It was 8 a.m. when Mom called.

For as long as I could remember, my mother never got up before 9 a.m. And she certainly never called me in the morning.

I thought something was terribly wrong...

Davey, I'm not sure... I'm really worried and I haven't been able to sleep much lately. If the market keeps going up and up, won't I miss out on making a lot of money?

I was relieved. No burglars... and most important, no health issues or family emergencies. She had what I call "bull market anxiety." That feeling of being left behind that drives people crazy.

The market was just coming out of the financial crisis in May 2009... She was holding a lot of cash and was worried about when to get back in. My mom didn't want to "miss" the market rally, but she also was afraid to load up on stocks.

That month, I recommended my Retirement Millionaire subscribers purchase an asset that gives safety and income... plus some extra "juice" if stocks kept rising on the back of the Fed's newly created credit.

The recommendation I made – a convertible bond fund called the AllianzGI Equity & Convertible Income Fund (NIE) – earned us a gain around 170% including dividends when we closed it last year. And the fund has consistently paid a dividend of roughly 7%-10% a year.

Most individual investors fail to appreciate the purpose of bonds in a portfolio. But you're smarter than that...

Yes, bonds seem staid... even boring. You lend some cash to a company or government and over the next few years, you book the interest payments (and principal, if you hold to maturity).

I want you to think about bonds a different way...

Bondholders, unlike stock investors, have a legal right to be paid by the company. If a company's balance sheet collapses, its share price collapses with it (and any dividend it pays will end).

Shareholders have no guarantees... but bondholders have much more safety.

Those interest payments are legal obligations. So if a company gets in trouble, bondholders stand at the head of the line when it comes to paying bills and creditors.

Even in the event of a bankruptcy liquidation, the proceeds go to the secured creditors and bondholders. And shareholders get squat.

Not only that, but the capital gain potential of bonds is widely underrated. If you can purchase corporate bonds at a discount – when they trade for less than face value – and hold to maturity, you receive the full face value when the bond principal is paid off. That can be an incredible, overlooked built-in capital gain... regardless of what the market or an individual company's stock has done.

As long as the company doesn't go bankrupt, bondholders get paid. It's that black and white.

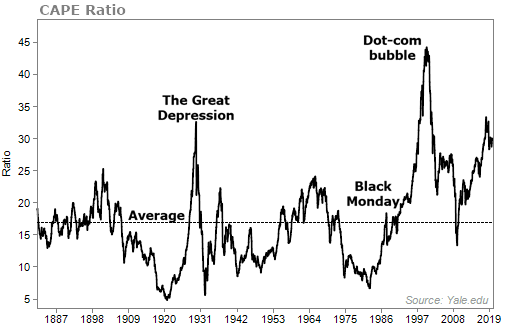

Today, there's no doubt the market looks expensive... If you consider the cyclically adjusted price-to-earnings ratio (or "CAPE" ratio), there have only been two times since 1880 that the market was more expensive.

The CAPE ratio is similar to the price-to-earnings ("P/E") ratio, but it uses the earnings over the last 10 years. It's supposed to be more robust compared with the business cycle.

The problem is that the CAPE ratio does a very poor job of predicting returns over the next few months (or even years). Still, this shows the extreme we're in today.

But markets can remain overvalued for months... even years.

Now, I always recommend keeping some money in the stock market by owning great businesses.

But now is also the time to start thinking about what might happen in a crash... and how you can profit. Because the moment when you throw caution to the wind and go all in on stocks is usually when the top occurs.

When the crisis does occur, there are going to be tremendous deals available. You'll be able to buy blue-chip companies at a bargain price... but you'll also be able to buy what's called "distressed debt".

And purchased at the right price, corporate debt can make a fortune for investors.

Remember: All that has to happen for you to be right... to get paid 10%-20% per year in payments... and to make up to 100% or more in price appreciation... is for the company to not go bankrupt.

This occurs because you're dealing with safe, legally binding contracts that have less risk than stocks and can pay you no matter what happens in the stock market.

Buying corporate debt can help you collect safe income in a bull market... but it really becomes an incredible money-making strategy when the credit cycle turns. And that may be closer than you think.

You can click here to learn more about this strategy and how it helped one our own subscribers retire at age 52.

What We're Reading...

- Something different: U.S. tech giants bet big on India. Now it's changing the rules.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

December 4, 2019