We're officially in a new bull market...

A few weeks ago, I (Jeff Havenstein) told you that institutions have pulled a net $333.9 billion from stocks over the past 12 months. Individual investors took out $28 billion.

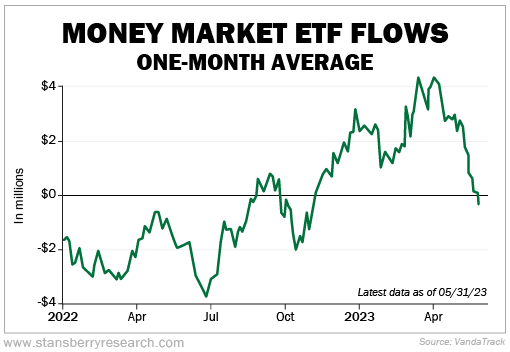

Investors have pulled out of stocks and thrown their cash into money market funds.

Just recently, though, money market exchange-traded funds ("ETFs") have been reporting outflows. Take a look...

This is a huge change. We have not seen money market ETF outflows since late last year.

As I talked about a few weeks ago, investors had simply become too bearish. Fund managers were trailing the S&P 500 Index and needed to find a source of higher returns.

The best way to do that is to buy stocks.

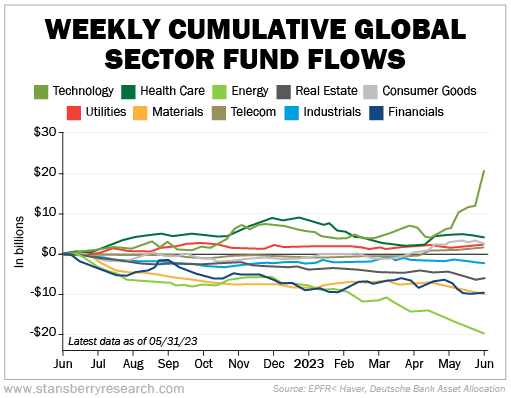

Specifically, we've seen investors loading up on technology stocks. The chart below shows cumulative sector fund flows for the past 12 months. As you can see, money is being pulled from energy funds and being poured into tech...

Of course, a big part of this move into tech is being fueled by the "artificial-intelligence (AI) boom." Companies like Nvidia (NVDA) are up 65% in the past six months alone as investors want a piece of AI.

Whether I think this boom will eventually bust is for another day... What I wanted to focus on today is the line right below the tech inflow.

The dark green line shows the inflow of money into health care. As you can see, inflows have been remarkably steady. It's one of the few sectors that has not experienced an outflow over the past 12 months.

If you look at a longer chart of sector fund flows, you'll see the same thing... Money just continues to move into health care stocks – no matter what is happening in the economy or market.

And that makes sense...

Every single one of us is a health care customer. We always need health care – in good times and bad. Folks can go without a vacation or a new pair of shoes in times of economic turmoil. But they can't go without their medication.

That means this $4 trillion industry is going to keep growing no matter what.

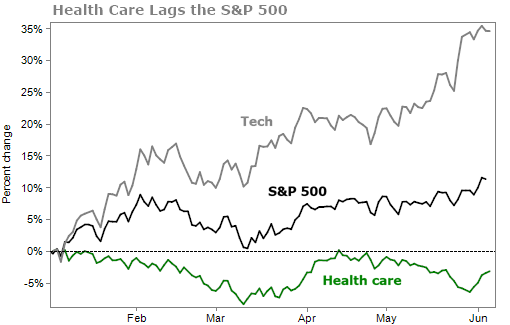

With that said, you would think health care stocks would be rising while there are plenty of fears in the market – from recession to inflation to banking. Instead, the health care sector significantly trailed the market and the tech sector since the start of the year...

I don't think this underperformance will continue.

While the hype is around technology and AI right now, money will continue to move into health care. And if the AI boom does turn into a bust, guess what... Money will continue to move into health care.

This is a sector every investor needs to own. And to get the very best health care stocks that consistently beat the market, I turn to Thomas Carroll.

Tom is one of the best in the business... He was ranked Fortune's No. 1 health care analyst in the U.S. in 2005. He also won the Wall Street Journal's Best on the Street Award, ranked No. 2 in 2012.

Lately, Tom has teamed up with Doc Eifrig to give subscribers access to the top health care stocks in the market.

Just last week, Tom revealed that a flood of money is flowing into one small corner of the market, and it's set to grow as much as 621% over the next four years. According to Tom, it could be the biggest medical story in a generation.

What We're Reading...

- Something different: Why Nvidia is suddenly one of the most valuable companies in the world.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

June 14, 2023