"Don't sell the bear's skin before you've killed him."

Sounds like practical advice... but that was exactly what the "bearskin jobbers" did.

Bearskin jobbers were the middlemen in the bearskin trade, back when selling animal skins was a way to put food on your table.

They had some shady practices. They would sell bearskins they had yet to receive. Basically, they would speculate on the future price of the skins, hoping the price would drop in the future. The difference between what they received and what they paid down the road would be their profit.

As you might guess, bearskin jobbers had an unpredictable income stream. Hence the phrase, "Don't sell the bear's skin before you've killed him."

Fast-forward a few centuries... Folks gambling in the stock market were doing the same thing as the bearskin jobbers. An investor would sell a stock he or she didn't own and hope to buy it back for a cheaper price in the future. We know this as "short selling" today. At the time, it was known as "selling the bearskin."

Bearskin jobber was shortened to just "bear," which is where the phrase "bear market" originated.

Or at least that's one popular theory...

There are more theories out there about how the bear and bull markets got their names. But whether this one is true or not, it's an analogy that's important to understand if you want to be successful in the market.

By definition, a bear market is a 20% decline in securities prices. During a bear market, there's widespread pessimism and fear. The last bear market was in 2007 to 2009, when the S&P 500 Index fell by a monstrous 57%.

Similarly, a bull market is a 20% increase in securities prices. There's typically widespread optimism and strong investor confidence.

The major difference is that bear markets tend to be much quicker than bull markets. The average bear market lasts about one year, while the average bull market lasts about three years.

Bear markets sting. It's a sharp price drop – with the average drawdown around 40% – in a short amount of time. Think back to 2008... Bear markets cut deep. I heard from plenty of folks who saw their nest eggs cut in half or more.

And they're wondering if the same pain is ahead right now...

Here at Health & Wealth Bulletin, we tend to fall on the optimistic side. We've written recently that we're seeing signs we're nearing a bottom. But despite our optimistic spirit, we always advise folks to prepare for the worst.

And this past Wednesday, our colleague Dan Ferris said the worst is still on its way...

Dan believes the biggest mega-bubble in stocks in history is about to burst...

He predicts it will be worse than the dot-com crash and the 2008 meltdown – combined. And it will impact nearly every asset you own.

On Wednesday night, he explained the biggest mistake investors are making and how millions of retirement nest eggs are in danger.

But if you prepare now, you'll not just protect your wealth... you could also end up in a better financial position than you're in now.

Click here to catch up on all the details.

Now, here are some of what is on your minds this week... Keep sending your comments, questions, and topic suggestions to [email protected]. We read every e-mail.

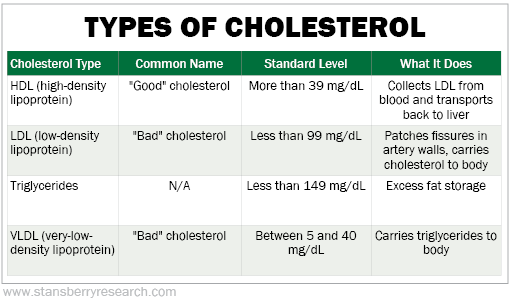

Q: I don't understand all the different cholesterol numbers that get thrown around. Can you explain? – A.D.

A: When it comes to your cholesterol, your doctor will probably focus on a single number – your "total cholesterol." That number reflects your high-density lipoprotein ("HDL"), your low-density lipoprotein ("LDL"), and one-fifth of your triglycerides.

Here's a quick overview of the types of cholesterol:

Typically, a "normal" total cholesterol reading is 200 milligrams per deciliter (mg/dL) or lower. Between 200 and 240 mg/dL is "borderline"... which means if you fall in this area, lifestyle modifications are recommended as your first line of defense:

- Eat the right foods. Avoid trans fats, processed foods, and other inflammation-triggering foods.

- Eat the right way. Try mindful eating as well as fasting.

- Exercise. High-intensity interval training is an efficient way to not just fight inflammation, but also to help burn inflammation-triggering excess fat.

If you're worried about your cholesterol, don't just look at the total numbers. Make sure you get a breakdown of each. Also, some folks might have a genetically linked high-cholesterol disorder called familial hypercholesterolemia. If you have a family history of high cholesterol and/or your cholesterol is 350 mg/dL or above, you might have hypercholesterolemia.

If you do need to get your cholesterol tested, also get your inflammation score. You can find out what your inflammation score is through a test called a C-reactive protein screen, or CRP. Higher results mean you have more inflammation. This is a better representative of your risk of heart disease and heart attack than your cholesterol levels alone. Your inflammation score can also give you an idea of your risk of diabetes and Alzheimer's.

What We're Reading...

- Did you miss it? Three tips to help you build your best portfolio.

- Something different: Netflix reveals details about its password-sharing crackdown.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 21, 2022