For folks hoping to cash in on a surge in Big Tech, I have a simple message for you today...

Beware.

The headlines in recent weeks have been mostly positive... You've been bombarded with news about the S&P 500 Index making new high after new high. Year to date, the index is up 18%. And that's a fantastic return for just about any year, let alone with a few more months still to go.

The tech-heavy Nasdaq has done even better – up 23%.

But you've also likely seen headlines about how just a handful of tech stocks are carrying the S&P 500... stocks like Nvidia (NVDA) and Microsoft (MSFT). While, as we just mentioned, the S&P 500 is up 18% this year, the S&P 500 Equal Weight Index – which weights stocks equally, rather than by market cap – is only up 6%.

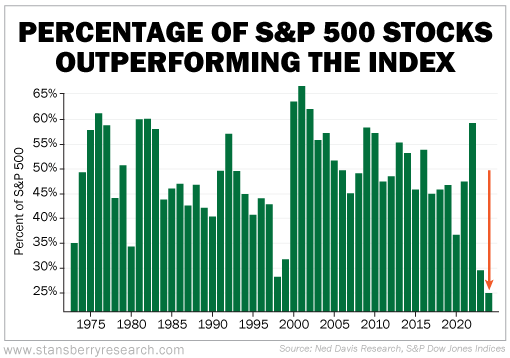

Shown another way, the chart below looks at the percentage of S&P 500 stocks beating the index. We're currently on pace for a record low...

We know that the Big Tech stocks can't carry the overall market forever. And one signal tells us we could be in for a rude awakening in tech... and soon.

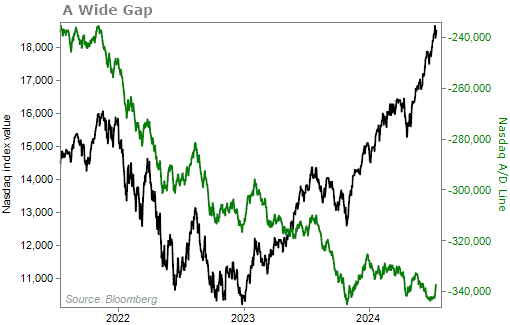

Longtime subscribers will be familiar with the "advance/decline" line.

This is a simple measure... You take the number of stocks that went up on a given day and subtract the number that went down. If more went up that day, the line goes up. If more went down, the line goes down.

In a typical bull market, as the market goes up, the advance/decline line goes up, too. When the advance/decline line moves lower while the market continues to go up, then it's time to worry. It means the gains are concentrated in only a few companies.

We saw this in the early 2000s before the tech bubble burst. And we're seeing it again today.

The Nasdaq has been on a tear since the start of the 2023. But take a look at the Bloomberg Cumulative Advance/Decline Line for the Nasdaq. It's been heading lower since the start of 2022...

I'll say it again... This cannot go on forever.

I believe we're on the verge of a big correction, especially in larger tech stocks.

As I always preach when things seem a little nutty in the market, having a good amount of cash is always a smart thing. And that seems like a great bet today when interest rates are so high.

My colleague Joel Litman is also getting weary over today's market. Specifically, he's predicting that a new form of AI is about to trigger a sudden and dramatic stock market panic.

Joel is one of the smartest people I know. I always take his stock market messages seriously.

If you haven't already, Joel and his team and are steeping forward with their urgent message. Tomorrow night's event is free to attend. Be sure to reserve your seat by clicking here.

What We're Reading...

- The stock market's concentration, in one chart.

- In case you missed last Wednesday's issue... A 10% Stock Correction Is 'Highly Likely.'

- Something different: Jerome Powell indicates Federal Reserve won't wait until inflation is down to 2% before cutting rates.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 17, 2024