For investors, a lot of crazy – and painful – things happened in 2022.

Perhaps nothing was more surprising than the performance of bonds.

Let me give you an example...

In 2021, Apple (AAPL) decided to borrow $1.75 billion for 40 years, even though it didn't need the money... Apple had $190 billion in cash on hand and generated another $92 billion each year. But interest rates were low, and money was cheap. So it made sense to go to the bond market.

Investors who bought the bond signed up to lend Apple the money at 2.8% per year. That's not a huge yield, but it's more than you'd get from most stock dividends. And Apple is a rock-solid company that will have no trouble repaying its investment.

The bond was a super-safe investment. And here's what has happened to it...

An investor who lent money to the safest company in the world is down about 40% in about two years. Plus, bonds are supposed to be a safe haven when there is market volatility.

Of course, nothing has gone wrong at Apple. The company still has more cash than debt. It's still a highly profitable business.

This move down is entirely due to interest rates.

To review the math on bonds, that Apple bond was issued at $100 (meaning $1,000 per bond) and paid a coupon of 2.8%. Then the prevailing rate for investment-grade bonds changed to roughly 5%.

Active bond investors won't pay full price for a bond yielding 2.8% when they can buy more recently issued corporate bonds or even Treasury bonds with higher yields. So the Apple bond's price fell until the yield to maturity reached about 5%.

The move here is so drastic because it's a long-term bond. But even a similar bond with a seven-year maturity is down nearly 20%.

Buying Apple bonds seemed like a can't-miss prospect. And it was. Apple is going to pay all its interest payments and principal back to investors. But that only happens after you hold for 40 years.

In between, prices fluctuate.

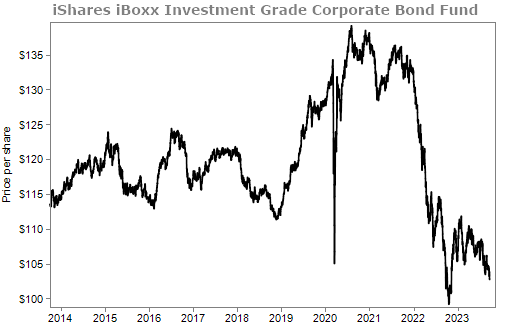

Corporate bonds as a whole have come down to a level that hasn't been seen in years. Take the iShares iBoxx Investment Grade Corporate Bond Fund (LQD). This is a good proxy for the safest, most liquid bonds in the market, and it has been running since 2002.

Normally, investment-grade corporate bonds provide a nice, ongoing return. Not this year...

Again, this is almost entirely due to interest rates.

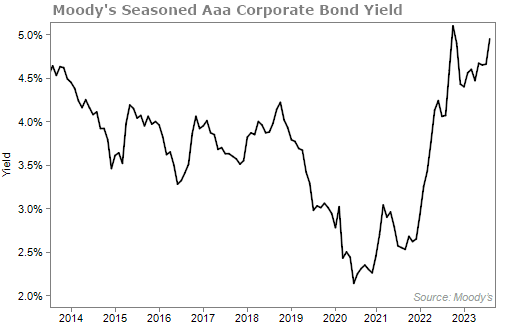

As a result, prices have gone down. But yields have gone up.

The yields on safe corporate bonds are currently 4.9%. That's nearly the highest yield in 10 years. Take a look...

Bond investors were crushed in 2022 and for most of 2023. But they are starting to look attractive because of their high yields.

My colleague Joel Litman agrees. But that's not all...

According to Joel, there's a crisis coming for U.S. stocks. And in a special presentation, he'll walk you through every warning sign he's seeing... and most importantly, what you need to do to avoid the worst financial damages you've sustained in your investing life to date.

The hint is that bonds have an important role to play in the coming months and years.

Click here to make sure you don't miss Joel's presentation tonight.

What We're Reading...

- Something different: Meta's Threads struggles to grow amid rivalry with Elon Musk's X, ranking ahead of only Tumblr.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 27, 2023