If you have any money in the markets, pay close attention to what happens next week.

It will most likely define how stocks perform the rest of the year.

So mark your calendars for October 10 and 11. That's when Chinese Vice Premier Liu He will be in the U.S. trying to hash out a trade agreement.

You see, investors are desperate for a trade deal. While they care about other market movers – like the Fed's willingness to cut interest rates or fourth-quarter earnings – the trade war carries the most weight. And we already see the negative effects from the trade war showing up in the economy. Specifically, in industrial activity.

Yesterday, news broke that shook the markets. The headlines were that manufacturing had its worst reading in 10 years. The S&P 500 Index and the Dow started the day in positive territory then sharply fell sharply on the report. The S&P finished the day more than 1% lower. And the Dow sank more than 300 points.

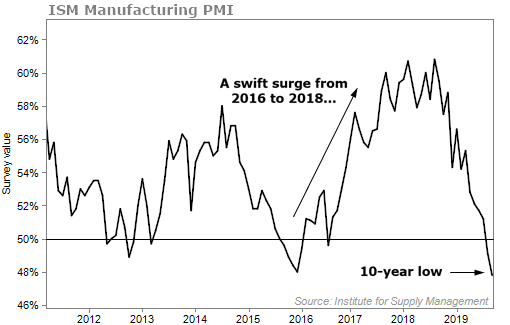

This is a drastic turn. In 2017, we saw a surge in industrial activity.

Heavy industrial businesses aren't like consumers. They don't buy more or less in a given month because of their optimism, tax refunds, bonus seasons, or the weather.

Industrial corporations plan months or years in advance. They carefully weigh potential returns and capital costs. They only start expanding when they're highly likely to be profitable. To measure how the industry is doing, we look at the ISM Manufacturing Purchasing Managers' Index ("PMI").

The PMI surveys executives in manufacturing. A reading above 50% means growth and expansion. In 2018, the IPM soared to around 60%.

But yesterday the Institute for Supply Management said U.S. manufacturing activity contracted to its weakest level since June 2009.

In August the reading was at 49.1%. That was the first time it flashed a contraction signal in 35 months. But September was even worse – dropping to 47.8%.

That's the lowest reading since June 2009...

In a statement, ISM Chair Timothy Fiore pointed to trade weighing on manufacturing...

Global trade remains the most significant issue, as demonstrated by the contraction in new export orders that began in July 2019. Overall, sentiment this month remains cautious regarding near-term growth.

As Peter Boockvar, Chief Investment Officer of Bleakley Advisory Group, said, "We've tariffed our way into a manufacturing recession."

We've talked about this before. Businesses are not willing to spend as much or expand until they have a clearer picture of what's going to happen. They want to know how long tariffs will remain in place and if there could be more tacked on.

Remember, when business investment slows, companies hire less. And when the job market gets softer, consumers become tighter with their money and spend less.

This isn't a panic moment. Don't cash out of the market and go hide under a rock because of this weak reading. Manufacturing is only 10% of the U.S. economy.

But the ISM manufacturing data do have a pretty decent track record as a leading indicator for the economy. According to Scott Garliss, editor of Stansberry Newswire, since ISM began compiling the index in 1950, the average amount of time from the index's peak to recession is 31 and a half months.

It's clear manufacturing peaked in August of last year. If that's right, that gives us roughly 18 and a half more months before a recession hits the U.S. economy.

But... all of this could change next week. If there's progress on the U.S.' trade war with China, businesses may regain confidence and purchasing managers and supply management executives may become more optimistic.

So make sure to pay close attention to trade talks next week.

The truth is we're at a very critical time in the economic cycle. I believe there are still chances to make big profits in the market... but there are also chances to lose if you're not careful.

That's why I urge you not to miss the Stansberry Conference & Alliance Meeting in Las Vegas.

If you've never been, the Stansberry Conference is a gathering of financial heavyweights and contrarian thinkers. We've had presentations from Shark Tank investor Kevin O'Leary, political satirist P.J. O'Rourke, and senior editor of digital products at The Economist Kenneth Cukier.

This year might be one of our best line-ups yet... You'll hear from investing legends like Dr. Nouriel Roubini and Jim Grant, former intelligence officer and current D.C. insider Buck Sexton, and of course a range of our own talented analysts from Stansberry Research.

If you want to prepare for what comes next in the markets, this is a must-see event.

Right now, you can join us for two full days of inspirational speakers... action-packed presentations... and tons of great investment ideas you can act on in real-time.

You can see all this from the comfort of your couch. And if you act now, you can claim a free gift.

What We're Reading...

- Dow drops 300 points after weakest manufacturing reading in 10 years.

- Something different: Five things about passive investing nobody talks about.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 2, 2019