Wednesday was a record-breaking night for me here in Baltimore.

More than 32,000 people signed up for my Urgent Market Briefing.

During the event, we received hundreds of questions. I wish I could have answered all of them. Since the event, you've flooded my inbox with even more questions and concerns about the current market.

Today, I'm taking some time to answer a few more. We'll get back to our regularly scheduled Q&A next Friday.

Please keep sending your questions – income related or otherwise – my way at [email protected].

Q: Doc, any chance of a replay? I could only watch the first 30 minutes. Lots of good info. Thanks! – B.F.

A: I'm glad you at least had the chance to watch the beginning, B.F. If you want to learn about one of the biggest dangers I see in the market right now, where 2019 could make or break your portfolio, and what you should do with your money now, make sure you watch my urgent briefing.

The replay is only available through Thursday, January 31. You can watch it here right now.

Q: The most pressing thing on my mind is the 'Melt Up' status and how can I position myself to take advantage? Honestly there was so much early 'hype' regarding the Melt Up in various Stansberry publications that I've found it difficult to understand where the 'theory' is today and a concise strategy. Particularly on the heels of December.

And to toot your horn a bit, my path with Stansberry has been to focus on your teachings and writings. I find them most straightforward with a logical path to follow. – D.D.

A: Thanks for your dedicated readership, D.D.

I saw a lot of questions on the Melt Up on Wednesday night, so I hope to clear it up for everyone...

There's still time for you to bet on the Melt Up... just please make sure you do so with the right amount of money.

The best Melt Up stocks are obviously tech companies that don't pay dividends. It isn't an ideal scenario for investors focused on stable portfolios that can ride out a lot of volatility – for example, people who are at or near retirement and plan to count on the income they earn from their portfolio.

I think you should have a small portion of your portfolio ready to capitalize on the Melt Up. But the bedrock of your portfolio should be made up of high-quality income investments, which is the type of investment you'll see in Income Intelligence.

I don't think investors should flee the market entirely. I'm saying that right now is the best time in nine years to reduce your risk and prepare yourself to ride out what's coming next.

Q: Are closed-end funds good or bad investments in this up and down market? – C.K.

A: That depends on the type of closed-end fund (CEF) you're buying.

Closed-end funds issue a limited number of shares. So the share price can fluctuate based on investor demand... and not necessarily match what the securities in the fund are worth. This means that closed-end funds can trade above ("at a premium") or below ("at a discount") the value of the fund's assets, or the net asset value (NAV).

The NAV is the total value of a fund's securities (long- and short-term assets) minus the company's liabilities, divided by the number of shares outstanding. I prefer to invest in funds that are trading at a discount to NAV because that gives us a dollar of assets for less than a dollar.

While buying funds at a discount does work, it's even more important to avoid funds that sell at a premium. They may chug along for a while – even years – but if investor sentiment changes, they can collapse quickly.

That's why in every other issue of Income Intelligence, we publish the CEF Blacklist. It shows the closed-end funds with the highest premiums... often as high as 30%, 40%, or even 50%. In our opinion, you should never own any of these funds. If you do, find a replacement.

That will immediately add strength to your portfolio and protect you from the wild collapse that can come with an overvalued CEF.

Q: Do you see any trends or indicators that show interest rates and the yield curve returning to "market" conditions instead of a Fed-controlled situation? – J.G.

A: First let's talk about interest rates.

There's been all this discussion about how rising interest rates will be the final nail in the coffin for this bull market. That may be true. Corporate debt has gotten out of control, rising over 40% since highs back in 2008. And there's no doubt that rising rates will make it tough for highly indebted companies to pay off their obligations.

But the question is: Should rates be raised? Based on history, the answer seems like yes...

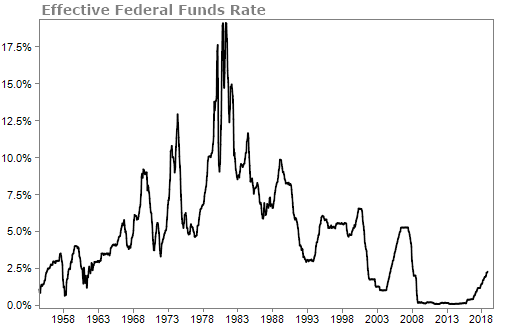

Interest rates have been artificially low for years now. We've never seen a period of time where rates have been suppressed for this long. And it's because the Fed wanted the economy to recover after the Great Recession. Well, the economy has recovered. We're at the point of almost too good, as we've already seen GDP exceed potential GDP.

To me, interest rates are starting to return to "normal" or "market conditions" based on rates over the past few decades. It was during 2009-2015 that interest rates weren't "normal."

As for the yield curve, we keep a close eye on it to give us a sense of when a recession will hit. Every recession in the past 60 years was preceded by an inverted yield curve. The curve hasn't inverted yet so we're not there now... but we're very close.

What We're Reading...

- Did you miss it? One of the biggest risks in the market today.

- Something different: The poem used to signal the start of D-Day.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 25, 2019