U.S. stocks are booming. They've been outperforming all other markets.

They're also getting expensive...

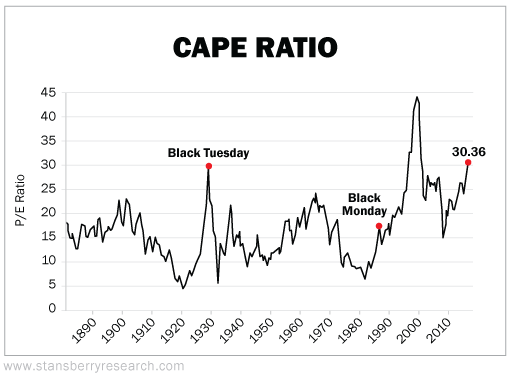

By one measure, called the cyclically adjusted price-to-earnings ratio (also known as the CAPE ratio), the S&P 500 Index is currently trading at a CAPE ratio of 30.36...

Most analysts consider that to be in over-valued – and even dangerous – territory...

The CAPE ratio is similar to the price-to-earnings (P/E) ratio, but it uses the earnings over the last 10 years. It's supposed to be more robust compared with the business cycle.

The problem is that the CAPE ratio does a very poor job of predicting returns over the next few months (or even years).

Don't think I'm calling for a crash... You'll waste your time if you sit around trying to call a top for this market. In fact, today's record prices probably aren't the highest we'll see.

Remember... when the CAPE ratio for U.S. stocks is high, it doesn't help us figure out where it will go tomorrow. But it does suggest that stocks may not have as much upside in the next decade as we saw in long bull market we've experienced in recent years...

Quantitative firm Research Affiliates uses an approach that takes the CAPE ratio, income growth, and the typical mean reversion of valuation multiples into account. That method expects U.S. large-cap stocks to return just 1% per year over the next 10 years.

Of course, I don't have a crystal ball. Simply because markets are expensive doesn't mean that they can't get more expensive.

But a pricey market does mean it's an ideal time to add another "tool" to your investing toolbox.

It's an options strategy known as "covered-call writing"... and you can use it to generate easy double-digit income with lower risk than by simply buying a stock. And you can also use it to generate more income on stocks that you already own.

I first learned this strategy when I was at Goldman Sachs, and I believe it's one of the best ways for retirees to make more from an investment portfolio.

Covered calls work best for investors who favor income, lower risk, and steady stocks over high-growth investments. That describes many of my Retirement Millionaire Daily readers... You probably have a significant portion of your portfolio dedicated to safe, blue-chip stocks. Well, this is a way to "boost" your income on those stocks.

I'll get into more of the details tomorrow. For now, know that when you look at the numbers, the benefits of the strategy are clear.

The CBOE S&P 500 BuyWrite Index is an index that uses this strategy. It tracks the results of buying the S&P 500 Index and then selling the next expiring call with a strike price just above the index's price. Right now, this index yields more than 4%... compared with just 1.9% from the S&P 500.

That's more than double the yield on the very same stocks.

Again, that's if you went out and simply bought up an entire index – hundreds of stocks. But you can put this same income-doubling (or higher!) strategy to work on almost any stock that you already own...

For example, say you own 100 shares of a blue-chip company. You like the business, but you would be willing to sell your shares at a certain price...

With a call option, you can agree to hand over your 100 shares of the stock on a certain day (called the "expiration date") at a set price (called the "strike price"). Usually this price is higher than where the stock is currently trading.

This is known as "selling" a call option... The call buyer pays you money (called the "premium") today to enter the contract. They agree to buy the stock from you at that price, but it's their option to exercise or not. They are the buyer of the option, and you're considered the seller.

If the stock price goes above your set "sell price," you hand your shares to the option buyer and get paid the strike price. If it doesn't, then you can turn around and sell another call option... with each trade you make, you boost your income a little more.

So if you think about covered-call selling, you want your holdings to go up a little bit, but not too much.

I've recommended this strategy to thousands of folks since 2010... And it continues to work, trade after trade. We often hit double–digit annualized gains... and we only trade the best and safest stocks. We've made money more than 94% of the time.

But we don't know when this historic bull market with end.

That's why this week, I'm sharing a special "Crash Course" program.

This program will help you "guardrail" your portfolio against a market shockand simultaneously position yourself for more upside...

On Saturday, I shared the full story of how I've achieved one of the best track records out there – with more than 350 winning positions.

This morning, I released my second "Course"... it walks you step-by-step through a live and actionable FREE trade recommendation. You can access it immediately by signing up here.

And after you sign up, you'll also receive a special final Course program tomorrow...

I'll announce what could be the biggest and most important call of my publishing career. It's a plan that involves expanding our toolbox in Retirement Trader for the final stages of this historic bull market. It'll help you keep what you've made these last few years, and position you to capture most of the upside that remains. If you're at or near retirement — you do not want to miss this!

- This 'stealth' bull market could see triple-digit gains.

- Did you miss it? You're no Warren Buffett.

- Something different: How to handle the Equifax data breach.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

September 18, 2017

Baltimore, Maryland