I'd bet that you're smarter than 92% of Americans. Here's why...

As a reader of Health & Wealth Bulletin, you're serious about being in control of your own finances. If you've been following me for any significant amount of time, you'll know I've covered everything in the investing world from options to asset allocation to fixed-income investing.

And that's why you're likely smarter than the vast majority of your peers.

According to a recent survey by BNY Mellon Investment Management, a staggering 92% of Americans didn't know what fixed-income investing actually is. And this survey didn't factor in younger Americans who are still trying to learn the alphabet... This was a survey of a couple thousand adults.

The results were scary...

The survey revealed that Americans have little to no knowledge about fixed-income markets and ways to invest in them.

Fewer than one out of 10 respondents could correctly define fixed-income investing. About 30% believe fixed-income investing is intended only for your retirement. And nearly half have no clue about the right time to have exposure to fixed-income investments in their portfolios.

I've long said that fixed income should be a staple in any investor's portfolio. And that's because diversification among asset classes is essential...

Fixed-income securities are designed to pay a regular stream of income over a fixed period of time. You lend money to a corporation or a government, and at the end of the bond's duration (at maturity), you get back most of your initial investment (called principal), depending on what price you paid at the start.

Depending on your age and tolerance for risk, bonds sit somewhere between boring and a godsend. The promise of interest payments and an almost certain return of capital – at a certain fixed rate for a long period of time – will let you sleep well at night.

Including safe fixed-income securities in your portfolio is a simple way to stabilize and balance your investment returns over time, too. For people with enough capital, locking up extra cash (after you've saved six to 12 months of your expenses) in fixed income is a great way to generate much more cash flow than the nearly nonpaying money-market or savings accounts.

In my Retirement Millionaire newsletter, I've talked about many different fixed-income investments... from municipal-bond funds to preferred stock (a sort of half-bond/half-stock security) to corporate bonds.

One of the main reasons to have some money in safe bonds (not junk bonds... unless you follow our Stansberry's Credit Opportunities distressed-credit team) is to offset volatility from the stocks you own.

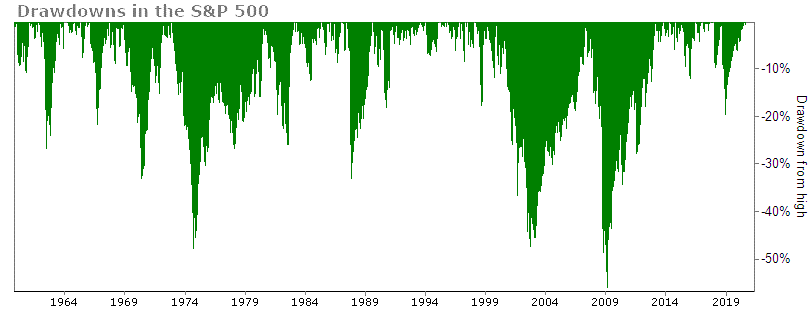

Over time, you're likely to make money in stocks. But it's not always a smooth ride. There are many up years – but there are some big down years, too. The chart below shows how far the market dropped from its peaks during various drawdowns over the years...

As you can see, stocks fall 20% and 30% from highs with regularity. They can even fall 50%.

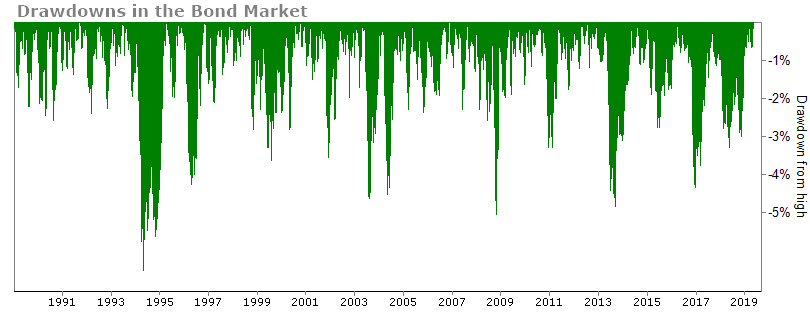

Bonds, too, have their drawdowns. But the most drastic declines are around 6%...

In other words, bonds also fall... But if you are used to stocks, you'll never lose a moment's sleep over your bond portfolio.

Now, a question I'm sure a lot of folks struggle with is: How much of my portfolio should be in bonds?

This answer depends on your tolerance for risk. And your age.

When you're younger, you can afford to take more risk and try to earn higher returns with your money. This leads you to having more money in stocks. (Even though you should have at least 10% in fixed income as a baseline.) And as you get older and more focused on capital preservation – versus appreciation – more money in bonds makes sense.

