Don't be Nick.

A recent story in the Wall Street Journal followed a 22-year-old student from Doylestown, Pennsylvania... Nick Restaino.

After the rebound in stocks we had seen in January, Nick is bullish again. Now he's buying popular technology companies such as Nvidia (NVDA) and Roku (ROKU) with some cash he had on hand and about $15,000 in borrowed money.

According to Nick, the recent dip created a buying opportunity. He might be right... While I've said I'm getting worried about the markets, I do still see opportunities to invest today. But Nick's big mistake is betting on risky tech stocks on margin.

His story in the Wall Street Journal focused on how the market's rally in January has revived investors' appetites for margin loans.

If you've been following my work, you know I keep a close eye on margin debt.

For those who have never bought on margin before, think of it as a loan from your broker. It allows you to buy more stocks than you'd normally be able to. But margin is risky... When you buy securities on margin, you must repay the amount you borrowed as well as interest, even if you lost money on your investment.

We've talked about how elevated levels of margin debt can signal a coming market downturn here.

In that Wall Street Journal article, Nick said he had $50,000 in available margin debt, pledged against only $20,000 in equity. If Nvidia and Roku go against him, he might face a hefty margin call.

Let's go over a simple example to explain the risk Nick and investors like him are taking...

Suppose Investor A buys $100,000 worth of tech stocks using $50,000 of his own cash and $50,000 as a margin loan. His broker requires a "maintenance margin" (the minimum amount of equity that must be in the margin account) of 25%.

Now let's think about what will happen if tech stocks get crushed in the next bear market. The value of Investor A's stocks falls 40% and are worth just $60,000. Now there is only $10,000 of investor equity in the account ($60,000 minus the $50,000 margin loan). And $10,000 dividend by $60,000 is 16.67% of what the shares are worth... less than the required maintenance margin of 25%.

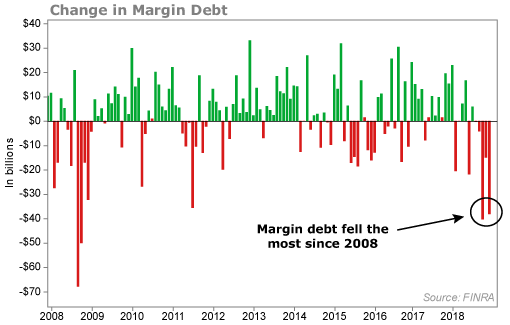

The broker will issue a margin call, requiring Investor A to deposit at least $5,000 to meet the 25% requirement. If Investor A doesn't have the money, the broker can sell any of the stocks in the account to meet the requirement. When this happens, investors are usually stuck with a big loss. According to FINRA, margin debt balances were headed in the right direction at the end of 2018. Margin debt peaked in May and fell 17% by December.

The chart below shows the monthly change in margin debt. As you can see, margin loan balances shrunk in October and December by their biggest total since 2008...

I'm glad to see margin debt balances have been shrinking... I've told readers for months to take some risk off the table.

What I'm not glad to hear is that this trend may not last long. From the Wall Street Journal...

We've seen the [margin debt] numbers come back a bit as the S&P 500 has rallied into 2019," said JJ Kinahan, chief market strategist at brokerage firm TD Ameritrade, adding that fluctuations in margin debt tend to be highly correlated with the broad index. "As the S&P 500 drops, you'll see margin levels drop. As it comes back, it recovers in a similar way.

E-Trade CEO Karl Roessner also stated "That balance on our side has been up a little bit."

This worries me. I'm worried investors will forget about the volatility we saw at the end of 2018 and jump right back into risky behavior.

I have one piece of advice for anyone thinking about using margin in today's market... Don't.

In this environment, the downside far outweighs the upside.

If you do make risky bets, make small bets. I have no problem with an investor putting a small portion of his portfolio betting on a "blow-off top" market (bull markets tend to end with extraordinary gains). The only issue with this is most folks don't know when to sell and book profits.

I've seen it too many times when investors will be up 50% in this kind of situation and ride their losing stocks all the way back down, wiping out any gains.

The point here is investors are easily suckered into the lure of easy gains. If you do take on more risk, be careful about using margin.

I don't have a crystal ball. All the years being in the market has not made me be able to predict what's exactly going to happen. The best I can do is look at the data and position myself and my readers for what's going to come.

2018 was a brutal year... Don't let 2019 take you by surprise.

If you want to hear the investing story nobody else is telling... and receive all of the information you need to make an informed decision on what you should be doing in your portfolio right now... make sure to tune in next Wednesday, February 13 at 8 p.m. Eastern time to the Bull vs. Bear Summit.

You'll walk away with a totally different outlook on the market – and a bulletproof plan for 2019.

What We're Reading...

- Something different: Watch all the 2019 Super Bowl commercials that were released before the game.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 6, 2019