Doc's note: This week, I'm sharing some of my team's favorite Health & Wealth Bulletin issues of the year. And we're starting with our investment analyst, Jeff Havenstein...

Stocks have been crushed this year. It's been hectic to know what to do as an investor. But like Doc said in this issue, one thing that works – no matter what is happening in the market or economy – is buying true capital compounders. And Doc has created a formula for finding these kinds of stocks.

In Doc's Magic Formula 2.0, he ran his formula, and it spit out four stocks... If you bought each of these stocks, you'd be down 7%. That doesn't sound great, I know. But over that time frame the S&P 500 is down double that, nearly 15%. This is a huge outperformance.

Looking back a little further, Doc ran his magic formula in August 2021. These results are even better given that more time has passed (these stocks do better over time, as we wrote).

Since writing the August 2021 issue, the market is down 14.2%. But the average stock in Doc's basket of 12 stocks is only down 5.5%. That's terrific!

The lesson is to stick with Doc's Magic Formula...

It's simple... but you build wealth over time by sticking with a consistent plan.

I tend to stay away from volatile stocks – for example, you did not see me getting sucked into the "meme stock" craze... and I generally only invest in true capital compounders.

Over the years, I have developed a "Magic Formula" to find these types of stocks.

Longtime subscribers will remember that back in November of 2019, I wrote an essay called "Doc's Formula for Buying Winning Stocks." Basically, I gave away the secret sauce that my team and I use to look for investment ideas.

The formula is simple. There are really only five things you need in an investment...

- Demonstrates consistent top-line growth – I like seeing a company that has multiple years of consecutive revenue growth.

- Does more with less – I like seeing a company that has a return on assets ("ROA") of at least 10%. (The formula for ROA is net income divided by total assets. The higher that number, the better a company's management team is at using its assets to generate income.)

- Increases dividends every year – I like seeing a company with at least 10 or more consecutive years of dividend growth. (This would make a company a "Dividend Achiever.")

- Avoids too much debt – I like seeing a company that has a net debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) of less than 4.

- Trades for a reasonable price – I like seeing a company that has a price-to-earnings multiple of less than 25.

In the August 25, 2021 issue of Health & Wealth Bulletin, I ran this formula and gave away 12 stocks that made it through my screen. These were blue-chip stocks like Johnson & Johnson (JNJ), Northrop Grumman (NOC), and Clorox (CLX). You can see the full list here.

If you would have invested in all 12 of these stocks, you'd be roughly breakeven today – about the same as the S&P 500 Index. But you'd be well ahead of the tech-heavy Nasdaq Composite Index.

And those results are about what you'd expect over an eight-month period. This basket of mature stocks will generally keep up with the market. They are not highfliers by any stretch of the imagination.

Here's where your advantage comes in, though... time.

You see, the longer you own these types of businesses, the better you'll do. These companies will grow sales, and that will churn out more free cash flow which can be used for acquisitions, higher dividend payments, or share buybacks.

Time is the real key to success with great businesses.

I always plan to have a holding period of at least a few years.

Given that the market has been volatile lately, I wanted to run my formula again to give away a few more picks. There are a lot of great stocks trading for very reasonable valuations today.

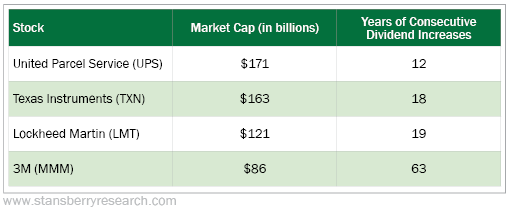

The following table shows four new stocks that came from my Magic Formula, sorted by market cap...

Again, all of the above companies are high quality... They grow their sales every year. They are efficient. They reward shareholders with bigger dividend payments. They have their debt load under control. And they all trade for a valuation less than the broader market.

If you use a well-thought-out strategy and stick with it – through ups and downs in the market – you will be a successful investor. It's that simple.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

November 21, 2022