After last Monday's sell-off, readers have flooded our inboxes with worried notes...

It's understandable. Up until recently, the S&P 500 Index has seen nothing but smooth sailing this year... And it has been even better for the average growth-obsessed investor who loves to buy tech.

But with the markets taking a bath last Monday – and with the tech-heavy Nasdaq Composite Index being in an official correction – a few of us here decided we needed to come out with an emergency briefing for our subscribers.

I – along with Stansberry's Investment Advisory editor Whitney Tilson and Director of Research Matt Weinschenk – sat down to have an open, unscripted talk about what's going on with the markets and economy.

It was a great chat. There was even plenty of debate... And anyone who has been with our company for long will know that we do not adhere to groupthink. It's often good to hear both sides of a topic so you can make a decision best suited to your own situation.

If you missed the emergency briefing, you can find that video here.

Today, I wanted to go over a few of the points I made in our talk.

It will come as no shock to any regular Health & Wealth Bulletin readers that I have become bearish lately.

After all, I've been pounding the table since June to avoid Big Tech.

I still think that's the case today. Expectations of market returns over the next few years need to be lowered because of the high concentration in Big Tech... and these companies' nosebleed valuations.

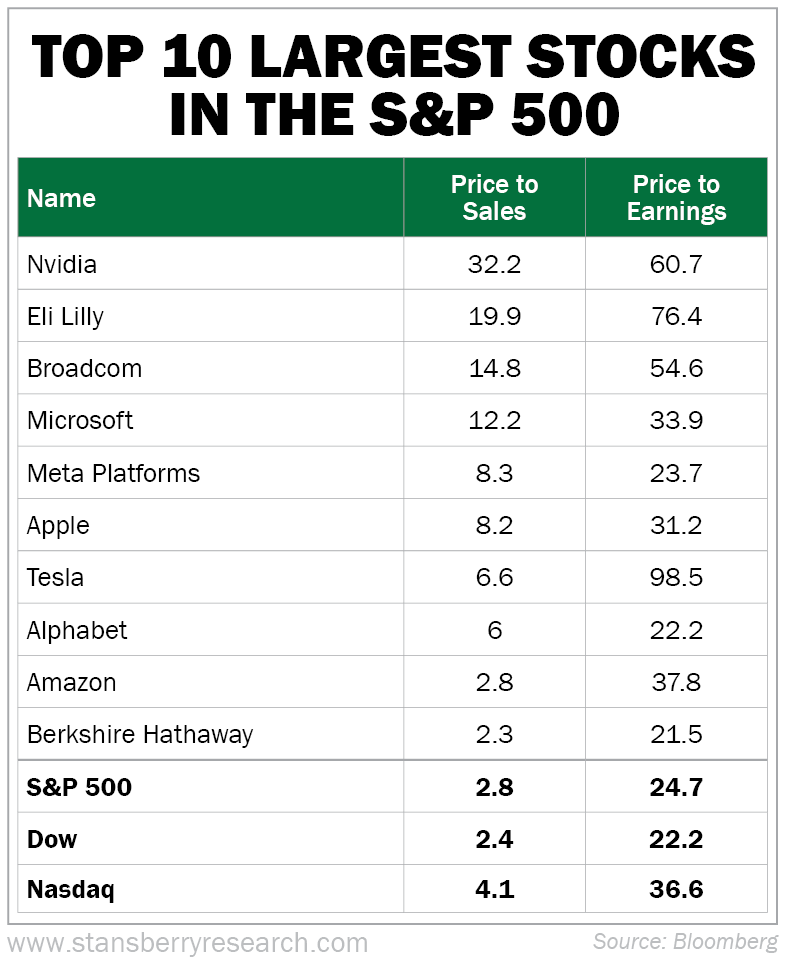

Below you'll see a table that lists the 10 largest stocks in the S&P 500 and their valuations. We've covered ad nauseam how Nvidia (NVDA) has been in a bubble, so we won't dive into that again today. But look at some other big stocks and their valuations...

Eli Lilly (LLY) is trading for 20 times sales.

Tesla (TSLA) is trading for nearly 100 times earnings.

Clearly, the giants in the market are richly valued today.

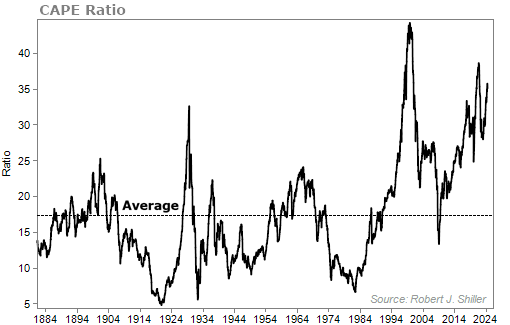

In the emergency briefing, I also made it a point to bring up the cyclically adjusted price-to-earnings ("CAPE") ratio.

The CAPE ratio simply takes the regular price-to-earnings ratio and smoothes out earnings over the business cycle. By doing so, we can then compare earnings with current prices to learn whether stocks are cheap or expensive today.

The CAPE ratio is currently at 35. To give you a sense of how big that number is, the average CAPE ratio has historically been just above 17. Today's ratio is the third highest in history...

As Matt pointed out in the video, the CAPE ratio has little value for measuring short-term returns. It doesn't tell you when a bear market is coming or what the market will do tomorrow – or even over the next year.

However, the CAPE ratio does help provide long-term indications.

And based on the ratio we're seeing today, expectations should be for flat or even negative returns over the next decade or so.

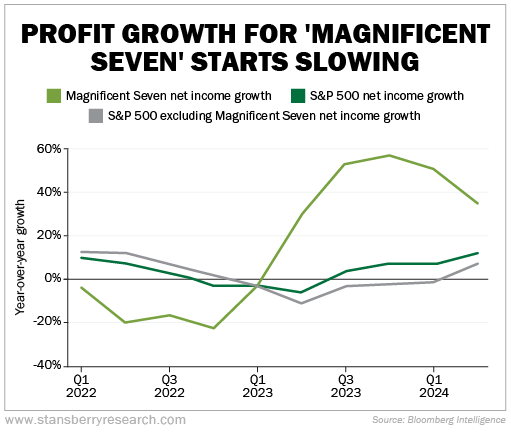

Finally, before I sign off today, I wanted to show you one more chart that just came across my desk (one that wasn't in the emergency briefing).

Market bulls frequently argue that Big Tech stocks are still worth buying because they have wide profit margins... They are so profitable that they deserve a higher valuation than the average S&P 500 stock. And that's true, to a degree.

But we're starting to see the profit gap between mega-cap tech stocks and the rest of the market shrink. Take a look...

In the briefing, there was a lot of talk about how there are still places to put your money and earn a solid return.

I'm a big advocate of U.S. Treasurys, as I've written about before.

And outside of the top mega-caps, there's still some value. For example, we've also written earlier this year about the opportunities in small caps and mid-caps.

If you take any one thing away from today's issue... I hope it's to please stay as far away as you can from the largest tech stocks in the market. The returns over the next couple of years are sure to disappoint you.

What We're Reading...

- Something different: Starbucks replaces CEO Laxman Narasimhan with Chipotle CEO Brian Niccol.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 14, 2024