Our financial "heroes" are riding to the rescue...

With the economy starting to slow – even as stock valuations remain high – conditions are ripe for a market downturn.

The world's central banks don't want that blood on their hands, however, so they're taking immediate action... In the U.S., the Federal Reserve rushed to defend the status quo with a 50-basis-point interest-rate cut last month.

Meanwhile, its Chinese counterpart recently unveiled a massive stimulus package – a combination of monetary easing, government spending, and investment incentives. As a bonus, increased economic activity in China could kickstart global growth and serve as another tailwind for U.S. stocks.

Now, there could of course be unintended consequences. These central-bank "heroes" may be chasing short-term benefits at the expense of long-term fiscal stability... Premature rate cuts and excess stimulus could reignite our recent painful inflation.

That's definitely a worry we're keeping an eye on.

But whether you believe in the wisdom of these moves or not, they are going to drive markets.

Our expectation is a period of divergence. As this bull market faces off against slowing economic growth, some investments will thrive... while others will struggle.

As we've said many times before, you won't build lasting wealth by buying stocks like Nvidia (NVDA) at about 37 times sales. (You don't need to be a finance guru to know that this is a nosebleed valuation nearing bubble territory.)

And remember, the top six tech companies – including Nvidia – make up 30% of the S&P 500 Index today. Given that heavy concentration, we worry that index investors will see weak or negative returns when tech stocks eventually fall to reasonable valuations.

But... this could take some time to play out. The Fed is cutting rates, which should lead to higher asset prices.

So despite our bearishness on the S&P 500 – big tech stocks in particular – the market still has great opportunities.

Specifically, real estate investment trusts, or REITs, have rallied lately on the prospect of lower interest rates.

As a refresher, REITs own, operate, or lease real estate. In exchange for paying out the bulk of their income as distributions to shareholders, they pay little to no corporate income tax.

And while REITs get some of their value from the real estate they hold – like any homeowner does – it's more like you're investing in a landlord than a homeowner.

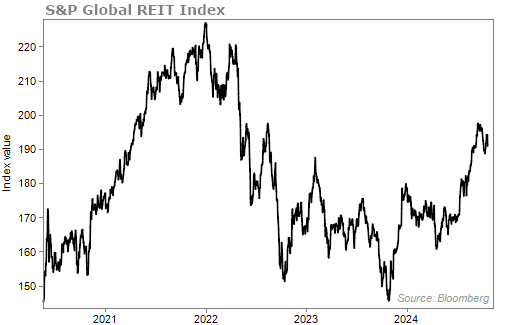

That's because REITs generate yield from rent, and the asset class trades more based on yield than it does on real estate values. So with interest rates headed down, REITs have started to perform very well. See for yourself...

Given what's going on in the economy and market, this uptrend in REITs is primed to continue. So this asset class deserves to be in your portfolio as the gains pile up.

That leads me to a new system my team and I have developed in my Income Intelligence newsletter. We call it the Intelligent Retirement model...

Unlike the outdated, one-size-fits-all "60/40" portfolio where 60% of your money is in stocks and the other 40% is in bonds... the Intelligent Retirement model is data-driven. It looks at market conditions and asset valuations to suggest the perfect allocation for you to prepare for retirement.

This model got us into REITs in March earlier this year... right before REITs started to rocket higher. And during our most recent allocation update in September, the model told us that REITs are still worth investing in.

REITs are not what the typical investor clamors for. They're not exciting, and they don't get much coverage in the financial news... But we know they're an important part of a well-rounded portfolio given today's market conditions.

Consider buying some REITs if you don't already have exposure.

Income Intelligence subscribers can read about our favorite new REIT recommendation in our September issue.

And if you're not yet subscribed to Income Intelligence but would like to learn more, click here.

What We're Reading...

- Something different: Lockheed Martin shares slide 5% on F-35 headwinds despite lifting profit and sales forecast.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 23, 2024