We've dropped down from double digits in the '70s and '80s to less than 7% today. Since the last recession ended in 2009, Americans haven't improved our saving power.

We've dropped down from double digits in the '70s and '80s to less than 7% today. Since the last recession ended in 2009, Americans haven't improved our saving power.

You can't create wealth without savings. And without investing those savings, you can't retire happy. The most critical thing we can do as individuals – and as a country – is save and invest.

People are already behind... then they have to fork over a double-digit percentage of their annual earnings to the government.

The personal savings rate is just 4%. The average federal tax rate is around 14%. That's before state and local income taxes, property taxes, sales tax, and levies are added to the costs of things like gasoline and alcohol.

But even after you pay your income taxes and add to your savings, your investments get taxed – in some cases – over and over again. Capital gains, interest, and dividends all create taxable events. Most Americans pay a 15% tax rate on long-term capital gains. That's a major drag on your wealth-building.

[optin_form id="73"]

One of the most powerful ways to shelter your wealth from the IRS... grow money for retirement... and have freedom in your investment choices... is with an individual retirement account, or "IRA."

With this type of tax-deferred account, you park your cash and compound your wealth tax-free. You don't have to pay taxes on capital gains, dividends, or interest income for any stocks, bonds, or funds you hold within it.

You can use an IRA similar to a regular brokerage account. You can buy stocks and bonds, and sell covered-call options. And if you have a fully self-directed IRA, you can invest in many other assets, including real estate, private stocks, businesses, and even precious metals.

I use my self-directed IRA to generate income by selling stock options. When I use this account for options trading, I don't have to follow any accounting or tax requirements.

In fact, if you do all your trading inside a retirement account, you don't have to report any trades to the IRS. The goal is simply to maximize your total returns as quickly and as easily as you can... and get better returns than a pension could offer.

So stick it to the taxman, and start supercharging your retirement savings with an IRA.

What We're Reading...

- Something different: Why some homes survive wildfires.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 8, 2018