If you're the person who pays off your credit card each month, the credit card companies have a special name for you...

Deadbeat.

Today, I (Laura Bente) am here to tell you that you want to be a deadbeat.

That's right. Deadbeats are the kinds of customers credit card companies hate. That's because they're less profitable than someone who carries a balance over each month.

Deadbeats don't worry about interest charges or late fees. They don't have to worry about their balances getting out of hand.

All of that means less money to the credit card company.

But too many people are giving their hard-earned cash to these companies...

Around 51% of Americans roll over their credit card balances each month, according to a survey from J.D. Power. It's no wonder why...

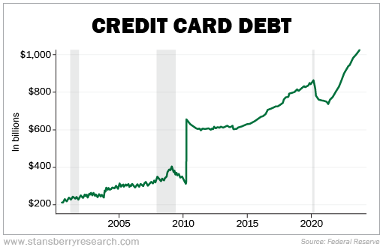

Last month, my colleague Jeff Havenstein looked at how credit card debt has soared over the past 13 years (recessions in gray)...

Of course, we know Americans are struggling right now. Interest rates are looking like they'll remain high for at least the near term. That means if you're considering financing a car or home right now, you'll be stuck paying much more in interest than you would have if you'd bought a few years ago.

Even essentials like groceries are still expensive. Food prices started going wild at the beginning of the COVID-19 pandemic. And while the increases have slowed, we're still seeing costs rise.

The recent consumer price index ("CPI") report from the U.S. Bureau of Labor Statistics showed that food prices rose 3.7% from September 2022 to September 2023.

Some people, understandably, are having a tough time keeping up with their credit card bills. But there are lots of people who keep a balance that they can afford to pay off.

A common misconception is that you need to keep a balance on your card to create history, thereby improving your credit score.

This advice is worse than terrible...

Some people think that you don't build credit history when you pay your balance in full each month... and that you need to maintain a small balance to acquire history.

False.

You build a history just by using your credit card. And if you pay the balance off each month, that shows potential lenders you're responsible.

If you've followed this nonsense advice, you're wasting your money and hurting your credit.

When you leave a balance on your credit card, you have to pay interest on it. While it may not be a lot, it will add up over the years. And it's easy to let the balance get out of hand.

What's more, carrying a balance lowers your credit-utilization ratio (basically how much of your available credit you're using). This ratio is one of the key components when it comes to calculating your credit score. So this balance can bring down your credit score.

If anyone tells you to keep a small balance to "help" your credit, ignore them. Remember, most people working in banks are salespeople, like account managers and tellers. I know from experience that they get incentives to keep you as a customer and keep you spending. And their companies make money when you pay interest on your credit balance.

Don't line their wallets while emptying yours.

When it comes to your credit card bills, this is one time you can be proud to be a deadbeat.

What We're Reading...

- Something different: Britain's loneliest sheep finds a new home.

Here's to our health, wealth, and a great retirement,

Laura Bente, CFP®

November 9, 2023