Whether you're someone who only glances at their score once in a while or watches it every month on their credit card bill, you're about to be in for a shock...

That's because your score could jump higher or fall lower this year. And it'll happen regardless of what you do.

The FICO credit score comes from the Fair Isaac Corporation (hence the name FICO). Every few years, Fair Isaac changes the formula used to calculate that score.

Overall, the score looks at your payment history, credit limits, credit utilization, and more.

Each credit bureau also has a separate score based on the accounts reporting to them. Approximately 90% of lenders use your FICO score. Plus, your FICO score is typically available through your bank or your credit-card company – and often for free.

FICO scores are typically Good, Very Good, and Exceptional for anything at 670 and above. Fair is 580 to 669, and Poor is 300-579.

Lenders look at these scores to calculate how likely a borrower will be to default. They then use that to determine interest rates and lines of credit.

There are several versions of FICO scoring... kind of like versions of Windows software. This summer, version 10 will be released, along with version 10 T.

FICO 10 and FICO 10 T will increase the weight of personal loans. That's because more people are consolidating their debt into personal loans and then using that to take on even more debt.

FICO 10 T goes another step further to identify folks at risk of default. It uses "trended data." That means they look at all of your debt for the past 24 months to see your behavior... Are you paying down debt? Are you taking on more debt? This two-year window changes depending on what you do to manage your own debt.

The good news for most people is that these new FICO versions likely won't go into use for a long while. Many lenders hesitate to adopt new scoring systems until the data come through – why trust a new system when so much money and risk of default is on the line?

According to credit analyst Ted Rossman of Bankrate, FICO 8 is the most commonly used model. That came out in 2009.

Even better news: There are good, practical steps you can take to make to improve your credit or keep it high regardless of the FICO scoring system.

First, make a habit of keeping tabs – not just on your FICO score, but on your credit reports. This is the best way to get a clear picture of your credit – including old credit cards you might have forgotten about and any possible fraudulent lines of credit.

The three main credit bureaus – Experian, Equifax, and TransUnion – each offer a free report once a year. Your credit report will list out all open lines of credit and debts (all credit cards, mortgages, and loans should be on there).

You can request all three reports at once or spread them out, depending on what works best for you. Get all three at once if you want a full picture of your current credit history or stagger them every few months for regular monitoring.

It's important to get all three because they don't all report the same data. Some lenders, like banks, might only work with two of the three bureaus.

But clearing up any possible fraud or looking into forgotten credit cards is a great way to improve your credit.

Speaking of cards, the second tip is to be careful about which cards to close. You might think closing all but one or two cards would boost your score, but it likely won't...

You want to think about age, along with something called credit utilization.

Don't close your oldest card – you want a longer credit history to improve your score.

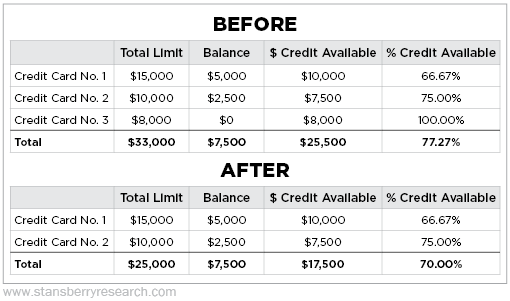

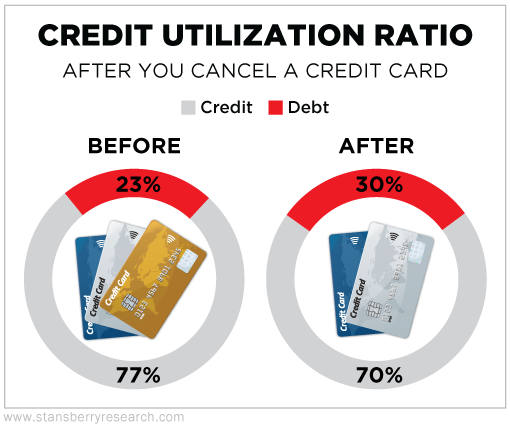

Credit utilization ratio is the measure of how much of your total credit you're using. To calculate the ratio, you divide debt by available credit. Let's say you have three credit cards. Here's what happens if you close the card without a balance...

You can see that the credit utilization ratio jumps from 23% to 30%. That might not seem like much, but even a ratio that's just a little higher can mean you're stuck with higher interest rates on loans and other credit cards.

Now, if you're paying an annual fee on a zero-balance card, you might want to consider closing it. Especially if you're not anticipating needing any loans in the near future.

Those are two ways to boost your credit. But there's more you should know about credit reporting and how to keep your information secure. Read more in my report, "How to Protect Your Income from Big Banks, Big Pharma, Big Everything." Retirement Millionaire subscribers can access it here.

And if you aren't a subscriber, you can sign up today for just $49. Click here to learn more.

What We're Reading...

- Something different: A good reminder to protect your phones, too.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 30, 2020