I (Jeff Havenstein) hope you can forgive me for an issue I penned in October 2022...

I came out with a big market call during the 2022 bear market... And I was wrong.

It turns out I was seven days early.

So please, take it easy on me in the feedback e-mail inbox.

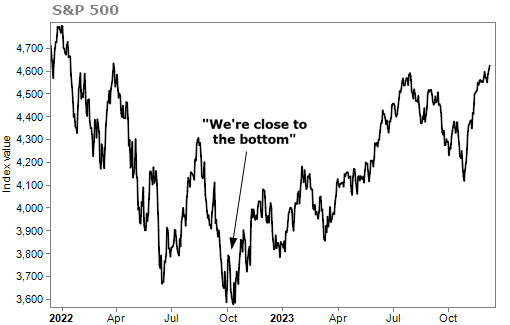

If you're a new reader, I am an analyst for Dr. David "Doc" Eifrig on most of his publications. Back on October 5, 2022, I wrote an issue called "We're Close to the Bottom."

I laid out all the reasons why a bottom in the stock market was nearly here. Specifically, I wrote about how the housing market was actually solid, despite many folks worrying over another 2008-like collapse. Unlike 2008, there was little speculation in the housing market... The folks buying homes were real families with high credit scores.

I thought there was far too much fear over our economy (and I have consistently written that in Health & Wealth Bulletin over the past 12 months).

Most importantly, I thought the markets were close to a bottom for one simple reason: sentiment.

There was just too much pessimism in October 2022. It had reached an extreme. Here's what I wrote...

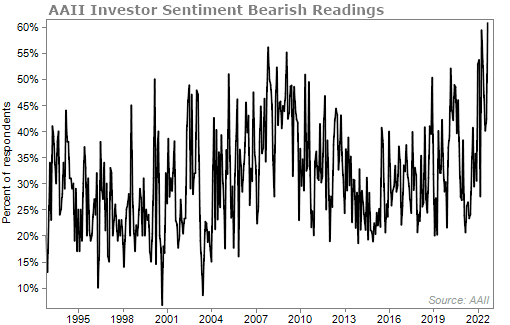

One of the first indicators I look at is from the American Association of Individual Investors ("AAII").

Since 1987, AAII members have been answering the same simple question each week: What direction do you feel the stock market will go in the next six months? The results are compiled into the AAII Investor Sentiment Survey.

Members are pretty evenly split between feeling bullish, neutral, and bearish – though they've been more bullish than not. Historically, about 38% of investors are bullish, 31.5% are neutral, and 30.5% are bearish.

This year however, they have been extremely bearish. Over 60% of respondents have said they are bearish – a 30-year high. Take a look...

This means investors do not have their portfolios positioned to take advantage of a market recovery. When stocks start to move higher, they'll feel left out and buy in droves. That will of course push the market even higher, prompting more buyers to join the fun.

I wrote this on October 5, 2022. The S&P 500 Index proceeded to fall 5% over the next week, bottomed on October 12... And it has since rallied 29%. Take a look...

Doc has long been writing about the importance of having a contrarian mindset if you want to make money in financial markets. Whenever you see the masses doing the same thing, do the opposite.

In October 2022, everyone was scared. Again, the AAII Investor Sentiment Survey had recently hit an extreme level of bearishness – more than the COVID-19 drop and even the 2008 housing bust.

Of course we were going to see stocks rally when everyone was so negative. How could they not? (If you believed the economy was on solid ground.)

Here's how I finished my October 5, 2022 issue...

In summary, extreme bearishness and too much fear surrounding an economic crisis means we're close to a bottom. Of course, short-term market movements depend entirely on what the Federal Reserve is going to do. That's why I'm not calling the bottom just yet. There still may be more selling to come.

But I don't think we'll see another 20% or so drop from here. And that means investors focused on the long term need to think about scooping up their favorite stocks on the cheap.

Again, please take it easy on me for being a few days early.

But in all seriousness, I hope you listened and started buying stocks.

In general, always be on the lookout for extremes in the markets. If folks get too bearish, it's time to buy. And the opposite is also true... If everyone is giddy and living in la-la land because stocks can't do anything but make new highs, it's usually time to take profits and become a bit more cautious.

Today we're somewhere in the middle. There are pockets of fear, but there's also hope. The S&P 500 has been rallying lately, so investors are somewhat confused about what to do.

If you want a different take on the market, I suggest you check out my friends Joel Litman's recent presentation. Joel teamed up with Chaikin Analytics founder Marc Chaikin to find what they call "perfect stocks."

This will be one of your last opportunities to see their presentation, so click here to learn more.

What We're Reading...

- Why we're close to the bottom.

- Something different: Fed to start cutting rates midyear in 2024 with high chance of soft landing, CNBC Fed survey finds.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

December 13, 2023