Municipal bonds have been surging since their December lows...

We're not yet at a "Yield Rich" buy signal in our Income Intelligence Income Trigger updates... mostly because the yield on U.S. Treasury securities has also been rising, and we use that to compare with what we can get in municipal bonds... But we're getting closer.

And it's time to take notice of what these super-safe bonds can do for you ahead of a potential Trump tax-cut buying opportunity...

Municipal bonds – or "munis" – are loans that investors make to cities and states to build roads, schools, or other public buildings. For example... toll roads in California, water distribution in Texas, and maintenance of the New Jersey Turnpike.

In return, the government promises to send investors regular interest payments, plus return of the initial investment, called the "principal," at the end of a set period of time.

And there's a bonus...

Right now, several safe muni-bond funds are yielding around 5%. That's a great yield at a time when savings accounts yield less than 1%. But the income is even better than it looks...

As an incentive to get folks to loan their money to cities and states, the income you earn from muni bonds is exempt from federal taxes. If you're in the 28% tax bracket, that makes a 5% yield equivalent to about a 7% taxable yield.

And because most muni bonds are exempt from federal taxes (and for the right bonds, even state and local taxes)... it makes more sense to hold them in a regular, taxable brokerage account instead of your 401(k) or IRA.

We suspect that munis may dip on doom-and-gloom headlines as a tax-cut deal gets worked out. That may be our chance to buy.

So far the biggest fear of the muni-bond market – the elimination of the tax exemption for buying munis – isn't in the rough drafts that we've seen of the tax plan.

In fact, some think that a Trump tax plan could increase demand for muni bonds. Bloomberg quotes John Miller, who manages $120 billion of municipal bonds at Nuveen Asset Management in Chicago...

The deductions, except for charitable and mortgage are going away, including your state and local tax... Your effective rate could easily migrate up. As your effective tax rate migrates up, your demand for munis – which are still tax free under this plan – would be increased.

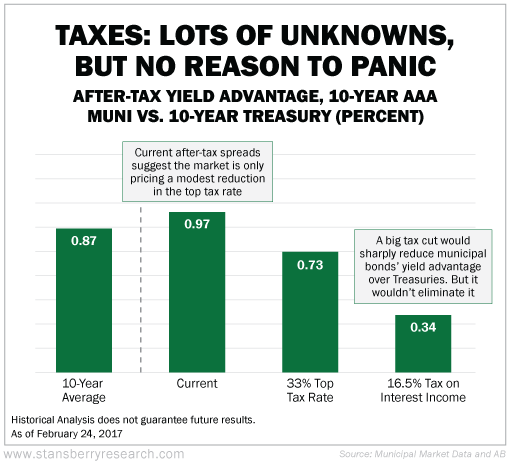

And this chart from investment-management firm AllianceBernstein shows that while a tax cut would decrease muni-bonds' advantage over Treasury securities, it wouldn't eliminate it...

As you can see, even after a tax cut, munis would still offer more yield than equivalent Treasury securities.

I believe that muni bonds should be in every retirees' portfolio for two reasons...

1. They're incredibly consistent. Many muni-bond funds are structured to pay interest out monthly... perfect for retirees who are looking for a safe, dependable income stream. Most muni funds have paid out like clockwork since they were established... every single month.

2. They're super safe. Most are backed by the full taxing power of the issuing municipality. If money runs short, the city or state can raise taxes and pay off its bills. That's what makes munis so safe.

From 1970 to 2013, an investment-grade municipal bond had a 0.08% chance of defaulting over 10 years. During that same period, junk bonds had about a 3% chance of defaulting over 10 years.

If you own mostly stocks, then buying bonds will help balance out some of the ups and downs of your portfolio. The prices of muni bonds usually move independently from stocks. And their consistent history of paying steady dividends can help you sleep at night.

We've been telling readers to buy municipal bonds for a long time. I even went on national television to make my case. Municipal bonds have been – and will continue to be – a great deal for income-seeking investors.

But like all assets, you want to buy muni bonds at a good price...

If you watch the headlines... or, better yet, are a subscriber of my Income Intelligence advisory service... you can use "headline risk" to figure out an even better time to buy.

If you see a big drop and scary headlines, it probably means a lot of investors are overreacting to a single event...

Right now, the two major factors that may smack muni-bond funds are Puerto Rico (which recently declared a form of bankruptcy) and the final details of the Trump tax plan.

If you're interested in buying muni bonds at the right price, I recommend waiting for a big buying opportunity. My Income Intelligence subscribers and I are watching a buy trigger for munis closely in our Income Triggers. I expect we'll see one soon...

If you're not an Income Intelligence subscriber and want to stay on top of the latest moves in income assets – including muni bonds, dividend-paying stocks, real estate investment trusts (REITs), and master limited partnerships (MLPs)... as well as our just-launched "Unorthodox MLP Index" – join us today at a 50% discount by clicking here.

We'll alert you to the next "Yield Rich" signal in muni bonds in Income Intelligence as soon as it triggers.

[optin_form id="73"]

What We're Reading...

- Think a Trump tax cut spells doom for muni bonds? Think again.

- Something different: This guy makes good money farming in other people's front yards.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

May 10, 2017