I've said it before...

Stocks have been the greatest wealth-building tool in all of history. Lately, though, we've heard from folks who have moved most of their assets to cash. They want to avoid any further losses and keep their powder dry.

While we admire someone who wants to preserve their hard-earned nest egg, we don't think you should ever be totally out of stocks.

But if you have to own them in a bear market... which ones should you own?

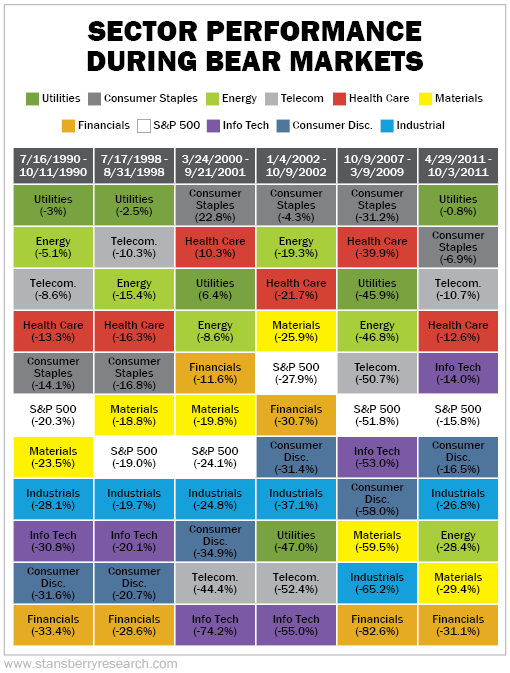

To help answer that question, we looked at the 10 broad sectors of the market and their bear market performances from 1990 to 2011. Take a look...

This table offers some clear lessons. Utilities, consumer staples, and health care stocks offer opportunities to safeguard your wealth. Aside from the global financial crisis, every other bear market has had some sectors that stayed near even, and some posted gains.

The key here is to not completely leave the market and go to cash. Investors who do this during a bear market miss out on the biggest gains when markets start going back up. And they miss the opportunity to invest in quality companies at a discount.

I'm not the only one telling folks to stay invested...

Next Thursday, January 12, my colleague Greg Diamond is hosting the "Get Out of Cash" event.

During the event, Greg will unveil how a strategy that dates back to 1876 is pointing to a historic market move in 2023, which you'd otherwise never see coming. And he'll explain why this will offer a fantastic moment for investors to get back into stocks. He's also sharing his No. 1 investment free of charge when you tune in.

This is an event you don't want to miss. And if you sign up now, you'll receive Greg's VIP report, "3 Cash Cows for 2023," where he details three stocks to potentially double your money three times within 2023.

Now, let's get into some of the things you've had on your minds this week. As always, keep sending your comments, questions, and topic suggestions to [email protected]. We read every e-mail.

Q: Doc, I just don't see how you can be obese and healthy. – S.C.

A: I want to stress that it's important to maintain a healthy weight. You should definitely keep an eye on your weight because obesity increases the risk of illnesses that include diabetes, heart disease, liver disease, and arthritis.

The gray area involves how you define obesity...

Most folks, including doctors, typically focus on your body mass index ("BMI"). It's a quick and dirty guide to determining obesity that shows your weight in relation to your height.

The problem is that BMI doesn't take into account countless other important health factors... like muscle mass, ethnicity, bone density, or sex. That means an extremely healthy, well-muscled athlete can officially be "overweight."

I'm a numbers guy. I won't look at just one data point and make a blanket judgment. And thankfully, there's plenty of research out there on this...

A great study from our friends across the pond reviewed why Americans and Brits had similar BMIs, but Americans have a higher rate of diabetes.

The difference was that Americans in the study had wider waists in particular. And this – not BMI – had a direct connection to diabetes risk.

If you're looking for a quick guide that's more helpful than BMI, take your height in inches and divide that amount in half. Your waist circumference should be that number or less. So an average male who stands 5 feet 9 inches tall should have a waist of about 34.5 inches. Measure just above your belly button, and don't hold in your breath or suck in your stomach.

Waist size matters because of visceral fat. The first layer of fat under your skin is subcutaneous fat (this is the fat you feel when you pinch your skin). Under that layer is the visceral fat, which wraps around your organs. Visceral fat builds as we age, eat fatty foods, or don't exercise.

Visceral fat triggers inflammatory responses and can even interfere with insulin. That means it's a contributor to diabetes and fatty liver disease.

Your weight or your BMI is not a full picture of your health. Those are just starting points. Understand the factors that affect your health and measure your waist circumference. If those numbers suggest you have extra pounds, you might indeed need to revisit your lifestyle to protect your health.

Q: Do options still work in a down market? – J.W.

A: Stock options are the right to buy or sell a stock at a given price. And you can buy options to make either bullish bets (that stocks will go up) or bearish bets (that stocks will go down). You just need to get the move and the timing right to make money.

I use an even safer approach in my Retirement Trader newsletter. We sell conservative options and pocket the modest – but consistent – income we collect from those sales.

The simplest environment for selling options is a rising market. When the markets rise, our holdings tend to rise... and we get to collect our option income without drama.

But while bear markets can be tough for any trader, Retirement Trader has some advantages...

First, we start with high-quality, blue-chip stocks. They tend to hold their value better than risky stocks in bear markets.

Second, our option income means we effectively buy stocks at lower prices. This gives us a cushion for stocks to fall before we take losses.

Third, because of the way options are priced, we can earn higher payments when there's fear in the markets.

Lastly, we sometimes "roll" a struggling position, which means we give shares more time to recover... allowing us to collect more income from the same stock.

We do sometimes alter our strategy in severe downturns as well. But most of the time, these factors are enough to keep us consistently profitable in any market.

As I showed subscribers in the most recent issue of Retirement Trader, we earned an average annualized gain of 20% while the markets soared in 2021... and the same 20% while markets fell in 2022.

What We're Reading...

- Did you miss it? Our bond outlook for 2023.

- Something different: Why we love comfort food.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 6, 2023