It's a classic American story...

You spend decades working knowing that when you're ready to retire, you'll have Social Security and a pension to take care of you in your golden years.

And for more than a generation, that has worked. But if you're counting on the government to take care of you, it's time to rethink your retirement strategy.

This past Wednesday, Dr. David Eifrig (or "Doc" as we like to call him) hosted a Retirement Wake-Up Call with his senior analyst, Matt Weinschenk.

During this special event, Doc revealed the biggest retirement lie we're all told, why he's worried about a retirement crisis no one is talking about, and much more. What Doc and Matt shared during this call will challenge everything you've learned about investing and saving for your retirement.

So today, instead of our usual Friday Q&A, I wanted to share a conversation I (Laura Bente) had with Matt where he explains the dangerous state America's retirement system is in, if it's still a good time to invest in the stock market, and one of the biggest threats to your retirement dollars...

Laura Bente: As a financial planner, I've talked to a lot of people about how they'll pay for their retirement. Most of them plan to rely almost entirely on whatever money they'll get from Social Security or a government pension. They believe that their retirement is safe because it's essentially backed by full faith and credit of the U.S. government. Can people trust the government to fund their retirement?

Matt Weinschenk: We think self-sufficiency is always a virtuous goal. That doesn't mean you can always get there... sometimes people need help in all sorts of ways.

But I don't want to add to anyone's stress about Social Security. Social Security's future funding is not a financial problem, it's a social and political one. And I firmly believe that when the time comes, the funding needs will be met.

The problem, though, is if that prediction is wrong, it would be absolutely devastating for folks counting on that money. And of course, we could end up somewhere in between with a significant reduction in expected payouts.

Laura: Who should be worried? Are we just talking about people who are currently retired? What about those who are retiring in a few years? Or those not retiring for another decade or two?

Matt: Retirement and health don't work if left to the last minute. These are the two things you must plan for ahead of time. The earlier you start figuring out retirement, the more you can turn time into wealth. And as for your health, we know that having healthy habits throughout your life works so much better than waiting for big problems to arise and then trying to get healthy.

Laura: We've all heard that the stock market is the greatest creator of wealth. Is now a good time to get into the stock market or put more money into stocks if I'm already invested?

Matt: Despite high valuations, the market still looks healthy. And stocks will always be a part of building wealth. There's simply no better way to increase your wealth than being a partial owner of quality businesses.

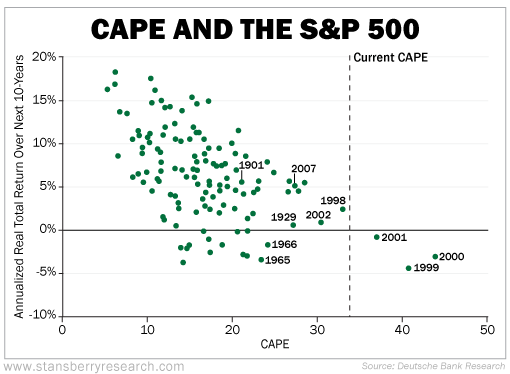

However, when valuations get this high, it gets harder to earn the kind of returns you expect. We've covered this in Health & Wealth Bulletin before. If you are paying more than 30 times the company's earnings for stocks, you can't expect to keep earning 8% or 10% a year in an index fund. History tells us it's more like 0% for the next decade.

We think you need stocks, particularly good stocks, but temper your expectations for now.

Laura: What sort of indicators do you look for when you're determining the health of the market?

Matt: Just there, I was referring to the CAPE ratio, which is like a price-to-earnings ratio but uses the average of 10 years of earnings to cover an entire business cycle.

We try to capture leading indicators of the economy and pair them with financial indicators that show the market's appetite for risk-taking.

But having a full view of the market takes a lot of work, and I don't think that individuals should be trying to time the market that way. Rather, they need to prepare for whatever may come.

Laura: What's something people can start doing today to protect their retirement?

Matt: People need to understand that what we've seen for the last 30 years or so has been an anomaly. We've seen high and stable economic growth paired with low interest rates and low inflation.

Put simply, that's not always the case!

We can get big recessions and stagnation. We can see inflation that erodes wealth.

So much of the standard, textbook investing advice has been designed for what we've just seen because these advisors haven't taken enough history into account. It won't last forever.

We think investors need a smarter collection of assets and need to be prepared for things that they haven't seen before. Just because something hasn't happened since the 1970s or 1930s doesn't mean it won't happen again.

Laura: Thanks for taking the time to chat with me, Matt.

In their recent Retirement Wake-Up Call, Doc and Matt explained why it's time to rethink conventional wisdom about saving for retirement...

You've probably heard about the "60/40" allocation for your entire adult life: Put 60% of your investment portfolio in stocks and the other 40% in bonds. But that model could spell disaster for your portfolio.

Instead, they've designed an Intelligent Retirement model – a brand-new investment strategy designed to protect you from market crashes... inflation... and the harmful effects of the 60/40 portfolio. It could mean the difference between a retirement you enjoy or a retirement you struggle through.

If you haven't watched the Retirement Wake-Up Call, you can still catch the replay right here.

Do you have more retirement questions? Send them our way to [email protected].

Here's to our health, wealth, and a great retirement,

Laura Bente, CFP® with Dr. David Eifrig

June 25, 2021