Would you switch places with John D. Rockefeller? You'd get his oil wealth (he was America's first billionaire)... But in return, you'd have to give up air conditioning, computers, speedy travel, quality recordings of music and movies, and the modern variety of food...

That's not to mention modern medicine's cures for what ails you, or the fact that around 160 out of 1,000 born in the U.S. in Rockefeller's day died before the age of five, compared with around five out of 1,000 today. We can't imagine what his trip to the dentist was like.

So, would you take that trade? Or do you think Rockefeller would want to switch places with you?

Throughout the history of humankind, most folks haven't had two nickels to rub together. For thousands of years, we were lucky when we could stay out of the rain and keep our bellies full.

It has only been since the 1900s or so that common people have really been able to amass widespread wealth. America's $68,000 median household income makes us unimaginably rich in the view of history.

And while you may not feel rich compared to your neighbors, when you expand your view to the rest of the world, even a low income in the United States puts you in rarefied air.

Most importantly, the progress of technology, culture, and medicine provides us a living standard that kings, sheiks, or robber barons from just a century ago would envy.

So you are, in many ways, rich.

And it's a very good time to be rich...

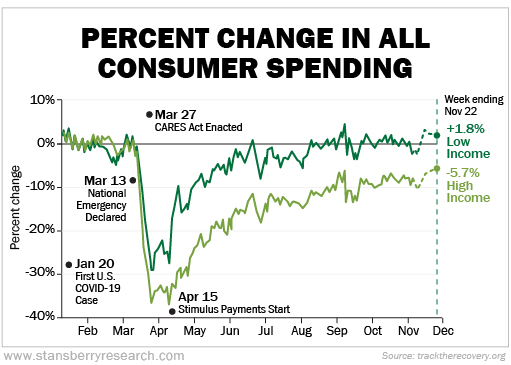

Higher-income folks have been sitting on their money during the COVID-19 pandemic. Low-income folks spend on things they need, and they haven't spent much less. But the wealthier have postponed many of the things they used to buy. They are still 5.7% off their normal spending habits...

But the rich holding on to their cash is not a "problem" – it's an opportunity. Their economic activity will join the recovery... and soon.

It's a fact that there are problems all over the global economy. And certain businesses and industries will struggle. But the recovery is underway.

And a certain class of people has sailed right through the pandemic – economically, at least. They've got jobs, income, and savings... more savings than ever. They are ready to spend.

So while you may think there aren't any profitable – and safe – opportunities left in the market, there are plenty... if you know where to look.

If you're nervous you've missed out on the incredible recovery that happened in the stock market in 2020... if you're wondering what's next for this Fed-fueled bull market in stocks... if you want to know what the Biden-Harris administration means for the markets... and more, you need to tune in.

Plus, we'll each unveil our No. 1 money move for 2021.

It doesn't cost you anything. All you need to do is sign up right here.

Now let's take a look at some of your burning questions. And please keep them coming our way. We read every e-mail... [email protected].

Q: I recall reading something about dangerous receipts. Can you point me to that information? – T.P.

A: You likely found that in a recent issue of my Retirement Millionaire newsletter, which subscribers can read here. But let me recap that topic for everyone...

When printed on thermal paper, receipts – like you'd get at a grocery store – expose you to bisphenol A ("BPA"). This harmful chemical is often used in the production of polycarbonate plastics and epoxy resins. BPA exposure interferes with cell repair, energy levels, reproduction, growth, fetal development, and other body processes.

The chemical typically enters the body through the ingestion of food and drinks that have been stored in containers manufactured with BPA. But when BPA enters the body through the skin, much more of it reaches your bloodstream because it bypasses the liver, which metabolizes some BPA when you get it in your food or drink.

Do what I do... the next time a cashier asks you if you want your receipt, say "no, thank you." I haven't put my hands on a store receipt in years.

If you really want that receipt, see if the store can e-mail you a copy. As an added benefit, requesting a digital copy makes it easier to organize and store your receipts.

Q: Do you prefer hard stops or trailing stops? – A.B.

A: For most of our Retirement Millionaire recommendations, we use a 25% hard stop. That means if the stock falls 25% from where you bought it, sell it. That's in contrast with a trailing stop, which I use in my other newsletters and is based on how far a stock has fallen from its highs while you've owned it.

Using a hard stop means that if the stock does move higher and you have big gains, you can ride through some volatility without getting stopped out.

If you follow a trailing stop, you'd have to sell your winners much sooner – a hard stop means we hardly ever sell winners early. And if a stock does fall 25% from our entry price, it either means we were wrong about the stock or we had horrendous timing.

Picking the right kind of stop can be tricky. Generally, we recommend hard stops for income-generating investments (stocks we plan on holding for the long term) and trailing stops for growth investing.

Q: In your recent Retirement Millionaire you told us to exercise more. Do you have suggestions for us old folks not wanting to go on a bike ride? – A.H.

A: You don't have to do anything strenuous to exercise. You can get all the benefits of exercise with "lower impact" activities like long walks, gardening, and yoga. If it's difficult to do anything for too long, you can break up your movement throughout the day. For example, instead of one long walk, you can go on three short walks of about 20 minutes each – one after each meal.

And for all those folks who sit at a desk all day, make sure you add breaks to do your daily exercise. Make sure you're getting up every 45 minutes. Take a few minutes to stretch, rest your eyes, and get some fresh air.

What We're Reading...

- Something different: There's no way we could stop a rogue AI.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 22, 2021