The turmoil in the banking sector has the market on edge...

Two regional U.S. banks have collapsed. Credit Suisse had to be rescued by UBS over the weekend. And so far, regulators have failed to calm investors.

There's a certain 2008-like feel in the air. Though, as I (Jeff Havenstein) explained last week, this isn't a repeat of 2008.

The biggest banks – I'm talking about JPMorgan Chase, Bank of America, Citibank, and Wells Fargo, which have nearly $10 trillion of combined assets – are in good shape. They're well-capitalized. Silicon Valley Bank was worth only a fraction of these banks, with around $212 billion in assets.

While this isn't a repeat of the 2008 financial crisis, there is one thing in common...

Gold is proving why it's considered the ultimate "chaos hedge."

Gold has been a store of value for thousands of years. Gold coins were minted for commerce beginning around 550 B.C.

No matter what happens to the economy, even if banks collapse and our economic structure spirals down, the precious metal will always have value. Investors like the safety of gold.

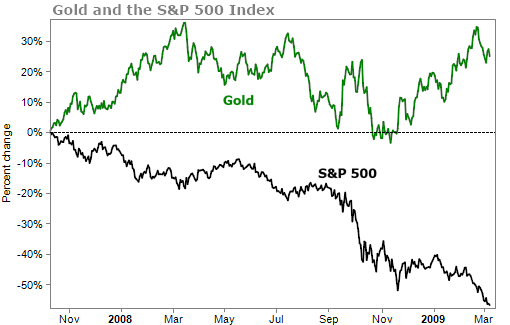

We saw that in 2008. The market was down 57% and the price of gold was up 25%. Take a look...

Over the past couple of weeks, stocks have slumped. They're down nearly 2% as I write. Over the same time, gold is up more than 5%.

Gold is once again proving to be useful in economic turmoil.

Still, no one wants to buy gold...

Doc Eifrig has been covering this phenomenon for months. Global physically backed gold exchange-traded funds ("ETFs") saw a net outflow of $5 billion in September, $3 billion in October, $1.8 billion in November, and another $534 million in December.

At the end of December, the pace of outflows was slowing as the price of gold was rising. But we've been seeing more of the same in January and February...

Global gold ETFs saw a net outflow of $1.6 billion in January and $1.7 billion in February.

This is now the tenth consecutive month of tonnage decline... the longest losing streak since January 2014.

I don't think this streak will last much longer. Everything that is going on in the economy today is reminding investors of the value and safety of gold.

No, gold doesn't pay any yield. And sure, prices may fluctuate. But you're never going to lose a night of sleep owning this precious metal. You'll always know that government regulators won't need to step in to guarantee its value.

You want to buy assets when they are hated. And you have an opportunity today.

Doc has been preaching the importance of owning some gold as a part of your overall investor portfolio. I'm here making that same plea.

If you don't own any gold, think about buying some today. I'd recommend anything around 5% to 15% of your portfolio in gold and gold stocks.

Often people flee straight to gold and silver at the first sign of trouble. History tells us most precious metals can do well when people get fearful.

But there are actually two less obvious assets that remain among some of the best options for protecting and growing your wealth with less risk, even in the worst type of monetary crisis.

I believe it's critical you learn about these two outperforming, yet underrated assets right now – and of course the best ways to buy them.

I recently went on camera to explain why this could be your last chance to build a retirement war chest that could last you all the way through the uncertain years ahead with debt ceilings, wars, and political election cycles...

And to do that, you'll want to do more than just double your money to protect yourself when the market finally collapses... currencies go haywire... and bond prices plummet.

Click here for all the details.

What We're Reading...

- Something different: Suspended Grizzlies star Ja Morant's nightclub incident could cost him $39 million.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

March 22, 2023