As long as the economy stays strong, this bull market can keep going...

But, as I've written before, this economy is confusing. Some indicators show the economy is still going strong, others point to an impending recession.

Now, we're seeing a critical part of the economy flashing a warning sign.

We're starting to see cracks in the U.S. consumer...

Consumer spending, which makes up 70% of our economy, is holding up this economic expansion. As long as the consumer keeps spending, the economy has a chance to continue expanding. But if the consumer stops spending, hang on tight.

Unfortunately, recent data is showing signs of weakness... Consumers are having trouble paying their obligations.

Let's start with credit cards. If you are fortunate enough to have a pristine credit score, you likely have no problem getting approved for a new card or a credit line increase. Unfortunately, not all Americans are so lucky... Some folks have to shop around at different lenders and figure out which one will approve them for a new card. It can be a long search.

Often, the lenders that approve riskier borrowers are smaller banks. These banks have to compete aggressively for new customers since they don't have a brand name like American Express (AXP) or Visa (V). That means they often approve borrowers with less-than-desirable credit scores. Basically, they have to settle for the scraps at the dinner table.

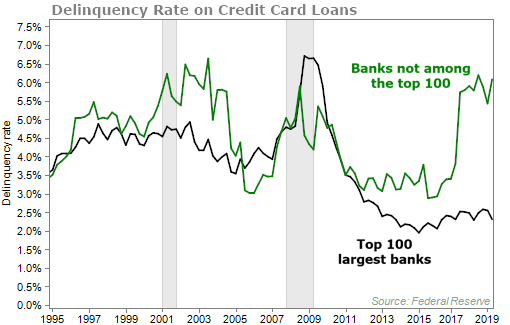

The chart below shows the delinquency rate on credit-card loans. The black line is the delinquency rate for the top 100 biggest banks by assets. The green line is the rate for the smaller banks – banks outside the top 100 in terms of total assets.

There's no sign of worry for the larger banks... But the smaller banks are seeing more of their customers being unable to pay off their credit cards.

The credit-card delinquency rate for smaller banks is now higher than it was at any time during the 2008 financial crisis. But the rate for larger banks, with presumably higher-quality borrowers, is down around 2.4%. Again, no signs of worry.

We also see something similar in the auto-loan market.

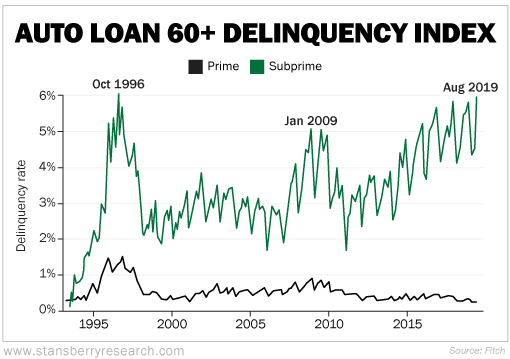

According to data from credit-rating agency Fitch, subprime automobile loans are experiencing the highest delinquency rate in two decades. As a refresher, a subprime borrower is a person that has a poor credit rating. They may have difficulty maintaining repayment schedules. As a result, banks often charge them higher interest rates to make up for the risk they take on.

In August, the auto loan subprime delinquency rate shot up to 5.93%... higher than the peak of the financial crisis at 5.04%.

You can also see that prime borrowers are having no issue at all making their auto-loan payments. The 60-day delinquency rate for them is around 0.3% – near historic lows.

This is typical late-cycle behavior. There are signs of stress in the weakest segment of consumers, but everyone is focused on JPMorgan Chase's (JPM) bottom line or Bank of America's (BAC) revenue growth.

The big banks are reacting...

If you listen to their conference calls, their tone is mostly optimistic about the economy... But their actions are sending mixed signals. According to a recent Bloomberg article, some of the big banks are preparing for more loan losses...

[JPMorgan Chase] increased the money it was setting aside for loan losses in its consumer and community banking division to $1.3 billion, from $980 million a year earlier. It did so even as the amount of loans in that unit's books fell.

Discover Financial Services lifted loan loss provisions by 8%, saying consumers were "holding up well" but the company was being "disciplined and conservative and credit because it feels late cycle."

American Express Co. also increased the amount it set aside for loan losses by 8% for the three months ended in September, because it had to write off slightly more bad loans, and more borrowers are falling behind on their obligations.

According to a survey conducted by UBS Group, 44% of consumers have expenses exceeding incomes. That's the highest in five years.

The fact is, the debt binge Americans have been on for the past few years will bite us eventually. And as each day passes, more signs of late-cycle behavior emerge.

A rise in credit-card and auto-loan delinquencies isn't going to change my investing strategy for the time being, but it is more evidence that the end is near.

This is a confusing time in the market for sure. Do you go to cash? Or bet on a final push in the market – or the "Melt Up" as my colleague Steve Sjuggerud calls it? Navigating ends of bull markets can be difficult.

But luckily, we have some very experienced analysts here at Stansberry Research who have been through many bull and bear markets. If you don't have time to follow the market regularly but want to maximize profits – and want to keep your money safe – you want to follow folks who know how to keep you prepared, while still making you money.

Right now, to celebrate my publisher's 20th anniversary, we have an incredible offer to help you make the most of our research... and your portfolio.

What We're Reading...

- Something different: Why Halloween candy is now scarier than the clowns.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 30, 2019