By 2040, one in five Americans will be over the age of 65.

That's a big jump from the one in seven ratio we're seeing today. And it means that by 2040, nearly 90 million Americans will be what we call "retirement age."

The arch nemesis of those retirees is inflation.

Most folks looking to retire need safe investment income. This traditionally comes from owning bonds, which pay a fixed rate. But if your income stream is fixed and the price of goods and services shoots higher... your cash stream is worth less. If you're relying on that income for your retirement, you could be in trouble.

So what is inflation doing right now... and how worried should you be about it?

Some economists define inflation strictly as the supply of money or how much money exists. And you can see the logic... the more money available, the more money assets can command.

But to me, that seems like an academic argument. What matters to me is price inflation, or how much I am paying for the things I need. And the amount of money in the economy is only one factor driving price inflation.

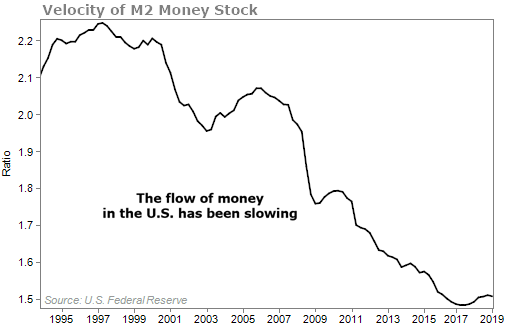

A more important factor determining price inflation is how quickly money is moving through the economy – the so-called "velocity."

As subscribers of my Retirement Millionaire newsletter know, the money velocity reflects the amount of money individuals and businesses have to spend on consumption or investment relative to the money available for banks to lend.

Here's how the money flow looks right now...

As you can see, U.S. money isn't moving around that well. There's still fear in the U.S. on the part of lenders and people with money looking to invest.

Another factor for price inflation is rising interest rates. After all, if it costs businesses more to borrow, they'll pass a lot of those costs on to the consumer. We've seen multiple rate increases over the last couple years. But the Federal Reserve, which controls short-term interest rates, won't raise interest rates any higher until it considers inflation a threat (or until the global growth picture clears up).

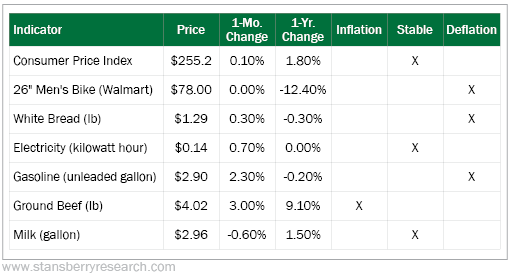

The most recent U.S. Bureau of Labor Statistics Consumer Price Index (CPI) shows prices are up 1.8% from a year ago. That's very close to the Fed's 2% inflation target. So based on the CPI's numbers, there's not much concern about inflation.

Some people object to the use of the CPI, citing shadow statistics. Others complain about how the CPI uses adjustments that don't reflect real life. I'm as skeptical of government information as anyone.

You can't rely on one data point to tell the whole story. I could read that an airlines' load factor is near highs, but since I fly all the time, I use my own eyes to help make investment decisions. That's why I don't just rely on the CPI... I also track a variety of indicators including "real-world" prices. And I publish them in my monthly income collecting service Income Intelligence...

For example, as you can see in the table, the price of one pound of white bread is down -0.3% from a year ago. The price of a 26" men's bike from Walmart is down -12.4% from a year ago. And I'm seeing the price of gasoline is about flat over the past year.

All of this tells me inflation – real-world price inflation – isn't an immediate concern.

Again, I'm as skeptical of the government as the next guy. I believe there are many reckless policies in place that could eventually produce a crisis. But as investors, we have to deal with the current facts.

And right now, since the facts show inflation isn't an immediate concern, I'm still comfortable recommending various fixed-income investments as long as their credit quality is high. Paired with blue-chip stocks, these vehicles will continue to provide retirees a great way to invest after they're 65.

In my income-focused letter, Income Intelligence, we select a combination of income investment ideas that work well together, and produce, consistent safe gains, with little volatility.

Our goal is to keep your money safe and liquid all while earning a yield to fight inflation. Click here to learn more.

What We're Reading...

- Something different: Iran-U.S. crisis: Rouhani derides new sanctions as 'useless.'

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 26, 2019