Historically, September has been the worst month for the stock market. And this past September did not disappoint...

The benchmark S&P 500 Index fell 4.7% – putting it close to correction territory. Tech stocks were hit even harder. The Nasdaq dropped 5.3% last month.

Based on history, these results shouldn't surprise you.

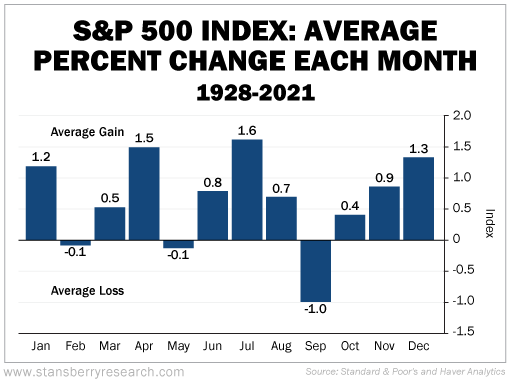

Since 1928, there have been only three months in the year where the market typically posts a loss: February, May, and September.

The average losses in February and May are only -0.1%, while the market, on average, loses 1% in September...

So the volatility we saw last month was nothing new. It shouldn't scare you into selling everything. There are actually reasons to be optimistic now...

September is behind us, and October through January have historically been the best gaining months out of the year.

One reason why the end of the year is a good time for stocks is because of professional money managers trying to earn big bonuses.

We've talked ad nauseum about how the majority of fund managers underperform the market. When October rolls around, many fund managers have trailed the broader market significantly. They have a lot of ground to make up if they are going to keep pace with the S&P 500 and earn their six-figure bonuses.

So what do they do?

They buy more stocks – typically risky tech names. And that helps push the market higher.

It's a ride you want to be along for.

Now, let's get back to this past September for a moment. The main reason why the market was down was because of big tech stocks like Facebook (FB), Amazon (AMZN), and Alphabet (GOOGL).

Matt Weinschenk, director of research at Stansberry Research, wrote about the September sell-off in yesterday's issue of Portfolio Solutions. Here's Matt...

Technology stocks are really at the heart of the September correction...

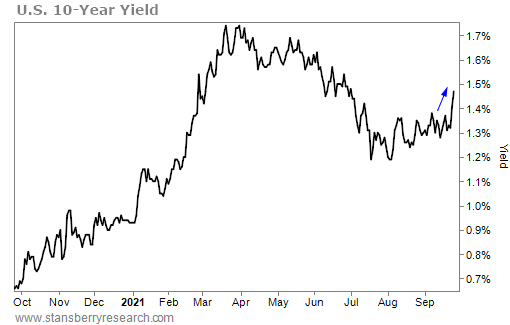

As the U.S. Federal Reserve signaled a move toward raising benchmark interest rates, market-based rates like the 10-year yield started climbing in anticipation.

That pushed bond prices down and the dollar up, which in turn led gold to fall 4.5% and real estate to fall more than 5%.

But these two things alone wouldn't have moved the dial much. The real catalyst for the September correction was technology stocks.

When you buy a growth stock – like a technology company – you're buying future earnings. Future earnings are discounted. You'd rather have a dollar today than a dollar in 10 years. How much you discount it depends on the interest rate.

In other words, the future earnings of a growth stock are worth a lot when the alternative is 0% interest. When you can earn nearly 2% in a government bond, the growth stock now has some competition.

That's our diagnosis of this pullback in a relatively straightforward line. Interest rates rose, driving big tech growth stocks down. And they make up such an overweight part of the S&P 500 Index that it led to a fairly big dip.

Matt went on to give other reasons why he doesn't believe you should panic about September's tumultuous market. In short, he believes that nothing has fundamentally changed that would alter his outlook for the market.

Again, over the past few decades, there has been a lot of selling in September. You should expect it.

Just because things were rocky last month, don't panic. The best few months for the market are here.

Everyone is talking about October 18th. And while the fate of our nation's debt is out of our hands, there is still one thing you can control – what it means for your wealth.

If you want to learn the most important step to take for your wealth right now, click here.

What We're Reading...

- Big tech's stock market leadership is threatened by rising rates.

- Should you "sell in May"?

- Something different: The U.S. could face a recession if Congress doesn't address the debt limit within two weeks.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 6, 2021