You've worked hard your whole life preparing for retirement...

You've been financially responsible, lived below your means, and built a nest egg that should get you through your golden years.

The first day of retirement is finally here and most folks ask themselves, "Now what?"

For most new retirees, the answer is simple...

Spend.

With no more clocking in from 9-to-5, it's time to go on a vacation with your family. It's time to work on house projects. It's time to golf and play tennis at the local country club.

Most people dream about all the stuff they are going to do in retirement years before they actually retire. And for most retirees, these things cost money.

So how do you go about spending your nest egg? You don't want to blow it all in the first few years of retirement.

The general rule of thumb has been that you shouldn't spend more than 4% of your savings in the first year of retirement. After that, you simply adjust the amount you spend annually to keep up with inflation.

As an example, if you have a $1 million portfolio, you can only afford to spend $40,000 in the first year. If inflation were 4%, you'd have $41,600 to spend the next year. The year after, $43,264, and so on...

The goal here is to limit your spending in year one, then maintain your purchasing power in the following years.

In general, if you follow this rule, your portfolio would last roughly 30 years... sometimes longer. This assumes investors hold 50% of their portfolio in bonds and the other half in stocks (something we don't recommend, of course).

The number of years your portfolio will last has a lot to do with inflation and the return you can get on your investments.

Late last year, investment-research firm Morningstar published a report that challenged the 4% rule. It said that, given current market conditions, you would run out of money before 30 years if you followed that advice.

Instead, you should spend no more than 3.3% of your savings in the first year, then adjust for inflation after that.

Morningstar lowered the spending limit because of expectations for future returns.

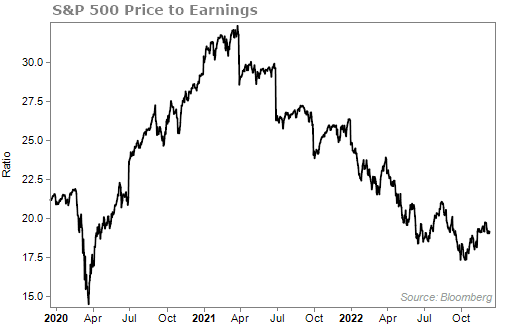

If you recall back to late last year, markets were hot. The S&P 500 Index ripped 110% higher following its COVID-19 low. Valuations were stretched as the S&P 500 was trading over 30 times earnings.

As I (Jeff Havenstein) have written about before, when valuations are at record highs, you need to lower your expectations for long-term returns.

The folks at Morningstar seem to agree...

Morningstar researchers simulated future returns over a 30-year period and found that in a quarter of the simulations – with a 50% stock, 50% bond portfolio – the portfolio would run out of money if withdrawals started at 4%.

They found that a retiree would only have enough money if they started with a 3.3% withdrawal rate.

That was a year ago. And things have certainly changed since then...

Valuations have come down quite a bit. The S&P 500 now trades for 19 times earnings. Take a look...

Yields are also much higher. Bond investments can finally offer a decent return – something we haven't experienced in years. The 10-year Treasury is currently yielding 3.6%.

As a result of a brighter outlook for investment returns, Morningstar has once again updated its ideal starting withdrawal amount... This time, it published that new retirees could spend as much as 3.8% of their nest egg in the first year of retirement. A big jump from last year.

Of course, no broad rule like this is perfect for everyone. But we do agree that expectations for future returns are much higher today than they were at the end of last year.

It makes sense that you should be able to spend a little if you started retirement today.

Unfortunately, there are plenty of stories where folks run out of money quickly in retirement... And a lot of it is because they spent way too much in the first year. They try to make up for lost time, in a sense.

Always have a plan for how you will spend during your retirement. You worked hard for your nest egg. Take every step possible to make it last.

One step is to prepare your portfolio for whatever the market throws at it. According to Wall Street legend Marc Chaikin, the next move from the Federal Reserve could determine whether we see a recession or not next year.

Tomorrow, Marc will explain how this decides whether you make or lose money in the early days of 2023. He'll also reveal the industries you should – and shouldn't – avoid if you want to keep your money working for you.

Click here to make sure you don't miss any details.

What We're Reading...

- The 4% rule for retirement spending makes a comeback.

- What almost everyone gets wrong about the retirement distribution 4% rule.

- Something different: The 10 best movies added to Netflix this month.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

December 14, 2022