Let's take a moment and rewind back to 2018...

"FAANG" stocks were all anyone could talk about. FAANG is the acronym for Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), and Alphabet (GOOGL).

All you had to do was buy any of the FAANG stocks, close your eyes... and your investment would be worth a lot more.

Amazon and Netflix had more than doubled over the previous two years. Apple and Facebook were up around 70%. And the worst performer was Google, which only went up about 50%... but still beat the market handily.

Buying the FAANG stocks was like betting on New England Patriots quarterback Tom Brady to make another Super Bowl run. You were likely going to make money.

At the time, we knew many of the FAANG stocks had great businesses. We also talked about Microsoft (MSFT), which isn't a FAANG stock, but a lot of people lumped Microsoft in with the FAANGs.

These companies were bringing in loads of cash (well, except Netflix which has basically been flat since 2018). They also had economic moats, or the ability to maintain their advantages over competition.

Back in 2018, I knew that a $1 trillion company was close. And I told you that either Apple, Google, Microsoft, or Amazon had a real shot at becoming the first U.S. company to do it...

It won't be long now before either Apple (APPL), Alphabet (GOOGL), Microsoft (MSFT), or Amazon (AMZN) become the first publicly traded $1 trillion company...

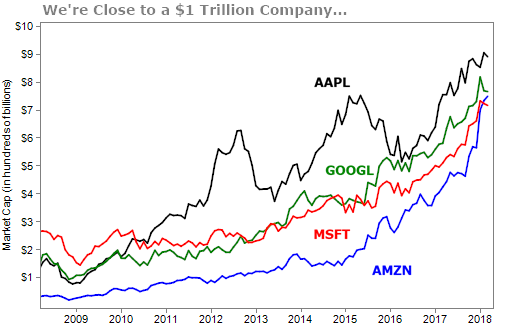

The growth of these companies over the last decade is remarkable...

Apple has grown from an $80 billion firm in early 2009 (in terms of market capitalization) to $890 billion today. Microsoft has more than tripled since 2013. Alphabet has grown 290% since 2010, and Amazon has doubled since the beginning of 2017.

The chart below shows the market cap of these four behemoths soaring over the past 10 years...

It's really anyone's guess which company will cross the $1 trillion mark first. It might be the next iteration of iPhone sales that pushes Apple above it. Or it could be Alphabet if Waymo (a subsidiary of Alphabet) wins the autonomous-vehicle battle by coming out with the best self-driving car.

And even though Amazon was late to the party – it didn't become a $200 billion company until 2015 – its growth skyrocketed over the past two years. Before we know it, Amazon may control every aspect of how we shop.

As it turns out, all four of these giants crossed the $1 trillion threshold. Apple was the first. And about a month ago, Google became the latest to join the $1 trillion club.

You can see that all four are now above a $1 trillion market cap...

|

Company |

Market Cap (in trillions) |

|---|---|

|

Apple |

$1.4 |

|

Microsoft |

$1.4 |

|

Amazon |

$1.0 |

|

|

$1.0 |

Back in 2018, I told you to be mindful of the valuations on these high risers. You needed a clear vision of how the company will grow, in order to justify its pricey valuations.

And even though these companies looked expensive given their crazy run-up the past couple of years, you could easily make the case for all four to keep getting bigger. It might seem absurd to think that, but they dominated their respective industries... had tremendous cash flows... and still had opportunities to grow.

In my Retirement Millionaire newsletter, we've recommended Microsoft, Amazon, and Alphabet. We're up 644% on Microsoft on our 2010 recommendation, 124% on Amazon since May 2017, and up 85% on Alphabet since December 2016.

But here's the crazy thing... we still rate all three stocks as "buys" today!

There's always this mindset to stay away from stocks that have already posted big returns. Most investors want value. We have "buying cheap" engraved in our minds.

And buying cheap is great. The only problem is that it's hard to find much value in today's market. But that should not stop you from having your money in the stock market...

Many of my indicators are telling me there is still upside in this bull market. I think there's even more upside in the most popular mega-cap names.

One question you should be asking is which company will be next to cross the $1 trillion threshold. You could make the case for Facebook. It has a market cap around $600 billion so it still has a ways to go.

Or maybe it's one of the Chinese tech giants like Alibaba (BABA). It has a market cap just under $600 billion and has been growing revenues by about 40% the last few years.

My colleague Dr. Steve Sjuggerud is so bullish on stocks that TONIGHT, he is hosting a massive online event to show you exactly how to cash in on this dramatic shift in his "Melt Up" thesis... including what he believes to be the No. 1 stock to own during the Melt Up.

There are likely extraordinary gains to come over the next few years. You don't want any regrets about missing out on it.

Click here to reserve your spot for tonight.

What We're Reading...

- Alphabet breaks $1 trillion market cap for first time ever.

- Should you bet on the world's largest company?

- Something different: Fed's Powell says economy in good place, warns on coronavirus.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 12, 2020