Everywhere I went, the bears had me surrounded...

Last summer, I attended the Sprott Natural Resource Symposium in Vancouver, Canada. The conference was flush with knowledge on the mining and resource exploration business...

I planned to spend my time the way I usually do... notebook in hand, asking people about opportunities and dangers in the markets, and where they see individual sectors headed.

But subscribers turned the tables on me.

Many subscribers and Alliance members (our highest level of subscribership) discovered me and surrounded me daily with worried questions:

- "Doc, what's going to happen to the dollar?"

- "Doc, when the stock market collapses in October, what should we do?"

- "Doc, have you seen the dangerous 'death cross' in the charts on the Nasdaq?"

- "Doc, have you seen that the advance-decline line is rolling over? Should I sell everything?"

A year later, the questions have changed somewhat, but people are still worried.

Everyone in Vancouver wanted to know if it was time to sell. On the other hand... I was at the conference to figure out what to buy. And that's still the case today.

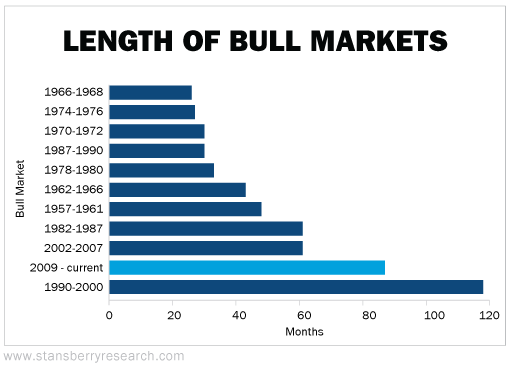

Yes, the current bull market has been going on a long time.

We've now enjoyed a bull market lasting a remarkable 87 months. The average bull market since the 1950s has lasted 51 months.

With the current bull market at seven-plus years, some young Wall Street traders have never seen a serious market decline.

Does that mean the bull has to end soon? Do bull markets die of old age?

No. People feel that after a certain amount of time we're "due" for a bear market or a recession, but it just doesn't work that way.

Yes, a big market collapse could be days away. And concerns about U.S. debt, the potential for inflation, and the value of the dollar are valid.

But ultimately, most people fixated on these worries are driven by the fear center in their brains. They're still scarred by the last market dip. So their brains search for any reason to do... something. Action releases dopamine, a brain chemical that soothes anxiety.

The drive for comfort is so strong that people will even grasp at signs that something bad is happening, just so they can join the herd and move along with it.

The problem is that being this kind of "perma-bear" leaves you out of the market.

According to recent work by investment bank JPMorgan, investors buying and holding stocks from 1995 through 2014 achieved 9.85% annualized returns. But if an investor had missed just the 10 best "up" days, his returns collapsed to 6.1%.

Clearly, being a "perma-bull" has paid off well.

So while some investors are wondering when to sell, I'm still looking for great opportunities to buy.

That's why, from July 26 through July 29, I'll be back in Vancouver for the Natural Resource Symposium.

This event is one of the best resource-focused conferences of the year. Attendees will include Rick Rule of Sprott U.S. Holdings, Bob Quartermain of Pretium Resources, Robert Friedland of Ivanhoe Mines, and many more.

You'll also have the chance to meet some of my colleagues from Stansberry Research like Dan Ferris, editor of Extreme Value, and Matt Badiali, editor of the Stansberry Resource Report.

Click here to learn more about how you can secure your place at this must-see event.