Companies have been buying back record amounts of their own stocks... and it's been great for this bull market.

In fact, it's one of the key drivers pushing stocks within 1% of all-time highs.

You've probably seen all the positive news about stock buybacks in the media, but do you know why? And, even more important, what does this mean for your portfolio?

So today, let's take a dive into stock buybacks...

First, I want to explain exactly how buybacks work and why companies do them...

A stock buyback occurs when a business purchases its own shares from the marketplace. This is good for investors because it decreases the number of outstanding shares, which means the relative ownership stake for each investor increases. Basically, as a shareholder, your slice of the pie gets bigger.

A company may buy back its stock as a way to reward shareholders or to bet on itself. If a business believes the market has discounted its stock price too greatly, it will buy its shares knowing they should be worth more.

A big share repurchase is also a bullish sign to some investors. It can signal that management believes in itself and may know something the market doesn't.

Another reason for buybacks is for a company to improve its financial ratios... making its stock more attractive to investors.

For example, a popular metric investors look at is earnings per share ("EPS"). This is calculated by taking a company's net income and dividing it by the number of shares outstanding. If net income (the numerator) increases and shares outstanding (the denominator) does not change, then EPS increases. That means the company is more profitable and can pay more out to each shareholder.

The problem is that net income doesn't have to increase for EPS to go up. Earnings may be flat but if the number of shares outstanding (again, the denominator) goes down, then EPS goes up. This may signal that a company is more profitable than it actually is.

Buying back stock has a similar effect on other popular profitability metrics – such as return on assets ("ROA").

Let's suppose a company buys back 1 million shares of its own stock for $10 a share. You can see that this significantly improves the company's EPS and ROA – even though net income didn't increase...

|

|

Before Buyback |

After Buyback |

|---|---|---|

|

Cash |

$20 million |

$10 million |

|

Assets |

$40 million |

$30 million |

|

Earnings |

$2.5 million |

$2.5 million |

|

Shares Outstanding |

$10 million |

$9 million |

|

EPS |

$0.25 |

$0.27 |

|

ROA |

6.25% |

8.33% |

It's easy to understand why companies want to buy back their own stocks. But not everyone thinks this is the best use of cash...

For a company flush with extra cash, it essentially has four choices what to do with that money. It could pay cash dividends, make an acquisition, spend to improve its business, or buy back its stock.

According to Bloomberg, more than half of U.S. corporate profits go towards share buybacks.

Since so much cash is going towards buybacks, politicians have even proposed legislation to prevent it unless companies pay their workers more and offer other benefits. It's a highly debated subject.

Economists could go back and forth for days about whether buybacks are a company's best use of cash, but one thing is clear... If you want your business' stock price to increase, buying back stock is a good option.

And if a lot of big companies are buying back large amounts of their own stocks, it could help move the market higher.

That's what we've been seeing the past few years.

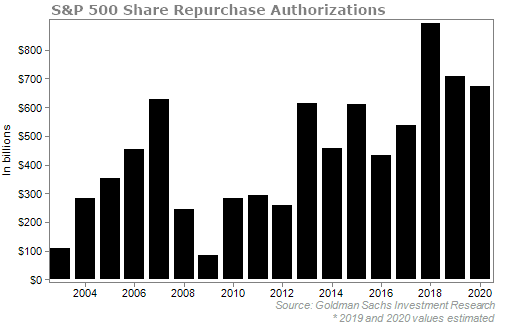

Last year, S&P 500 Index companies authorized $895 billion worth of share repurchases. That was an all-time high... And 42% higher than what companies authorized in 2007.

But according to a recent Goldman Sachs report, the buyback bonanza is slowing down.

The investment-banking giant reported that stock repurchase plans are down by 18% in the second quarter compared to last year. For 2019, Goldman estimate buybacks will drop by 15%. And in 2020, they estimate a 5% decline.

Even though buybacks are slowing, they're still high when you compare them to previous years...

This decline stems from a recent drop in CEO confidence. Executives are nervous right now about global growth and the trade war. As a result, Goldman estimates total cash spending will fall by 6% this year... the sharpest drop since 2009.

This is worrying for sure. Without buybacks and with other cash spending falling, it's reasonable to be concerned about what will push the market higher. And I've talked before about other troubling signs I see in the economy...

But we have to take this slowdown in stock buybacks in context. They are falling from all-time highs. Companies are still pouring in hundreds of billions into stock repurchases. And they're still high compared to previous years.

But a slowdown in buybacks is just another signal that this bull market is getting long in the tooth.

What We're Reading...

- Something different: Verizon will offer customers a year of Disney+ for free.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 23, 2019