It's hard to stomach the past two weeks...

Last week was the worst week for the S&P 500 of 2019.

This past Monday, the Dow plunged 950 points before closing down 767 points. It was its sixth largest point decline ever.

The S&P 500 lost $1.4 trillion of stock market value over four brutal trading days.

Welcome to volatility, my friends.

I know you're worried... Readers are asking us what to do now.

Today, let's take a step back and see what exactly is going on in the market today. And I'll share what I expect the market will do from here.

Last Wednesday, the Federal Reserve announced it was cutting rates by a quarter point because of headwinds the Fed saw in the economy. This was the first rate cut since 2008. You would think investors would cheer this... After all, a rate cut is meant to keep an economic expansion going.

But investors were disappointed. They hoped for a 50-point rate cut instead of a quarter point cut. And more importantly, they were expecting that Fed Chair Jerome Powell would indicate that more rate cuts are coming in the future. But while Powell didn't rule out more rate cuts, he didn't commit to any.

Stocks fell 1.1% in response.

On Thursday, the market opened higher, but fell 0.9% due to President Donald Trump's announcement that the U.S. would impose 10% tariffs on an additional $300 billion of Chinese imports effective September 1, surprising most investors. The two sides agreed on a cease-fire not too long ago.

On Friday, China's Foreign Ministry spokeswoman Hua Chunying said this about the tariffs: "If the U.S. is going to implement the additional tariffs, China will have to take necessary countermeasures. China won't accept any maximum pressure, threat, or blackmailing, and won't compromise at all on major principle matters".

It seemed like trade talks were falling apart. And folks raced to hit the sell button.

Stocks fell 0.7% on Friday, putting the total loss for the S&P 500 Index at -3.1% for the week. That's the biggest one-week drop we've seen this year.

Then came Monday. And things got even worse...

First, the Chinese government announced that Chinese companies would suspend any purchases of U.S. agriculture products. This was a shot at President Trump as he pushed China to agree to an increase in agricultural purchases.

Then China let its currency, the yuan, drop to its lowest level versus the dollar in more than a decade. A drop in a currency's value makes the country's products cheaper on the international market – a move designed to lessen the impacts of tariffs.

And with that, stocks crashed 3% on Monday.

Tuesday showed some signs of the panic receding... stocks finished about 1.3% higher for the day.

And, as we write this morning, stocks are already up about 1%...

But these big drops show us there's real fear in the market right now.

There's a lot to fear. Even with the recent pullback, stocks are still near all-time highs and have lofty valuations. Investors don't see an end to the trade war anytime soon. And it's hard to keep relying on the Fed cutting rates to justify pushing stocks higher.

You can see the fear in the market by looking at the CBOE Volatility Index (VIX). The VIX looks at how much people are paying for S&P 500 options expiring within the next two months. It's a little like looking at how much people are paying for flood insurance in a city and using that to deduce how often floods hit that area...

I'm going to tell you to do the opposite of what is going on in the market... Now is not the time to panic.

Here's what I believe... This is most likely not the start of a market crash. The market just hit fresh highs at the end of July, and consumer confidence was up near all-time highs, too... It only makes sense that the market cools down a bit.

We typically only see the "big drop" when there is a recession attached to a market pullback. And all of my indicators are telling me we're not at recession territory just yet. The economy is still in good shape, even though there have been signs of slowing growth.

We can look at the yield curve – the 10-year U.S. Treasury yield minus the two-year Treasury yield – and see that it hasn't inverted yet. Without an inversion, a recession is unlikely (every recession in the past 60 years was preceded by an inverted yield curve). Also we've seen no real shift in the unemployment picture. Unemployment is still near all-time lows. Until we see unemployment start to tick higher, the chance of a recession remains low.

This is normal market volatility. It may turn into a bigger correction like we saw in late-2018, but nothing tells me it's time to panic and sell the farm.

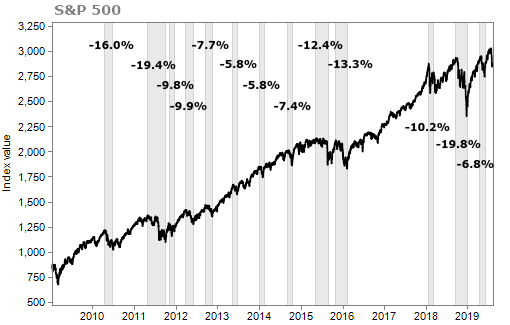

Below is a chart of the S&P 500 from 2009 to today. You can see that 5% to 20% market drops are a normal part of a bull market...

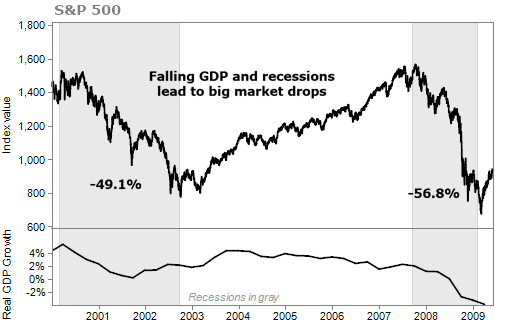

Now take a look at the next chart...

We've only seen massive drops when gross domestic product ("GDP") growth is falling...

And you won't see a 50% drop in the market without a recession. My indicators for the economy are not telling me we'll see a recession in the next couple months. Take this market drop for what it is – normal market volatility.

Stick with our game-plan... Continue to be conservative and defensive. And most of all, don't panic.

What We're Reading...

- A recession is coming (eventually). Here's where you'll see it first.

- Something different: Jeff Bezos sells Amazon stock worth $2.8 billion last week.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 7, 2019