Next week, you can safely ignore the Federal Reserve headlines...

The Fed's decision to raise... or maintain... its interest rate at its March 14-15 meeting should have virtually no effect on your life or your investments.

So, considering the questions I've received about the Fed's upcoming meeting... and the market-implied odds of a rate hike this month nearing 100%... I'm re-sending an updated version of a Retirement Millionaire Daily essay that I first published in December 2015.

When I first sent my "ignore the Fed" advice, many folks in the financial media were warning that a rate increase would send the stock market tumbling...

[optin_form id="73"]

Bloomberg declared, "No One Knows How Messy the Fed Increase Could Get"... Business Insider warned: "The Fed's rate hike could cause chaos in markets"... The Guardian called it the "rate rise heard around the world"... and an analyst at the Royal Bank of Scotland even issued a recommendation to "sell everything except high-quality bonds."

All this fearmongering was ridiculous...

Not a single, coherent investment strategy relies on selling all of your positions based on a prediction of a market crash. No successful hedge fund, portfolio manager, pension fund, or private wealth manager operates on such a nonsensical scheme.

At times, you may increase your allocation to cash and defensive plays. You may add some short positions.

But the best way to minimize losses and stress in a market downturn is through asset allocation, diversification, and using stop losses... not changing your entire portfolio based on what might happen in the next month. Or worse, what has happened in the previous month.

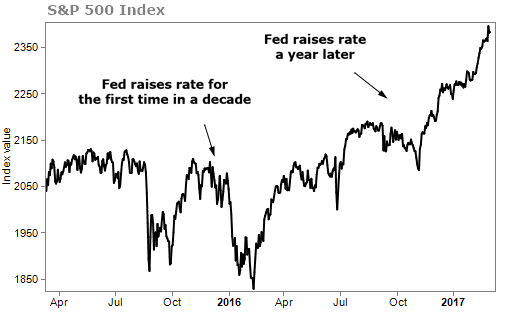

And sure enough... the U.S. economy has kept "grinding on"... while stocks have done the same. In fact, the S&P 500 Index is up about 18% from the first time the Fed raised its interest rate in December 2015... and about 4% from its increase in December 2016.

For a few months, the-sky-is-falling pundits thought they were right... The market did pull back in early 2016. But the dip was several weeks after the Fed raised rates... And it was caused more by volatility in China than anything the Fed did. Before long, stocks had bounced back and have repeatedly set new highs since.

Here are four reasons why you should completely ignore what the Fed does next week...

No. 1: There Are Different Interest Rates

There are lots of different interest rates... from interest rates on U.S. bonds to the interest rate you earn on your savings account.

The most chatter is about bonds... Bond prices and yields move in opposite directions. So some people are worried that the Fed raising interest rates means bond prices will fall.

Here's the current interest rate you'd earn on different maturities of U.S. government Treasury securities, depending on time to maturity...

| Maturity | Interest Rate |

| 2-year | 1.29% |

| 5-year | 1.99% |

| 10-year | 2.46% |

| 30-year | 3.06% |

Here's the point: None of these rates are controlled by the Fed... None.

They're all controlled by supply and demand. If a lot of investors want to lend for five years, they'll buy up the bonds and the interest rate on five-year bonds will decline.

The only interest rate the Fed controls is the "federal funds rate"... the rate at which banks and credit unions lend to each other on an overnight basis.

Now, in theory, if the Fed raises that rate, it would hurt bonds with longer maturities (what we'd call "further out on the curve"). But in practice, this effect is miniscule.

Supply and demand will determine what happens with the interest rates that affect everyday life most, not the Fed's rate.

No. 2: The Change in Interest Rates Is Extraordinarily Small

If the Fed raises rates, it will be a very small increase – say, one quarter of one percent. The Fed will then, in the future, continue to raise rates very slowly.

That's what we saw the last two times the Fed raised rates – in December 2015 and 2016. A rate increase of 0.25%. And remember that prior to the financial crisis of 2008, the federal funds rate was regularly as high as 3% or 4%. So we could have as many as a dozen raises before we're at "normal" levels again.

Make no mistake about it, this is still an "easy money" policy.

No. 3: The Change in Interest Rates Is 'Priced In' and Meaningless

Financial markets are forward-looking... If everyone knew that a stock would be worth $10 tomorrow, they'd buy and sell until it was $10 today.

Markets aren't always perfectly priced, but this rise in interest rates has been anticipated for years.

Again, in theory, higher interest rates drive down the price of bonds. This leads some to claim that the day the Fed hikes rates, bonds will plummet. But do you really think there's an investment manager sitting on a pile of bonds who hasn't considered that rates are set to go up?

As our colleague Steve Sjuggerud says about Fed decisions, "Let me ask you... how many crises have you been able to mark in advance on your calendar?"

No. 4: Stocks Perform Well When Interest Rates Rise

Many investors fear that rising rates will choke the life out of the stock market.

The theory goes that higher interest rates reduce profits for companies because they pay more to borrow... Plus, other interest-paying assets will look more attractive relative to stocks.

In reality, the Fed typically raises interest rates when the economy looks healthy enough to withstand it. Right now, GDP is growing, employment is strong, and even wages are growing a little.

In my experience, it's the real economic factors pushing stocks up that outweigh the theoretical ones that could push stocks down.

Looking at historical data, when interest rates rise from low levels, like from 0%-4%, stocks tend to rise with interest rates. (It's not as safe if rates start at a higher level... When rates rise from 5% and higher, that does tend to put pressure on stocks.)

Talking heads in the media place more importance on interest rates than they should.

Over the long term – spanning a business cycle that includes a recession and recovery – the Fed can certainly affect the path of the economy.

But if and when the Fed announces a change next week – it won't mean much at all. Please ignore it.

What We're Reading...

- Fed chair Yellen signals a rate increase is "likely appropriate" in March.

- Something different: "Who wants to run 26.2 miles through the Maine North Woods in the middle of December? And who really believes that doing so will make a lick of difference for a mill town on the ropes? This guy does."

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

Baltimore, Maryland

March 8, 2017