2020 has frightened a lot of investors.

Most folks weren't ready for the volatility we've seen this year... especially after the S&P 500 Index soared 29% in 2019. That was its best year since 2013. And now, because of the uncertain outcome of the presidential election, many folks want to sit in cash and wait it out.

If the recent spike in volatility has shaken you... it's time to change your mindset.

My colleague Steve Sjuggerud doesn't think we're seeing the beginning of some bigger market plunge. It's just part of the "Melt Up."

In his own words, "This is the Melt Up in action."

In a recent issue of Steve's True Wealth, he talked about how you should expect many ups and downs during this Melt Up...

Major volatility is a hallmark of a stock market Melt Up. And the recent correction is likely one of many we'll see in the coming months.

Let me explain...

The Nasdaq soared 390% from mid-1996 to its peak in early 2000.

That's the era of the original Melt Up. And things heated up even more in the final inning... The Nasdaq jumped 109% in the last 12 months of that boom.

This is the kind of move that's possible today, now that the Melt Up is back on. It could mean life-changing gains in a matter of months.

The latest dip is just normal market behavior... It's not yet time to panic and prepare for 2001 all over again. This time around, the Federal Reserve has pumped trillions of dollars into the system, and the federal government has spent trillions on fiscal stimulus.

Take this pullback for what it is... an opportunity.

On Wednesday night, more than 100,000 people signed up to watch Steve host his "Melt Up" event. During the presentation, Steve explained...

- What the COVID-19 pandemic has meant for the Melt Up

- Why stocks could soar to new heights from here

- Exactly what you need to do to take advantage of the biggest money-making opportunities

When Steve talks, I listen. I hope you took the time to watch the presentation, but if you missed it, we've made the replay available to you for a limited time.

If you have any money in the market, this is a must-watch. Click here to see it.

Now let's dig into this week's Q&A...

Q: A few months back, Doc laid out a way to set up something (I think it was an IRA) that gives you the ability to be able to pay for long-term care. Could you either publish it again or send it to me? It's called something like an ABC. Thanks. – T.D.

A: The investment you're thinking of is called Asset-Based Care ("ABC"). Essentially, an ABC is an annuity on steroids. ABCs are safe and liquid, and they yield more than most certificates of deposit (CDs) at your local bank. We have a full report for Retirement Millionaire subscribers detailing what we love about ABCs and how you can get started with them. Subscribers can read that here. If you're not already a subscriber, sign up now to get access.

Q: Hey Doc. Quick question regarding the last question you answered about portfolio allocation. Responding to your mailbag last week, you said:

In my asset-allocation guide, I explain how to distribute your portfolio among different assets classes – stocks, fixed income, cash, and chaos hedges (like precious metals). Keeping your wealth stored in a diversified mix of investable assets is the key to avoiding catastrophic losses.

My question is, when it comes to gold as a chaos hedge, should gold stocks be considered part of that asset class, or would that go under stocks asset class? Also, how could I gain access to your asset-allocation guide? – P.K.

A: To us, gold stocks count as a chaos hedge. And you can go further and say they may even be a better chaos hedge than gold itself.

Gold stocks tend to amplify the move in gold. Smalls moves in the precious metal can lead to big moves in its stocks. So if we see real chaos, they could protect your portfolio even better.

But on the other side, gold stocks tend to be more volatile than gold. And as an underground mine that is producing gold and selling it off, it is a declining asset. Investors often use the phrase "a melting ice cube," while gold itself acts differently as a store of value.

You could get a big return from gold stocks if you truly need your chaos hedge. However, when times aren't that bad, they could hurt your performance and make you wish you held regular gold.

The final call: Hold some gold stocks in your chaos hedge, but don't make them a large percentage of your portfolio. A little bit goes a long way.

Q: Since I've read that the Stansberry writers cannot recommend stocks that they personally invest in, then we really never know what all of you are REALLY investing in? So why recommend anything that's really fantastic, since then you can't invest in it? – M.P.

A: Since I started with my publisher, this has been our company policy...

Stansberry Research forbids our investment analysts from owning any stock they write about. In addition, other employees of Stansberry Research and associated individuals may not purchase recommended securities until 24 hours after the recommendations have been distributed to our subscribers on the Internet, or 72 hours after a direct-mail publication is sent.

The main reason is to avoid a conflict of interest. Wouldn't you rather an analyst recommend a company solely because he thinks it's a good investment for his readers and not simply to line his own pockets? Stansberry has hundreds of thousands of readers around the world... enough to cause big moves in some stocks.

The industry has a history of sleazy analysts making big bucks off of recommendations they don't actually believe in. (If you're not familiar with "pumping and dumping," I suggest you read about the scheme here.) We don't want readers to have any doubt about what we're doing.

Having said that, you might wonder, "Doc, does that mean you hold back the best recommendations for yourself?"

My research analysts can tell you that there are times they've suggested a stock to recommend to readers and I was tempted to invest in it myself instead. But my goal isn't to sit here and make millions by depriving my subscribers of the best stock insights. If all I wanted was to get rich from the stock market, I would have stayed on Wall Street. Instead, I felt a need to help society more than Wall Street was and so I went to medical school and beyond… but the question of my own money remains a good one.

Personally, I am quite conservative in style and so often use mutual funds, open and closed, to give me stock and bond exposure. Occasionally I'll sell options in my IRA or 401(k) on exchange-traded funds ("ETFs") that allow it. But in general, I set my risk profile up so I can sleep well at night and my team and I can give you our best and unbiased advice.

My goal is to give you the best information possible to empower you to live a healthier, wealthier life. That's why, if you read our newsletters, you'll notice we take pages and pages explaining why we're recommending a certain investment.

But here's where our unheard-of transparency comes in...

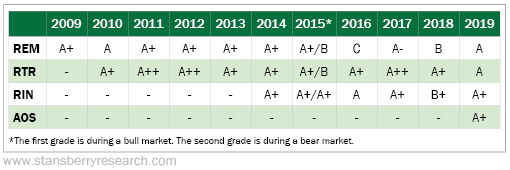

Every year, our publisher puts out an annual report card. It's a brutally honest assessment that measures how each Stansberry Research publication has performed.

Plenty of analysts have gotten failing grades over the years. But I think our grades every year speak for themselves...

Rest assured – I'm not holding anything back.

What We're Reading...

- Did you miss it? Our perma-bull is getting nervous.

- Something different: Animals keep evolving into crabs.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 23, 2020