We stumbled on a fantastic business at the exact wrong time...

It was October of 2019. Doc Eifrig and I (Jeff Havenstein) were looking for a new stock recommendation to deliver to our Retirement Millionaire subscribers.

We chose a global logistics company that helps move goods all over the world and deals with all the challenges of international shipments.

In general, logistics can be a tough business. Margins are thin. Lost shipments or unexpected costs can kill your results. And it doesn't take much cash to start in this business – barriers to entry are low.

But we loved the underlying "asset light" business.

It doesn't own any of the planes or ships that move the cargo. Planes and ships are expensive to purchase and cost a small fortune to maintain. Instead, this company buys air and ocean cargo space on a volume basis and resells that space to its customers at lower rates than they could get directly from the carriers.

With an asset-light business model, management has been able to focus on profitability. And that has allowed this company to stand apart from competitors.

We were sold on this business... so we recommended buying shares in October 2019.

We couldn't have guessed that this company was headed for major headwinds.

In March 2020, the world economy shut down because of the COVID-19 pandemic. Between the pandemic and the U.S. and China trade war, this sure wasn't an ideal time to own a logistics business. (Remember, this company relies on robust global trade.)

Even last year, worldwide merchandise trade volume was just about flat.

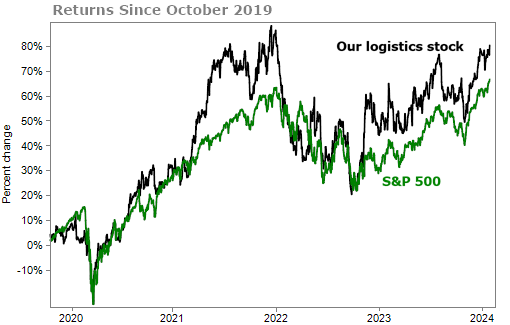

Still, shares are up 83% since our recommendation. It has even outpaced the S&P 500 Index. Take a look...

In our Retirement Millionaire portfolio review at the end of last year, we talked about all the headwinds this company has faced since we became shareholders. But as we said, "Just imagine what gains lie ahead when the world gets back to normalized global trade."

We think this stock can really widen its outperformance of the S&P 500 in the years to come.

Now, I'm not bringing this up to gloat or anything like that. (And I can't reveal the name of this company out of fairness to Retirement Millionaire subscribers.) I'm bringing this up to prove that quality businesses can return value to shareholders through all different kinds of environments – even bad ones.

Owning quality businesses is the key to long-term success in the market.

Of course, everyone knows that. But figuring out what makes a quality business is hard to do.

It took me years to learn from Doc how to find it. You need a company that gushes free cash, consistently increases dividends, has a strong balance sheet, can maintain and grow market share, and to top it off... you need to make sure you don't pay too much.

There hasn't been one number to sum everything up... But recently, Whitney Tilson and his team have come up with one.

It's called the Stansberry Score.

The Stansberry Score is an investor score, as opposed to a trader score... Trading services may rank a stock "bullish" or "bearish" based on technical indicators or trading flows and give you an outlook for the next few months.

The Stansberry Score goes deeper than that. The system our company has created can scan up to roughly 5,000 stocks and gives each stock a score, ranging from 0 to 100. Anything above 80 is considered a fantastic opportunity.

The score is based on four main factors... capital efficiency (the hallmark of Stansberry Research), financial, valuation, and momentum – with momentum being the smallest factor.

The logistics company Doc recommended back in October 2019 has a Stansberry Score of 88... There are only 19 companies (out of nearly 5,000) which rank higher.

The second most recent stock that Doc recommended in Retirement Millionaire got a score of 85. That's 113 out of nearly 5,000 stocks... The stock before that got a score of 81 and the one before that got a score of 80.

In Retirement Millionaire, we have a proven formula for finding high-quality stocks. It's based on deep fundamental analysis, with many hours poring through data and industry research. And while we recommend new stock picks each month, some folks need more comprehensive help to build their portfolios.

The Stansberry Score is a one-click way to make sure that the stocks you are buying are quality.

In The Quant Portfolio, Whitney Tilson and his team are using the Stansberry Score to find the highest-quality stocks... and then using an optimization algorithm to turn those stocks into a carefully allocated portfolio.

Access to The Quant Portfolio will only be around for a few more days. Click here to learn more.

What We're Reading...

- For Retirement Millionaire subscribers only, our October 2019 issue – "Everyone Except Two Mistaken Politicians Agrees This Stock Will Thrive."

- Something different: Oil market will face supply shortage by end of 2025.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

February 7, 2024