Forget what the "experts" are saying on CNN... Forget what your broker is telling you to do... Instead, focus on John.

Today, he's giving us a warning sign about the stock market. And it's a warning you need to pay attention to...

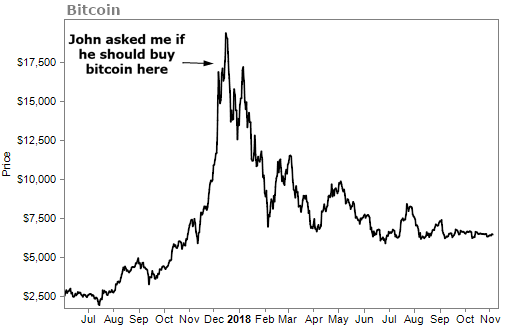

It's been a while since I (Jeff Havenstein) have talked about John. I last wrote to you about him in November 2018 after John accurately predicted the top in bitcoin...

If you recall, John asked me if he should buy bitcoin while I was visiting him in San Francisco. The date I arrived in California – and the date he bombarded me with questions about the cryptocurrency – was December 14, 2017, just a couple days before bitcoin peaked at over $19,000...

You see, John is my proxy to the everyday investor. He works for a software company in California, owns shares of the company he works for through his employee stock purchase plan, and has a slight interest in the broader stock market.

His interest in stocks is what you would expect from someone just playing around in the market... He follows stocks like Apple (AAPL) and Amazon (AMZN). And he won't shut up about Tesla (TSLA)...

Since he only owns shares of the software company he works for, most of our stock market conversations revolve around tech stocks.

When John asks me if I think he should buy more of his company's stock, I get nervous. When he asks me if he should take some profits off the table, I turn more bullish.

When Dr. David "Doc" Eifrig talks about the "dumb money," he's referring to folks like John.

To be fair, John's a smart guy. But he's far from an economist. He mostly bases his opinions on the headlines he sees on the news.

Over the past few months, I haven't heard much from John about stocks. Sure, he mentions how much his company's stock has gone up. But I didn't get a sense that he was overly excited or too worried.

That was until a few days ago...

John is flying into Baltimore tomorrow to go to our mutual friend's wedding. It's at a beautiful venue in Leesburg, Virginia, and he's coming a few days early so we can spend some more time together.

On Monday, while talking about the logistics for our trip, he abruptly switched the conversation to stocks. And what he said scared me...

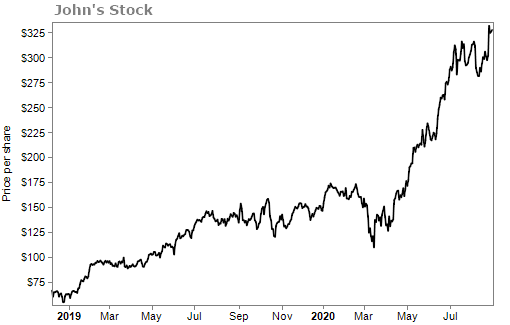

First, he talked about how great his company was doing and how the stock has been skyrocketing. It's a cloud software stock, so it's part of the tech sector that's soared lately...

He then told me that he recently opened up a new brokerage account and bought two new stocks.

I asked him what he bought. And he told me that he put some money into Apple and then some obscure software company with a $2 billion market cap. I've never heard of the company before... And it's literally my job to look at stocks all day. I even asked our senior analyst if he's heard of this company. His response was, "Nope, never heard of it. Sounds made up."

So I asked John why he bought those two stocks. I figured there had to be a good reason...

After all, this was his first stock purchase outside of his own company's stock... And that must say a lot about his confidence in these two stocks or in the market.

He told me that he bought Apple because he "wanted to own it for the long term" and because shares were "more affordable after the stock split." He said he bought the small software company because he "heard his friend talking about it, and it's up more than 200% this year."

Just like John asking me if he should buy bitcoin after its monstrous move up in 2017, this scared me...

I did some digging on John's small software company that he just bought... and it's your typical software stock. It has little profits, high revenue growth, and an expensive price tag – trading at 13.5 times sales.

I truly believe that many investors out there have a similar mindset to John. They see the gains in the stock market, and they want in. Specifically, they see the boom in tech stocks and feel the need to buy.

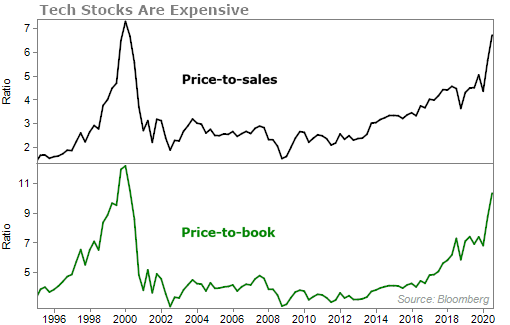

I don't throw the word "bubble" around lightly. But we're getting close to one.

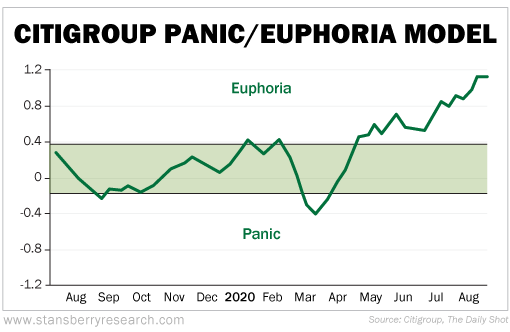

Citigroup's (C) sentiment indicator is high in the clouds of euphoria...

Technology stocks are hitting valuations similar to those of the late 1990s (before the dot-com bubble hit). They trade for 6.7 times sales and 10.3 times book value...

After months of stocks only going in one direction, things feel a little too good right now. And my conversation with John proves it.

Now, you have to be careful about "up" markets like the one we're in today. If you get completely out and turn to cash, you could miss out on tremendous gains. Investors like John could continue to push stocks higher for weeks or even months to come.

My advice – and Doc shares this opinion – is that now is not the time to take on a lot of risk. The economy is not in a good place right now, but stocks are at all-time highs... It just doesn't add up.

John is telling me that he's buying stocks today... So I think it's best to be cautious in this market.

What We're Reading...

- Billionaire Leon Cooperman warns investors of stock market 'euphoria' and shares three big risks to an economic recovery.

- Stocks are poised to see a correction of up to 10% that zaps euphoria from market.

- Something different: Amazon to open first online-only Whole Foods store in Brooklyn.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein and Dr. David Eifrig

September 2, 2020

P.S. Instead of chasing those "hot tips," my colleague Dave Lashmet uses a strategy to find stocks that are so lucrative and safe, they could help anyone start to amass a small fortune, no matter their current financial circumstances.

Right now, Dave says that thanks to a rare market event taking place, the results could be staggering – triple- or even quadruple-digit gains.

To learn how you can use this powerful strategy, too, click here.