It's a strange time to be a long-term-minded investor...

For one, the outlook for the next decade doesn't look great. I (Jeff Havenstein) wrote about this in the March 3 Health & Wealth Bulletin.

Basically, with how expensive stocks are today, we should expect to see low to even negative annualized real total returns over the next ten years.

That's pretty scary stuff... It sure doesn't make me want to hold stocks for all those years. My money would probably be better off elsewhere.

We're in the middle of a Melt Up, and that means investors with a holding period of a decade or more will be holding through the boom that will come in the next few months... but also the inevitable crash.

It raises the question of, "Why wouldn't I just wait to buy stocks after the crash?"

It's simple enough logic. But my response to that would be, "good luck"...

Timing a market bottom is nearly impossible. Buy back in too early and your portfolio will fall another 20%. Get in too late and you've missed all of the best gains already.

Besides, there will likely be incredible gains over the next few months, and you don't want to miss out on that.

We're in a tricky time for sure. It almost seems like it's better to be a trader today than an investor. And by that I mean trading in and out of the market as opposed to investors who hold through thick and thin.

But I'm here to tell you that you can still be a buy-and-hold investor – even with the grim outlook for the market over the next decade. You just need to own the right stocks.

Today, I'm going to show you some of the qualities I look for in long-term investments...

1. Stick with what you know.

This one is the most obvious, but it's also one of the most important.

Almost every time I see family members or friends, someone pitches a new stock idea. Most of the time it's some tiny tech company set to revolutionize the world. And every time, the story sounds great.

The only problem is that I'm no expert in nanomedicine or nuclear fusion. (Neither is the person pitching the idea.) If I can't explain the business model of the company or explain how the company makes money to a 10-year-old, then why in the world would I invest? I'd be better off hitting the casino.

The more you understand the company's products, its competitors, and even its weaknesses... the better you'll be able to predict future cash flows.

Take Chipotle (CMG), for example. Every time I go to grab a burrito for lunch, I make a note of how long the line was. If I'm consistently seeing long lines month after month, I feel good about the stock.

It's simple, but it works. Chipotle's business model isn't a secret. The more burritos it sells, the more its stock price should go up. And there are plenty of businesses you likely know and can keep tabs on...

For example, how often do you shop on Amazon (AMZN)? Do you have a PayPal (PYPL) account, and have you been using it more or less recently? Are you a Bank of America (BAC) or a Wells Fargo (WFC) customer? How has your experience been? And which banks do your friends use?

Also, what are your children into lately? If they are still obsessing over Star Wars, maybe it's time to dip deeper into Disney (DIS).

Stick with companies you know and understand. By just doing this, you'll become a better investor overnight.

2. Find a company with a moat.

Since we're looking for stocks to hold for a decade or more, you don't need to worry as much about timing and valuation. Instead, focus on the strength of the underlying business. You want to be sure the company is going to be around and thriving 10, 15, and even 20 years from now.

To find a "forever business," look for things folks love now and that seem to have staying power as the world changes.

On a more technical level, you need to find companies that have strong advantages over their competition. They need to have what Warren Buffett would call a "moat."

This can come in the form of a powerful brand, a lock on distribution, a large customer base, or ways to retain its customers.

Consider megabank JPMorgan Chase (JPM). It has a moat because of how massive it is. Other banks can't compete when JPMorgan is able to spend $12 billion a year on technology alone.

This is a company that will stand the test of time. It's a stock you can sleep well at night owning.

3. Look for Dividend Aristocrats.

The biggest objection I get from this one is that companies like Amazon and Alphabet (GOOGL) don't pay a dividend. Does that mean you shouldn't own them? Of course not.

I personally own plenty of both stocks.

But one thing I will say is that the majority of any long-term-minded portfolio should be made up of dividend-paying stocks. Specifically, ones that increase their dividend payments every year.

I love this statistic... Over the past 90-plus years, dividends were responsible for roughly 40% of the total market return. If you want long-term success in the market, own high-quality dividend payers.

