Gold bugs have been scratching their heads for most of the year...

Gold is a time-tested example of a safe haven. When volatility strikes and investors panic about falling stock prices, they typically turn to the safety of gold.

Unlike an individual company, gold is never going bankrupt. The precious metal has proven itself as a store of value over thousands of years. It always retains its purchasing power.

I often refer to gold as a "chaos hedge." In my opinion, every investor should have some exposure to gold.

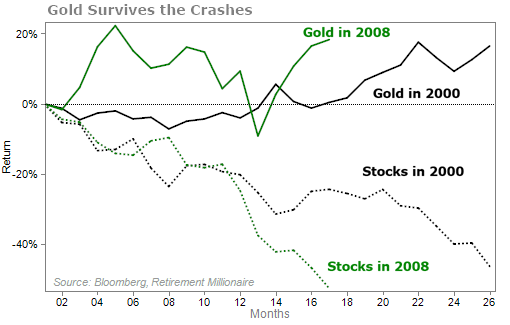

You can understand why by looking at its performance over previous major market collapses. When the dot-com and housing bubbles burst, gold rose about 20% each time. Take a look...

Lately, though, the precious metal hasn't done what it's supposed to do. It hasn't protected investors from falling stocks.

From peak to trough during this bear market, stocks were down about 25%. During that same period, gold was also down 10%. You still saved a lot by being in gold. But most folks would have expected the price of gold to go up during that time frame.

The truth is that you don't typically see stocks and gold moving in the same direction during a bear market... And this has left a lot of investors wondering whether gold has lost its place as a safe-haven asset.

In short, it hasn't.

Here's what's going on...

The biggest drawback to gold as an investment is that it doesn't pay a yield. It just sits in your account. Since all asset classes compete with each other, the yields on other investments matter.

When government bonds pay 1%, for example, holding gold becomes more attractive. You don't give up much yield. But when government debt pays more – say, 5% – some investors would move from gold to bonds.

That's what we see today... Rising rates have pushed some investors out of gold.

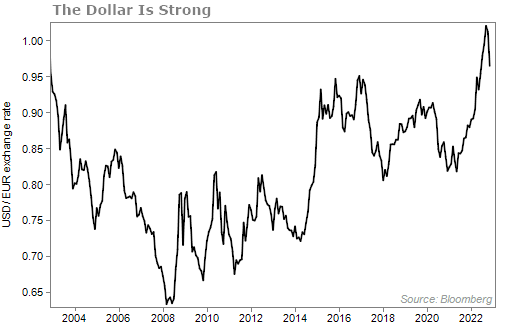

The dollar also plays a role in the price of gold. Since gold is valued more as a globally accepted store of value than for its industrial uses, its value depends largely on the currency it's valued in. For us, that's the U.S. dollar.

When the dollar is strong in relation to other currencies, the price of gold goes down. And when the dollar weakens, the price of gold goes up.

The dollar is incredibly strong right now – near its highest level in two decades against major peers like the euro. That has hurt the price of gold.

You can see how the dollar has fallen lately. Given its drop, we have seen gold prices move higher. Gold is up 8% this month alone.

There is one big reason to be optimistic about gold, however...

It's too hated at the moment.

As we've written about before, most big market moves are easy to figure out.

It's as simple as this: When times are good and people are buying, assets can move much higher. New highs tempt other folks to get in on the action, and their cash floods the market – driving prices higher and causing the cycle to repeat.

This can go on for a long time... But the music eventually stops. And it stops when no new buyers are left. This is when sentiment is at a peak.

With no one to prop up prices, they can only go down.

The opposite is also true...

When everyone is selling, investors move to cash and markets tank. Eventually, there's no one left to sell, and fear is widespread.

When this happens, so much cash is sitting on the sidelines, earning nothing, that investors have to use it somewhere. Folks start to buy again, and the market reverses.

We know gold is hated because no one is dumping money into the precious metal.

In fact, global gold exchange-traded funds ("ETFs") saw a net outflow of $5 billion in September and another $3 billion in October...

This marks six straight months of outflows.

Given rising rates and a strong dollar, no one is buying gold. Worse, they are taking money out of it.

Of course, when we see such an extreme, the opposite is likely to follow.

If your trust in gold has been shaken this year, I get it. But don't give up on it.

Better days are ahead.

Gold has a 5,000-year history of preserving wealth. That's not going to change going forward... Make sure you own some today – either physical gold or through a gold ETF.

What We're Reading...

- Gold steadies as bargain hunters see off dollar's advance.

- Something different: Ancient fish teeth reveal earliest sign of cooking.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

November 16, 2022

Editor's note: Wall Street legend Marc Chaikin sees a major financial reset on the horizon. And as it plays out, it'll be critical to move your money out of cash and popular stocks... and into an opportunity with the potential to double, triple, or even quadruple your money. Marc went live with his presentation yesterday. If you did not get the chance to hear what Marc had to say, you can access the replay here.