Wall Street analysts just can't get it right.

They project high earnings growth at the top of the market and declining earnings right at the bottom.

To find the peak in the market, we have to watch for when earnings estimates get too high. We haven't gotten there yet. With earnings season nearly over, 78% of companies have beaten analysts' estimates. That's the highest number since at least 2008.

What happens next is clear. Analysts will ratchet up their estimates, projecting higher and higher earnings growth... until the economy turns, and they are wildly incorrect.

That's what we're watching for.

We're watching for it out in the real world, too. Today, planes and hotels are full. Construction equipment is everywhere. Job boards are full of postings.

Everything looks good... But it's bordering on too good. That leaves us stuck.

This is one of the most uncertain periods in market history...

I know plenty of smart market-watchers and professionals who say we're on the verge of a sudden and dramatic decline. It could happen today... tomorrow... or several months from now.

Others say the market could go up 50%, or even 100% or more from here before it tops out. That's a massive move... and one that you don't want to miss. It could mean the difference between a bargain-bin retirement and one where you never need to stress about your everyday expenses.

Both sides have reams of data and truly compelling evidence to support their positions.

What we do know is that stocks are getting expensive.

Of course, I don't have a crystal ball. Simply because markets are expensive doesn't mean that they can't get more expensive.

But there is a place where you can still find bargains...

I recently got back from a trip to China with my friend and colleague Steve Sjuggerud.

Steve is one of the brightest guys I know. This is a guy with a PhD in finance and a track record that would make George Soros jealous.

Whenever I consider a new investment thesis, I always check Steve's research to see what he thinks. Or I even give him a call on the phone. He's no stranger to calling big market moves.

Since 2015, Steve has been telling his readers it was time to take notice of major opportunities in China. And he's has been right on the money. He assembled an entire portfolio of investments. And 22 of the 26 recommendations made great gains over the past few years, with at least three of his picks soaring more than 100%.

But one of the most surprising things I learned on this trip is that Steve has found his next big money-making idea... and it has nothing to do with China.

Steve calls it "America's next big bull market," and believes gains of 500% or more are possible over the next few years.

If you missed out on Steve's China call, or his Melt Up theory, this is your chance to get in early on the looming bull market Steve sees coming... in commodities.

Most Americans don't realize that commodities as a whole trade for about the same prices as they did in 1990. While everything else in the financial world (including stocks, bonds, and real estate) has soared, commodities still offer great bargains.

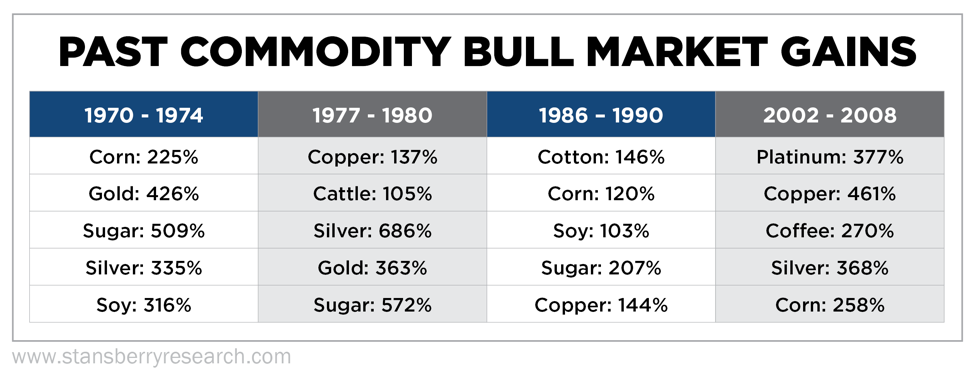

There have been essentially four big commodity bull markets over the past 50 years, and in each one of these, you could have made many times your initial stake, with the right investments.

This is a huge opportunity. One that only comes around once or so every decade. It's about to happen again... starting now.

Tomorrow night, Thursday, June 21 at 8 p.m. Eastern time, Steve is hosting a free, live online event where he'll talk about why commodities are set to move much higher right now... and three ways to invest in commodities... including the one Steve believes is the safest with the best potential upside.

Click here if you don't want to miss out on what could be the next big move in the market.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 20, 2018