To find the most consistent dividend payers, check out this list of Dividend Aristocrats. These are S&P 500 Index companies that have increased their dividends for 25 consecutive years or more.

Without knowing anything else about the company, you know a Dividend Aristocrat is a high-quality business. There's no way a company could increase its dividend for 25 consecutive years without generating a lot of free cash.

Over time, high yielders will reward you. It's all about the power of compounding returns.

4. Own companies that are highly efficient.

You want to buy companies that don't have to spend a lot of money to make a lot of money.

These are companies that are highly profitable and can return money back to shareholders. One way to find these efficient companies is by looking at something called return on assets ("ROA").

The formula for ROA is net income divided by total assets. The higher that number, the better a company's management team is at using its assets to generate income. These companies are better able to hold up during recessions.

The average company in the S&P 500 has a ROA around 2.7%. I like seeing a company that has a ROA of at least 10%.

5. Don't focus on valuation... but be aware of it.

As an investor, you always have to think about valuation. If the best business in the world is trading at an insanely high price, it can still make for a bad investment.

But while everyone would like to pay a reasonable valuation, when you're choosing a stock you want to own for many years and decades, you don't have to be as concerned as you normally would.

That's because you're going to buy these stocks for years and – for the dividend payers – keep putting cash into them. That means you won't be paying today's valuation... You'll be paying multiple valuations over the years – some high, some low, as your dividends keep rolling in and automatically buying new shares.

Still, you can't go nuts and buy some of the highest flyers in the market.

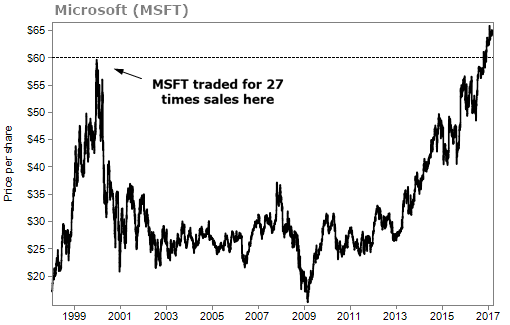

Take, for instance, the famous example of Microsoft (MSFT). If you bought it at the height of the dot-com boom, it would have taken over a decade for the stock to just break even.

Stick with reasonable prices. You don't want to be in a position where you're paying 60 times earnings or 20 times sales for a stock – even a great one.

Putting everything together, take a look at a stock like Colgate-Palmolive (CL). It has all the qualities I look for...

Colgate-Palmolive is a company you can easily understand. It sells household products, from toothpaste to laundry detergent to deodorant. You likely have many of its products in your house already. And it's easy to find out how popular the products are by asking if family and friends use them as well.

Colgate-Palmolive's moat is its time-tested brands and global reach. It generates billions in free cash flow every year, and that's allowed it to increase its dividend for 57 consecutive years. Shares are currently yielding 2.2%.

The stock has a ROA of 17.2%, meaning it's very efficient. And finally, shares trade for 27 times earnings, which is cheaper than the broader market.

Colgate-Palmolive is a stock that you could buy today and never have to worry about selling. In fact, it's the perfect stock that you could gift to a loved one, such as a child or grandchild...

And if you haven't already, I encourage you to read the April issue of Retirement Millionaire. In it, Doc goes into detail about how to create a portfolio of five specific forever stocks and tells you how you can gift them to a loved one. He calls it "the $5 Gift of Wealth Portfolio for the Next Generation." It's a must-read.

If you're already a Retirement Millionaire subscriber, you can click here to read the issue.

If you're not a subscriber, you can sign up today for an annual subscription of just $49 by clicking here.

What We're Reading...

• Emergency declaration issued in 17 states and D.C. over fuel pipeline cyberattack.

• Something different: FANGS and BATS sell-off spooks world stocks.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein and Dr. David Eifrig

May 12, 2021