The phrase "just because you can doesn't mean you should" applies to almost everything in your life...

Just because you can buy an expensive house doesn't mean you should. Just because you can skip work today doesn't mean you should... The list goes on.

This is especially true in investing and trading, where a too-risky strategy could easily wipe out your portfolio... a strategy liking using margin.

The simple definition of "buying on margin" is investing with borrowed money from your broker. Like a mortgage loan where the house is collateral, the securities you buy in a margin account are the collateral. And, like any loan, you'll have to pay interest on the money you borrow.

Buying on margin can be lucrative, and relative safe, if it's done right. I've told you for years about how to use option selling to generate safe and steady income.

But many people don't fully understand the risks of using margin or how to properly use margin.

Let me walk you through an example...

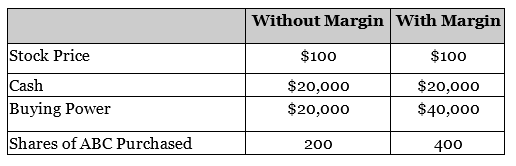

A trader has $20,000 and he's got a gut feeling that shares of company ABC will shoot up over the next few months. He decides to use margin, borrowing $20,000, to try and boost his returns.

This trader can purchase double the amount of ABC than he could using a cash account...

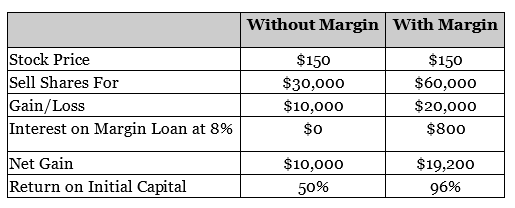

Here's what can happen if the trader is right and shares of ABC shoot up from $100 to $150 a share after six months...

The benefits of using margin are clear. You can make a lot of money if the market cooperates and the stock goes the way you want it to.

But that's not usually how it works out...

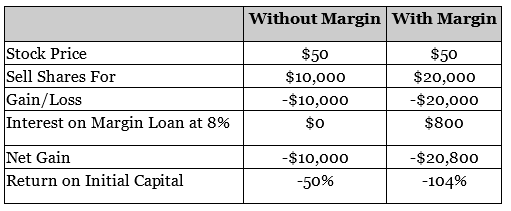

Here's what can happen if the trader is wrong about ABC. In this scenario, ABC's share price tanks from $100 a share to $50 a share after six months...

Using margin, you can easily lose more than 100% of your investment. No matter what happens, you have to pay back the margin loan – even if the stock goes to $0. A margin loan is just as binding as a loan from a bank... It must be repaid in full.

If you buy on margin and the stock suffers a steep and sudden decline, your broker may issue what's called a "margin call." This is where you'll have to come up with the money to post the minimum amount your broker requires to cover potential losses, which can be up to 100%.

If you're unable to meet a margin call, your brokerage can sell your stocks without notice to meet this requirement. If this happens, you can often lock in some pretty bad losses during a market downturn.

In my options-trading service Retirement Trader, we've used margin when we've sold put options. It's been a way for us to make our option sales with less upfront capital and boost our returns.

[optin_form id="73"]

But lately, as regular Health & Wealth Bulletin readers know, I've become concerned about the market. I think now is not the time to be making trades on margin, unless you're an extremely experienced trader and have a solid strategy in place.

Here is what I told my Retirement Trader subscribers in my most recent issue...

With the state of the market as it is today, we're making a change to the way we display trades.

Our first and foremost goal has always been to keep your money safe. Making money is great, but losing it is much worse. And we've always recommended only investments that I'd recommend to my own mother.

With that in mind, I don't want my mother trading on margin today.

If you're currently trading on margin in your own account, my advice would be the same... especially for beginner investors. It is important to eliminate any risk you can at the tail end of this nine-year bull market.

Remember, just because you're approved to use margin doesn't mean you should.

What We're Reading...

- Something different: A Chinese vase found in a shoebox sells for millions.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

Baltimore, Maryland

June 13, 2018