Buy the dip...

Your friend, your college professor, and even your mom have probably given you this advice. Buying the dip is what every investor wants to do.

For more than a dozen years, successful investing just needed these three words.

It seems simple. When stocks pull back in a bull market, you seize the opportunity and buy quality stocks at a discount. Naturally, these quality names don't remain cheap for long. You make money as they shoot right back up to new highs. Obvious, right?

Buying the dip has worked for decades...

Investors came out of the 2008 financial crisis convinced stocks would never go up again and petrified of a "double dip" recession that never came. But the market kept rising.

Sometimes we'd see an economic slowdown, or the Federal Reserve would raise rates a bit. The market would fall... and the best move every time was to buy stocks with both hands.

Mr. Market's final lesson was the COVID-19 panic in 2020... Man, you'd better have bought that dip.

It took nearly a decade, but investors learned to buy the dip again and again.

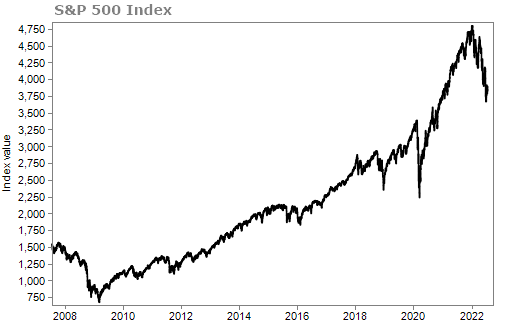

As you know, markets are down again this year. The S&P 500 Index recently dropped 10% over four days. And it sank into the common definition of a bear market – a decline of 20%.

And this dip isn't like the others.

As the crash began, it looked like another buying opportunity. Great tech companies were on sale. Other stocks followed.

But they've kept falling. The drop stands out even on a long-term chart...

Investors who buy the dip today are overlooking a key change from the past few decades of market struggles...

Starting in the 1990s, if the market crashed, Federal Reserve Chairman Alan Greenspan would swoop in, cut rates, and turn stocks around. It was like the protection of buying a put option... leading to the term "Greenspan put."

Then it was called the "Bernanke put."

By the time Janet Yellen and Jerome Powell came along, we were only hearing the phrase "Fed put." Why keep updating it for each chairman?

When the Fed is there to save you, buy the dip.

But the Fed has other priorities today...

Now, it must fight inflation – and do it aggressively, which it's doing by raising interest rates. That removes the put. It's as simple as that. The economy needs to cool enough to tame inflation before the Federal Reserve can even consider worrying about stock prices again.

In the long run, this will be healthy... We can proceed from the era of the "everything bubble" to a time when fundamentals and growth dictate the direction of asset prices.

But we have to get there from here. And that will take more time.

I'm not the only one being cautious right now...

Wall Street legend – and founder of our corporate affiliate Chaikin Analytics – Marc Chaikin says things will get worse for lots of stocks before they get better.

But that doesn't mean all stocks are suffering from a bear market. According to Marc, in the midst of all this turmoil, some specific groups of stocks will crash... while others will soar.

Marc recently revealed the financial story no one's telling right now that's keeping him up at night. According to Marc, millions of American investors are about to drive straight off a cliff... and miss one of the greatest moneymaking opportunities of their lifetimes.

During a special presentation, Marc also explained how his Power Gauge system can help you avoid dangerous times in the market and show you the best opportunities to grow your portfolio.

If you haven't watched it yet, see all the details here.

Keep sending your questions, comments, and suggestions to [email protected]. We read every e-mail.

Now, here are some of the things on your minds this week...

Q: How often should I worry about rebalancing? – E.R.

A: There are different approaches to rebalancing a portfolio. You can do it at regular intervals – such as quarterly or annually. And you can give yourself certain "bands" after which you rebalance to your target. For instance, if you intend to have 5% of your portfolio in a particular asset, you can allow it to go to 10% before you reset it.

I balance my own portfolio at least once a year. I'll do it more frequently if certain categories have moved particularly quickly. But in general, even with a few great picks, most people don't need to rebalance more than three or four times a year.

Imagine an investor has a $100,000 portfolio with 20 investments ($5,000 each). If one position goes up 25% in a year – a strong one-year return – you now have a portfolio worth $101,250 and your one position is up to $6,250. Your investment is just 6.17% of the total.

Sure, you can rebalance back down to 5% at this point, but I wouldn't worry about it until a successful position like this started to approach 10% or 15% of your portfolio. And remember... trailing stops will protect the gains, too. The main thing is to avoid putting all your eggs in one basket when choosing new investments.

Q: Tinnitus... any cure? – S.R.

A: There's no known cure for tinnitus. There are preventative measures to lower your risk of getting it. Treatment can depend on the likely reason you have tinnitus. We wrote more about tinnitus – its causes and some treatments you can try – in a recent explainer: How to Stop That Ringing in Your Ears.

What We're Reading...

- Did you miss it? The markets are wild, but we can still profit.

- Something different: Five ways to stop tech tracking.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 8, 2022