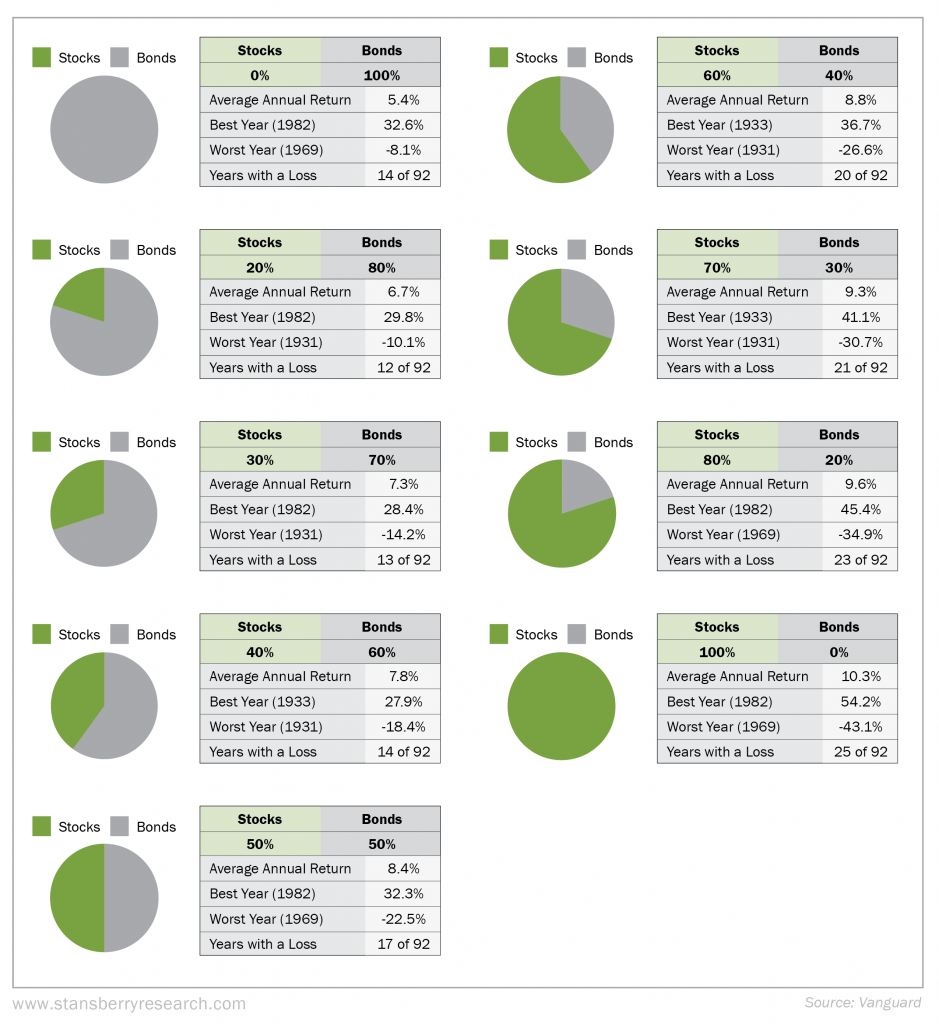

The diagram below should help you understand what to expect.

By viewing the range of simple allocations between stocks and bonds, you can see that a 100% stock portfolio has returned 10.3% a year – but with substantial risk. On the other hand, a 100% bond portfolio has returned 5.4% a year – with little risk. Only 14 out of 92 years had a loss.

And a more balanced 60%-stock/40%-bond portfolio returns a healthy 8.8% a year but reduced the worst loss from 43.1% to just 26.6%.

If you don't have any of your portfolio in fixed income, I suggest you do it now... Especially with signs of a market top flashing. The returns from bonds aren't going to blow you away, but consistently getting a check from the government or a company is a great feeling.

A simple "one click" way to get exposure to safe corporate bonds is through the iShares iBoxx Investment Grade Corporate Bond Fund (LQD). LQD has over 1,000 U.S. investment-grade corporate bonds of some well-known companies like Verizon, JPMorgan Chase, Microsoft, CVS Health, and Apple. These are all big, sturdy companies that should have no trouble paying off their obligations – even during a recession. When stocks are down 20% or 30% or even 50% – you'll be happy to collect income checks from your fixed-income investments.

What We're Reading...

• Most Americans don't know what fixed-income investing is.

• How to create a modern fixed-income portfolio.

• Something different: Juul disregarded early evidence it was hooking teens.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

November 6, 2019