There's a bull market outside of stocks that very few folks are talking about...

But if you've been reading Health & Wealth Bulletin, you know all about it. And if you've been following our advice, you're up nearly 17% this year and 35% from when we started writing about this investment in late 2022.

Despite the gains, no one in the mainstream media is talking about this asset. I (Jeff Havenstein) think more gains will come.

So today, I'll show you why this asset will likely outperform the S&P 500 Index over the next few months...

If you haven't figured it out yet, I'm talking about gold.

Doc Eifrig and I have been writing about the precious metal for a few years now. We pointed out the attractive setup back in late 2022 as money continued to pour out of gold exchange-traded funds ("ETFs").

Put simply, it was a hated asset... And that gave us the green light to buy.

Just about every quarter since then, we've been pounding the table to own gold if you don't already... and to even increase your exposure. We last wrote about gold in May, which you can read here.

Take a look at how gold is quietly in a strong bull market over the past couple years...

Now, it's not too late to buy gold. Again, I think more gains are to come. And I'm not the only one... One of the biggest banks in the world just made a call that the metal has 22% upside over the next 12 to 18 months.

I agree with that prediction. I might even go as far as to say it's too conservative...

The most obvious reason for prices to rise is that when volatility strikes in the stock market, investors flock to the safety of gold.

As we've said before, gold is the ultimate "chaos hedge." It's a physical asset and has been a store of value for thousands of years. Gold coins were minted for commerce beginning around 550 B.C. No matter what happens to the economy – even if banks collapse and our economic structure spirals into oblivion – gold will always have value.

In the past few weeks, we've written about how the S&P 500 is due for a correction – a drop of 10% or more. When we see that happen, we could see more rotation out of Big Tech and into gold.

The second reason to believe gold will do well is because of interest rates.

Since all assets compete with one another, if you can earn a decent return in a bank account or a bond, gold becomes less appealing. With interest rates sky-high today, most investors will choose a U.S. Treasury bill paying 5% instead of a gold fund paying 0%.

But... when interest rates fall, gold looks better by comparison.

Today, traders are expecting that the Federal Reserve will lower interest rates by September. As folks saw encouraging progress from the June inflation numbers, they're betting with 97.4% odds that interest rates will be cut by a quarter of a percentage point in September. Traders are also giving a 2.6% chance that the move down will be a half percentage point. But that adds up to 100% confidence in some cut.

Again, when interest rates are lowered, owning gold gets a little more attractive.

Finally, we're starting to see the big money get on board with owning gold... even though the average investor has no interest in it. Most mom-and-pop investors are only focused on Nvidia (NVDA) and any other tech darling.

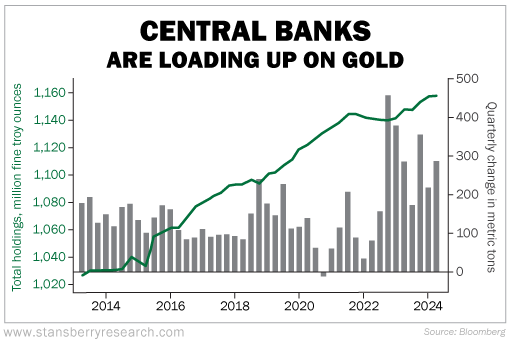

The chart below shows that central banks continue to buy a lot of gold...

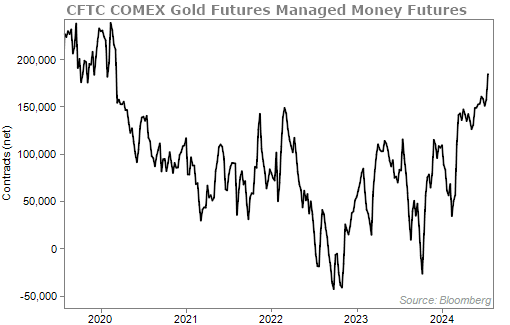

Also, hedge funds have been increasing their bets on gold using the futures market. Take a look...

The "smart money" is starting to see the value in owning gold. But this doesn't mean the run is over...

I could easily see gold hitting $3,000 an ounce in the not-so-distant future. Again, most folks in the market aren't paying it much attention. But that will soon change.

If you don't have exposure to gold today, it's not too late.

What We're Reading...

- From November 2022: Why gold hasn't worked this year.

- Something different: Comcast expects to carry 100 NBA games each season in new broadcast rights deal.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

July 24, 2024