Every time I walk into our Baltimore office, all anyone can talk about are my grooming habits...

I shower regularly. I brush my teeth. But it's my beard that has everyone in an uproar.

Most folks don't expect a former Goldman Sachs banker, an M.D., and a senior partner in our business to look like a member of the rock band ZZ Top. But here I am...

Please don't think I just let myself go...

Regular readers will know that I'm growing out my beard for the same reason a hockey player won't shave until they lose in the playoffs. Right now, my team and I are on one of the greatest winning streaks of all time...

In my Retirement Trader option-selling service, we have not taken a loss on a recommendation since March 2020 – at the height of the COVID-19 crash.

This past Friday was the third Friday of the month, the date on which options expire. I like to think of it as "pay day"... And that's exactly what happened last Friday.

When markets closed, we were sitting on three more trades that earned us profits. And we had closed out another winning trade just a few days prior.

With these positions closing, we have now closed 154 consecutive winning positions.

It's the longest winning streak of my career. And I don't know anyone else who has even come close.

So while I get a few odd looks as I walk down the street with a long beard, I'm not planning on shaving it anytime soon. I plan to keep the winning streak going.

The market has been down about 15% since the start of 2022, meanwhile, we have closed 46 trades for gains. Our average return has been 3.1%, or 19.7% annualized.

Given the harsh market conditions, a lot of people I talk to about my streak and beard remain skeptical. They think I'm doing something extremely complex, even dangerous – that will one day blow up in my face.

But the truth is that this strategy – one that has produced 154 winning positions with no losers – is simple. It's easy to learn, too.

Today, I want to lay out my strategy in simple English. Some of you may not be swayed to sell options by what I write here today... But if I can convince one reader to give it a try, then it will be worth the effort.

Let's go over one of the recent trades that closed for a gain this past Friday...

On December 9 in Retirement Trader, I made the case for higher oil prices. Regular Health & Wealth Bulletin readers know the setup in oil is attractive after reading my September 7 issue titled "Blame the President."

I stated that the supply of oil was too low, and demand was not going to crater. This setup will ultimately lead to higher prices. It's simple economics.

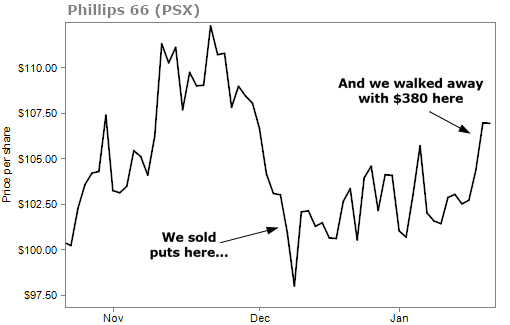

So on December 9, we recommended our Retirement Trader subscribers sell a put option on Phillips 66 (PSX) – one of our favorite oil giants.

Without getting to much into option jargon, we made a bet that shares of PSX wouldn't fall much from its then-current price around $99.50. Specifically, we bet they wouldn't fall too much below $97.50.

For agreeing to purchase shares if they fell below $97.50 by January 20, we were paid $380 for every put option we sold. That $380 was ours to keep whether PSX shares rose or fell.

Here's what could have happened...

PSX could have stayed flat and traded at $99.50 by January 20. If this happened, our obligation to buy shares of PSX would have removed. We keep the $380 and that was the end of the trade.

PSX could have moved higher by January 20. If this happened, our obligation to buy shares of PSX would have removed. Again, we keep the $380 and that was the end of the trade.

And even if PSX fell a bit, say to $98 by January 20, our obligation to buy shares of PSX would have removed. We'd have made $380 on a stock that dropped.

Here's where it gets better... Phillips 66 is a stock we would have wanted to own anyway. It's going to rise eventually because of the setup in the oil market.

So even if PSX fell all the way down to, say, $92.50, we'd have still gotten to keep the $380 in premium. But we'd have been forced to buy 100 shares of PSX for $97.50 a share. Thanks to the premium we collected when we first sold our puts, our cost to buy shares of PSX would have been $93.70... (The $97.50 cost per share minus our $3.80 premium.)

We'd have gotten to buy shares of Phillips 66 – a stock that we would have happily bought for $99.50 – at a 6% discount.

We could then hold the stock, collect its 3.6% dividend, and wait for it to rebound above $100 a share.

There was really no way to lose – as long as you sell options on stocks you want to own. That's the key.

But what really happened in this trade was that PSX finished over $100 a share on January 20. We didn't have to buy shares, and we walked away with our $380 that we collected at the beginning of the trade.

We earned 4.6% on our capital at risk in just 42 days. If you could make this trade every 42 days, you'd earn nearly 40% annualized.

The strategy is simple... Sell options on stocks you love, collect upfront cash, and either walk away with the cash at the end of the trade... or buy shares for a big discount to what they were trading for. (And if this happens, we have another way to earn even more income from the shares you own.)

I won't pretend that we're creating these complex trades that only a hedge-fund manager or MBA can understand... The strategy is simple.

I've said this before, but it's worth repeating... Every investor, no matter their education or experience, needs to sell options.

It can create thousands of extra dollars of income per month... and it will reduce your risk significantly.

Again, it's OK if I haven't convinced the majority of you to give option selling a try. That's fine.

But I really hope one of you will give it a chance. I truly believe it will change the way you invest money forever.

Because we just closed our 154th consecutive winning trade – a huge milestone for us – I wanted to reopen an offer that has been previously closed...

If you want to learn how Retirement Trader can help you learn how to make money no matter what the stock market does, click here.

What We're Reading...

- In case you missed it: Blame the President.

- Something different: China slams the U.S. on debt limit and accuses Washington of sabotage.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 25, 2023