"Now is not the time to panic."

That's what I told you last week, but it seems Wall Street isn't listening. On Wednesday, the Dow Jones Industrial Average closed 800 points down, beating last week's plunge. The losses were mainly blamed on one indicator – the yield curve.

The yield curve is the 10-year U.S. Treasury yield minus the two-year Treasury yield. We've talked about the yield curve in the past, but if you're unfamiliar... Typically, long-term bonds have higher yields than short-term bonds. An inverted yield curve is when that flips – when short-term bonds pay more than long-term bonds.

An inverted yield curve is a major indicator of a coming recession. In fact, every recession in the past 60 years was preceded by an inverted yield curve.

But it's impossible to time exactly when the next recession will start. An inverted yield curve means we're closer to a recession, but we could still be two years away.

That's why now is the time to invest in assets that go up as stocks go down...

When investors get scared of owning stocks, they want to put their money elsewhere. Typically, they move to the safety of bonds first. If they get worried about bonds, they move to cash. And if they're worried about everything, they flock to gold.

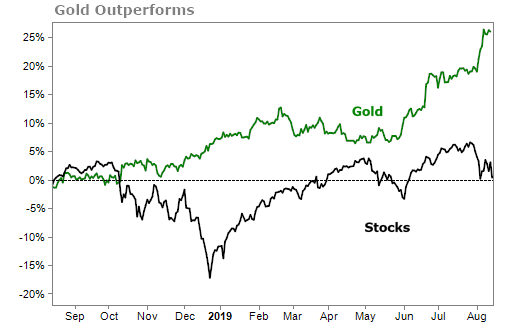

Given all the fears about the government and the economy, investors are bypassing bonds and cash and moving straight to gold.

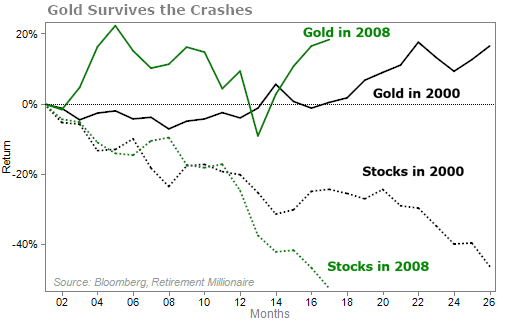

And if all the fears come true and the market crashes, owning gold is a profitable strategy...

This again proved true during the recent market correction...

If stocks do take a big 30% or 40% fall, you'll be happy to own some gold.

That's why our 2019 Gold Rush event next week is coming at the perfect time.

During the event, you'll hear the latest prediction of one of the world's most sought-after gold experts, John Doody.

His gold investing strategy has delivered audited gains of 530% since 2000, beating the return of gold, the returns of major gold funds, and more than tripling the S&P 500.

And on August 21, he'll also reveal the name of a little-known investment that he believes could soar 500% in the coming months.

Click here to reserve your spot now.

Q: It is my understanding that colloidal silver kills virtually all bacteria including MRSA as well as many viruses. Of course the FDA doesn't want us to use it instead of APPROVED drugs that often fail. – M.H.

A: We are often critical of the U.S. Food and Drug Administration (FDA), but this is one thing the agency got right... It warns against supplements like colloidal silver that have no proven benefits and may even be harmful.

Colloidal silver is silver particles suspended in liquid. You'll find bottles of colloidal silver with claims that it boosts your immune system. Some bottles also say the liquid is non-toxic.

However, consuming too much colloidal silver will not only turn your skin blue, it can lead to kidney damage and seizures. And it's regularly ranked on Consumer Reports' list of dangerous supplements and ingredients.

The big problem is the lack of evidence. We couldn't find anything to back up any claims that colloidal silver is beneficial. However, in a recent Indian study, researchers found the silver interfered with a type of bacteria that resisted drugs. This allowed the antibiotic linezolid to pass through the membrane and kill the bacteria.

Keep in mind, this study looked at a very specific type of bacteria with a certain type of function, so it won't work on all bacteria. It's not a reason to take colloidal silver at all. Even if it does prove to work against other types of bacteria, it's only effective when coupled with an antibiotic.

So I still don't recommend taking it. If you want to boost your immune system to better fight off bad bacteria, try probiotic foods like yogurt and kimchi. And don't forget to load up on antioxidants in foods like blueberries and coffee.

Q: Every time I've tried the annual credit report service, most of the credit vendors error out, leaving the message that I must write via USPS to get a report. Sounds bogus? I agree... – M.R.

A: We're glad that you're looking out for anything suspicious, M.R.! That means you're taking our advice to heart.

However, AnnualCreditReport.com does error out and direct you to a USPS form to request your reports for a good reason... it's to protect you. If you answer any of the identifying questions wrong (like which addresses have you not inhabited in the last 10 years), it won't give you online access to the sensitive information in the reports.

But sending a form through the post office isn't your only option... You can also call the credit reporting organizations directly and request your reports. The number is 1-877-322-8228.

Finally, you can check your credit score (but not report) through your credit-card company or through your bank. Don't forget your score and report are different – read more on that here.

Q: I belonged to an FFA Chapter in high school I judged livestock and grew animals for show and sale. I judged livestock in competition and profited from the sale of my animals at Jr. Livestock Shows.

Years later I've purchased show animals (beef, lamb and hogs) at auction at these Shows from students who maintain health records on their animals. Custom meat processors affiliated with the show are easily contracted to cut and package the meat to suit buyer preferences. It's a win-win way to support student entrepreneurs and deliver quality meats to friends, and families that have home freezers. – W.S.

A: Thanks for passing on this info, W.S.! We love shopping local for our fruits and veggies, as well as our meats. Farmers markets are a good source for finding meat vendors, too. You can speak directly with the farmers to see what they use in the way of pesticides, antibiotics, and more. You can also try a local community-supported agriculture ("CSA") program. These allow you to "subscribe" to a certain amount of fresh food from local farms. Some also include meat. Click here to find CSAs near you.

What do you want us to write about next? Send your suggestions to [email protected].

What We're Reading...

Did you miss it? Three reasons this investment is a buy today.

Something different: The pumpkin spice fad has finally gone too far.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 16, 2019